2 Gold Juniors Worth Avoiding

The junior mining sector provides a massive reward-to-risk proposition, if investors are able to separate the wheat from the chaff.

RNC Minerals and McEwen Mining are what I'd consider the chaff of the sector, with high-cost production and significant laggards to their peer group.

This article sheds more light on why the two companies are best to avoid.

The junior mining sector provides tons of opportunity for those that come prepared, but can quickly decimate a portfolio that's filled with some of the laggards. We've seen evidence of this with several falls from grace over the past decade like Primero Mining (OTCPK:PPPMF), Eldorado Gold (EGO), Hecla Mining (HL), and Colossus Minerals (OTC:COLUD). The latter was de-listed, and the others fell over 90% before finding their lows. While the majority of the junior mining sector tends to mirror somewhat the Gold Juniors Index (GDXJ), about 25% of them beat to their own drum. The leaders can see astounding runs like Fronteer Gold, Richfield Ventures, and Trelawney Gold, and the laggards can have lifeless performances. I don't always share all of my top ideas in the sector, but I do my best to point out the names where I see much more risk than reward. RNC Minerals (Royal Nickel Corporation) (OTCQX:RNKLF) and McEwen Mining (MUX) are two of these companies, and both continue to be Avoids. Both names continue to under-perform the benchmarks, have significant share counts, and are high-cost compared to their peers. This article will go into detail on some of the red flags with both companies, and why they're best to steer clear of as investments.

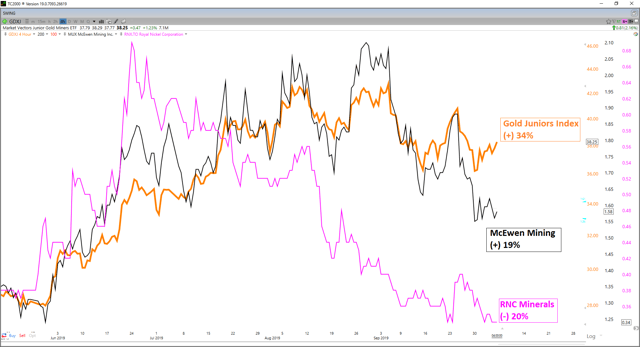

While the Gold Juniors Index has soared over 34% from its May lows, RNC Minerals and McEwen Mining have been significant under-performers. McEwen Mining initially powered higher, but is now up only 21% in the same period. Meanwhile, RNC Minerals has seen lethargic price action to say the least, with a (-) 20% return in the same period. There are of course a few other companies that have turned in similar weak performances, but the majority of them have decent stories, but are instead suffering from negative trends that are weighing on them. When it comes to RNC Minerals and McEwen Mining, there's not much to like either technically or fundamentally. Let's take a closer look below.

RNC Minerals

Beginning with RNC Minerals, the company has a couple of red flags, which are generally deal-breakers when it comes to if they're investable. The first for RNC Minerals is the company's share count, which is one of the highest in the industry. The current share count is 667 million shares fully diluted, a massive amount of shares for a company with only small-scale production. Generally, companies with high share counts are more challenging to move, and they tend to languish under the minimum requirements for many funds. This is because some funds have rules where they will not invest in stocks under $2.00 or $5.00. Given that a $1.00 share price would represent a $700 million valuation, it will be very challenging for RNC Minerals to even get back above the $1.00 level in the foreseeable future. Typically, high share counts are attributed to poor financing terms, issuance of too many options/warrants, and overall poor management of the treasury.

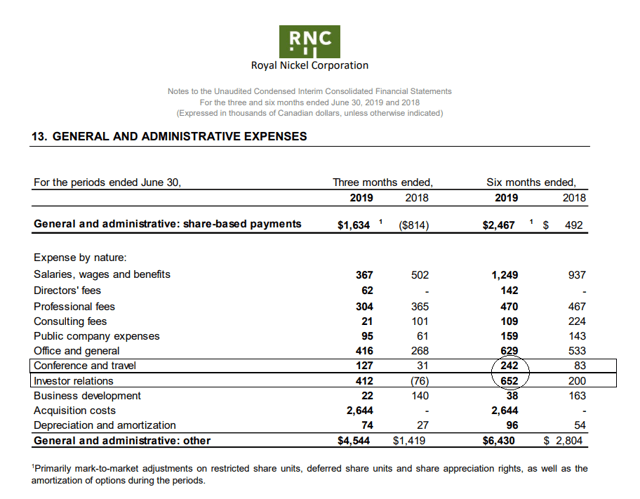

The second red flag is found in the company's financial statements for Q2 2019. For a junior producer with an annual production of 60,000~ ounces like RNC Minerals, there's no reason that investor relations spending should be above $150,000 per quarter or $300,000 in a six-month period. In addition, anything above $175,000 in conference/travel expenses in six months is also very high. The company's investor relations spend in the first half of 2019 was $652,000, with conference/travel expenses coming in at $242,000. In total, in these two line items alone, the company has spent $894,000 in the first half. This works out to nearly $1.8 million per year, and a massive drag on a company's treasury if it continues. Junior producers are not realizing much if any; cash-flow need to be as lean as possible, and keeping expenses to an absolute minimum is a must.

