2 Healthcare Stocks To Avoid This Month

Both healthcare stocks have been underperformers in November

Both healthcare stocks have been underperformers in November

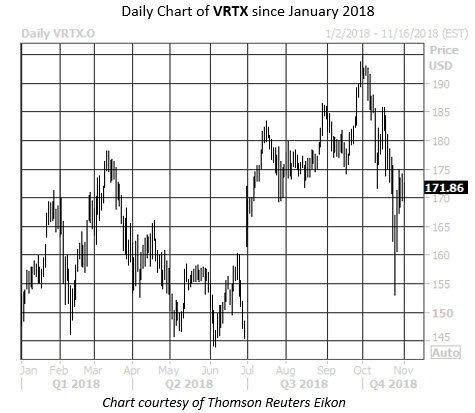

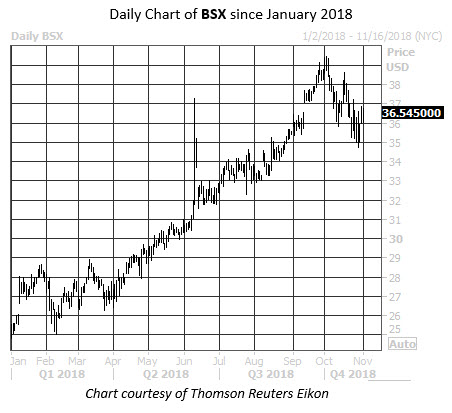

Biotech name Vertex Pharmaceuticals, Inc. (NASDAQ:VRTX) and medical device stock Boston Scientific Corporation (NYSE:BSX) both had subpar Octobers, pulling back amid the broader market sell-off. And while both stocks are trading higher today, the selling could be far from exhausted, if history is any guide.

VRTX's Rough Quarter Could Get Worse

According to Schaeffer's Senior Quantitative Analyst Rocky White, Vertex Pharmaceuticals stock has been one of the worst stocks to own on the S&P 500 Index (SPX) in November, looking at data from the past 10 years. Specifically, VRTX has averaged a monthly loss of 3.65%, with just four of those returns positive.

On the charts, the biotech stock is fresh off its worst month since October 2016, pressured by a competitor'scystic fibrosis drug breakthrough. The equity gapped lower in late October after earnings, and has racked up a fourth-quarter deficit of nearly 12% so far.

Despite the struggles, analysts are all in on VRTX. Of the 20 brokerages covering the security, 18 rate it a "buy" or better, with zero "sells" on the books. In addition, its consensus 12-month price target of $196.32 is a 14% premium to its current perch of $171.86.

In the options pits, puts have been bought to open over calls at an accelerated clip. VRTX's 10-day put/call volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands at 2.53 and ranks in the 98th annual percentile.

Analysts, Options Traders Bullish on BSX

Boston Scientific stock was up 1.2% to trade at $36.55, at last check. Since topping out at a 14-year high of $39.44 on Oct. 2, the stock has shed 7.3%. Plus, over the last 10 years, BSX has averaged a November loss of 3.78%, with just four of those returns positive.

Like Vertex, analysts are quite bullish on Boston Scientific, with 21 of the 23 brokerages rating it a "strong buy." BSX options traders are upbeat, too. This is based on the security's 50-day put/call volume ratio of 5.895 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), high enough to rank in the 88th annual percentile.