2 Toy Stocks That Could Be Headed for a Long December

Historically, December has been bad for shares of HAS and MAT

Historically, December has been bad for shares of HAS and MAT

Toy stocks are always in focus as the holiday season rolls in, and this year will mark the first without Toys 'R' Us after the company's bankruptcy earlier this year. What's more, toymakers Hasbro, Inc. (NASDAQ:HAS) and Mattel, Inc. (NASDAQ:MAT) are both flashing bearish signals heading into December, if history is any guide.

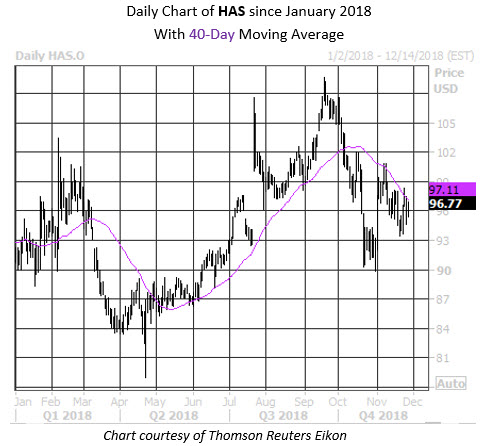

Hasbro Stock Threatening to Extend Pullback

Hasbro stock, at last check up 1% to trade at $96.77, is one of the worst stocks to own in December, looking back 10 years, according to Schaeffer's Senior Quantitative Analyst Rocky White. The stock has racked up an average loss of 2.56%, and has ended the month higher only 30% of the time.

A move of similar proportions would put Hasbro stock near its year-over-year breakeven level. On the charts, HAS gapped higher in early November following an upbeat quarterly report, but was ultimately stymied by its 40-day moving average. The shares have now shed 12% since their Sept. 19 annual high of $109.60.

Traders looking to take advantage of the equity's struggles may want to do so with near-term options, which are attractively priced at the moment. HAS stock currently sports a Schaeffer's Volatility Index (SVI) of 27%, which ranks in the 17th percentile of its annual range. This suggests that near-term options are pricing in relatively low volatility expectations at the moment, which could help maximize the benefit of leverage for premium buyers.

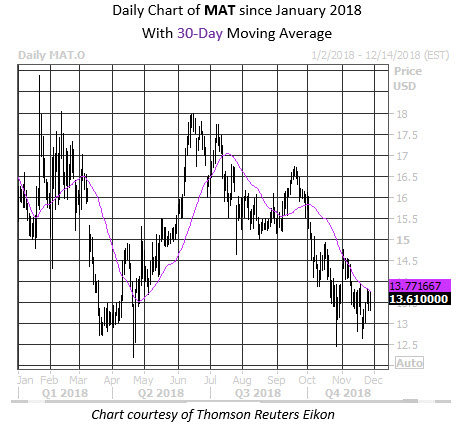

Mattel Stock Nearing Annual Lows

Looking at Mattel, the stock also tends to historically underperform during the last month of the year. Going back 10 years, MAT sports an average loss of 0.61% in December, and finished the month positive less than half of the time.

Mattel stock, at last check down 0.2% at $13.61, has carved out a channel of lower lows since mid September. Aided by an subpar earnings in late October, the toy stock has dropped 13% alone this quarter. Breakout attempts since then were thwarted by the shares' 30-day moving average, and continued struggles could brush MAT up against its April 20 annual low of $12.21.

Similar to its sector peer, MAT options are attractively priced. The stock's SVI of 42% sits in just the 12th annual percentile, revealing low volatility expectations are being priced into near-term contracts.