(Source: Company Website, Financial Statements)

(Source: Company Website, Financial Statements)

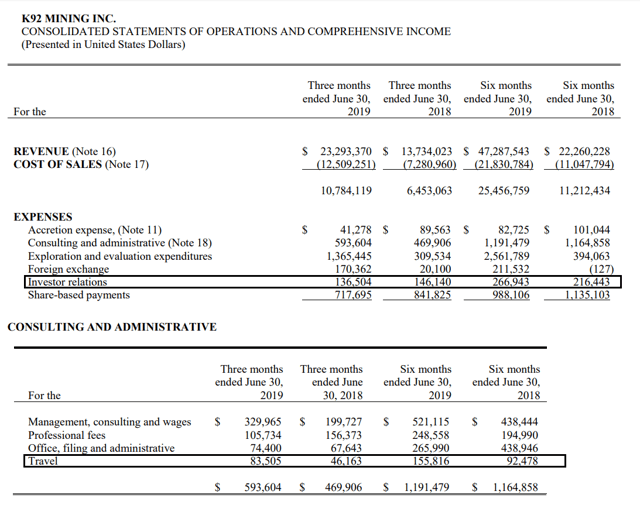

To put these costs in perspective, we can see that junior producer K92 Mining (OTCQX:KNTNF) had investor relations expenses of $266,943 in the same period, roughly 40% of what RNC Minerals spent. Moving to travel/conference expenses, the company spent $155,816, compared to RNC Mineral's $242,000. After combining the two, K92 Mining spent $422,759 in the first half of 2019, equaling out to less than $1 million per year at this run rate. This is less than half of what RNC Minerals spent, and there are two distinct differences with K92 Mining. The first is that K92 Mining is actually cash-flow positive, and the second is that it is a larger producer with 90,000 ounces per year in production.

(Source: Company Website, Financial Statements)

(Source: Company Website, Financial Statements)

In summary, K92 Mining is a cash-flow positive and larger producer and is spending less than half what RNC Minerals is spending on investors relations and travel expenses. Combined with an already massive share count, unreasonable spending is not a good sign. If RNC Minerals had generated a 50% return in 2019 thanks to its high investor relations spend, I suppose we could discount it. Instead, the company is one of the worst-performing gold stocks, and any investor relations spend has not translated to share price performance. This means that either it's not being spent wisely, or it simply has no effect. In a year when the gold (GLD) price is up 20%, this is inexcusable.

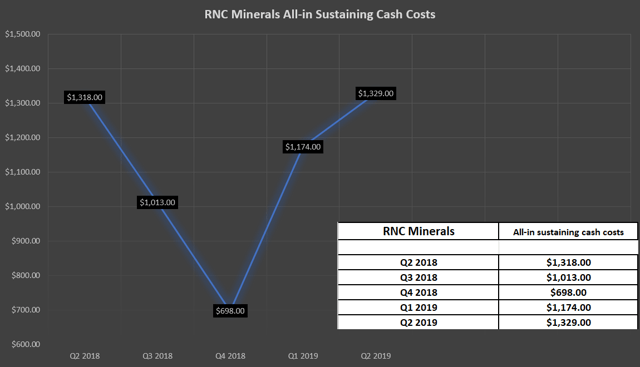

The third issue with RNC Minerals is from a cost and guidance standpoint. After several months of discussions about issuing formal guidance, we still have not yet seen official guidance from the company on costs or production. It is challenging to measure a company's performance or have expectations when there is no guidance to work with. While there was a brief belief that RNC Minerals could be a low-cost operator, those hopes have been crushed the past few quarters. The company's Q4 2018 results were exceptional from a cost standpoint thanks to the Father's Day Vein Discovery last June, but it is becoming clear that the Q4 2018 quarter was an anomaly. As we can see below, all-in sustaining costs have nearly doubled since, and are trending higher.

(Source: Company News Releases, Author's Chart)

(Source: Company News Releases, Author's Chart)

If we put a median value on the past five quarters of production, the all-in sustaining cost average is $1,174/oz, and the $698/oz can be long forgotten. The Q4 2018 quarter benefited massively from the ounces recovered from the Father's Day Vein Discovery, but we've since seen costs spike back to industry-lagging levels. With the average all-in sustaining costs among smaller producers near $900/oz, costs in the $1,100/oz plus range are unacceptable. Even worse, all-in sustaining costs came in at a new 18-month high last quarter at $1,329/oz. If not for the recent gold price move, the company would be producing at a loss.

There are three clear red flags with RNC Minerals that negatively separate them from their peers. The company's share count is massive, and dilution continues with a nearly 20% bump in the share count since last year. The capital raises were completed at successively lower prices, and warrants continue to be added to the deals. For reference, the April 2019 financing was done at C$0.46, and the December 2018 financing completed at C$0.49 per share. With the recent financing terms at C$0.40, the company is raising money at a 20% lower share price than it was in December, despite a 20% higher gold price. The second red flag is inexcusable spending, especially for a company that barely has any margins to work with at current cost levels. The third is high-costs that are trending up and no ability to issue formal guidance. When combining these three things, it's tough to get behind the company. A low-margin company that has diluted shareholders to a significant degree in a rising gold price environment is already enough to avoid a company. Adding the cherry on top of steep spending, this is a recipe for further dilution in FY-2020 if the company can't return costs to lower levels.

McEwen Mining

McEwen Mining is a highly-leveraged play to the gold price but has turned into more of a laggard as funds have likely moved on to the larger and lower-cost producers. While McEwen Mining outperformed nearly all of its peers in 2016, the stock is not being given anywhere near the same attention at higher gold prices this year. The company's all-in sustaining costs continue to be an issue, trending higher over the past five years. The company's exceptional performance in FY-2016 can be attributed to the company coming in well below the industry average from a cost standpoint, and hopes of growing production with Gold Bar coming online. While the company has managed to increase production since 2016, it's come at the same time as higher costs. For this reason, I see no reason that investors should expect the stock to trade the same way it did in 2016, as a leader in the space.

(Source: Author's Chart & Table)

(Source: Author's Chart & Table)

Looking at the above chart I've built, we can see that McEwen Mining's costs have been steadily trending higher since 2016. They are now more than 10% above the average of $898/oz among mid-tier producers, and this is a significant change in the investment thesis since 2016. While many investors continue to point out how McEwen Mining was one of the best performers in 2016, it must be pointed out that the circumstances are entirely different in 2019. The company's all-in sustaining costs are up over 25% from the $823/oz reported for FY-2016, and the company has transitioned from a cost leader to a cost laggard.

The challenges at the company's mines continue, with all of the company's mines coming in above cost guidance for the most recent quarter. The company's new Gold Bar Mine in Nevada saw all-in sustaining costs at $1,157/oz for the quarter, above the $975/oz guidance. El Gallo Mine costs came in at $1,000/oz vs. $915/oz guidance. Finally, Black Fox Mine guidance was $1,080/oz, and the first half all-in sustaining costs were $1,311/oz, nearly 22% above guidance. Ultimately, I see it as highly unlikely the company will hit its all-in sustaining cost guidance of $1,025/oz for the quarter. Instead, I would expect a slight miss with all-in sustaining cost guidance of $1,035/oz-1,045/oz for FY-2019. This would be yet another year of higher all-in sustaining costs, and a five-year high for costs.

(Source: Company's Q2 News Release, Author's Commentary)

(Source: Company's Q2 News Release, Author's Commentary)

McEwen Mining has made decent strides from a production standpoint with annual production up from 150,00 gold-equivalent ounces to 180,000 gold-equivalent ounces since 2016, but it's made zero progress in the cost department. The 20% bump in annual production has been completely offset by a nearly 25% jump in all-in sustaining costs, and this is no help to the company's bottom line.

Based on the fact that McEwen Mining continues to miss on cost guidance and have challenges at its mines, I see the stock as an over-promiser, and under-deliverer. I prefer to hold gold producers that under-promise and over-deliver like Kirkland Lake Gold (KL) has. There are simply far too many low-cost producers in the sector to justify investing in McEwen Mining at this time. For this reason, I see the stock as an Avoid.

Both RNC Minerals and McEwen Mining have got some help from the gold price this year to restart new uptrends, but neither has been successful. If a rising gold price cannot help these companies, I'm not quite sure what will. A $1,650/oz plus gold price could finally wake them up, but I prefer to invest in stocks that are highly profitable and executing no matter what the gold price is. For this reason, I see either the Gold Miners Index (GDX) or higher-margin producers as much more suitable investment vehicles in the sector. Both stocks continue to be laggards from both a fundamental and technical standpoint, and I see it was an opportunity cost to hold laggards, even in a bull market.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts