2 Ways To Play The Commodity Boom In 2022 / Commodities / Metals & Mining

A new commodity supercycle is beingdriven by a massive energy transition …

A new commodity supercycle is beingdriven by a massive energy transition …

And two elements are experiencing asupply squeeze that is creating huge opportunities for investors.

The first is lithium, the super metalfueling the EV and energy storage boom.

The second is helium, the key tofuture tech innovation and an irreplaceable necessity for semiconductors, whichare also undergoing a long-running supply squeeze.

Lithium prices have surged 500% overthe past year on the fast-paced global adoption of EVs.

BNEFpredicts that before the end of this decade, the battery sector’s lithiumconsumption will soar to 5X current levels.

Mining.com’s EV Battery Metals Index has more than quadrupled since mid-2020, and rapidly falling EV battery prices are shifting this race into fifth gear.

Helium, too, is in dangerously shortsupply ever since the U.S. Federal Helium Reserve in Texas auctioned off itsremaining stockpile and closed its doors forever, taking some 40% of supply off the market late last year …

That’s a nightmare for the auto industry, at large, with the giants forced to suspend production and miss vehicle targets.

Why? Because a single car typicallyneeds over 3,000 semiconductor chips.

They need helium to manufacture those chips, and there may be no element that canreplace it or come close to its cooling powers, which also makes this gascritical to the world’s most important scientific research and technologicalinnovations … from space travel, cryogenics and the Large Hadron Collider, toeveryday technology such as MRIs and fiber optics.

With prices hitting $280/Mcf in 2019during Fed auctions, helium can now sell for up to $600/Mcf. It’s wildly more expensive than natural gas–even in the middleof an unprecedented gas price surge.

Now, for both lithium and helium,it’s all about who can make the next significant discovery the fastest,creating new opportunities for investors to get in on what could be the supplysqueezes of the decade.

Here are 2 stocks that couldposition you to take advantage of some critical timing:

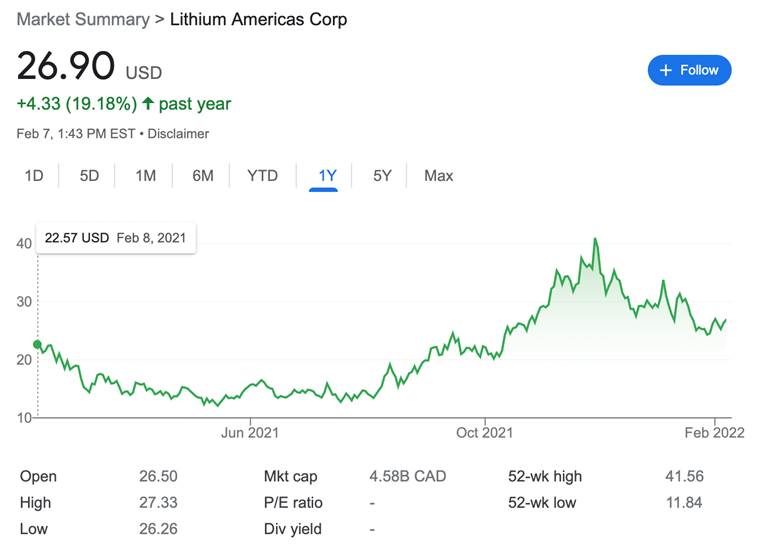

#1 Lithium Americas (NYSE:LAC)

Upgradedby three analysts last week alone, LAC is solidly positioned to take advantageof the lithium craze with its Thacker Pass mine in Nevada.

Would-be investors have been horriblyimpatient with lithium, that’s largely because the soothsayers started pumpingup lithium long before it was ready for the supply squeeze and the surge in EVand energy storage demand.

But all good things come to those who wait …

LAC is up around 34% over the past 12 months, and looks very well-positionedfor more growth this year, in tandem with a global lithium market that is setto top $8B over the next 5-6 years.

For LAC, the investor reward is more of the juicy potential returns you canonly get from a pure-play. This is an exploration play. There aren’t anyrevenues–yet. But the potential is enormous, in the form of two world-classprojects in Argentina and Nevada.

While Nevada is an excitingexploration-stage play that brings lithium to North America at exactly theright time, LAC’s Argentina play is already close to production. In fact, itshould come online in the middle of this year and that will be LAC’s first majorrevenues. We’re looking at production from Argentina of around 40,000 tonnesper year, with lithium prices soaring right now. And that production number isjust Cauchari Olaroz’s Phase 1. They’re also planning a 20,000-tonne expansionand this is being billed as a “low-cost” lithium brine project.

Source: Lithiumamericas.com

In Nevada, at LAC’s Thacker Pass project, mineral reserves are 3.1 million tonnes of LCE at 3,283 ppm Li.

LAC is expecting all major permitsto move forward with this by the end of this quarter.

Yes, it’s a lot of spending right nowbefore we get into production, but with market prices what they are, investorsshould be willing to wait for this one out because the exploration risk appearsto be much lower.

#2Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF)

The other critical element supplycrunch in this new commodity supercycle is helium, and because it’s flown underthe radar, there could be even more potential upside …

Especially when you get a micro-capcompany that’s just completed its first helium well with very encouragingresults.

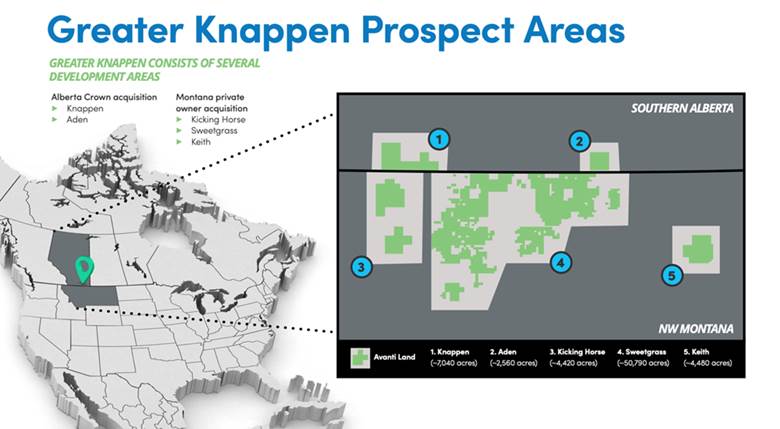

Avanti Energy is a smart early moveron this supply squeeze, and its initial 3-6-well program in its 100%-operated GreaterKnappen project that runs from Montana to Alberta could have the potential tobe an important element in North America’s ability to secure enough heliumsupplies.

All the better when a tiny companylike this reports encouraging results in its maiden drill program.

Drilled to a depth of 5,860 feet, Avanti’s first well (Rankin 01-17) encountered ALL the targeted zones for helium potential.

Avanti’s maiden helium well open-holelogging indicated five zones with reservoir characteristics (good porosity andlow water saturation) suggesting further testing is warranted.

Drill stem tests were also performedto high-grade zones for completions and two of the targeted zones showedeconomic helium potential.

Avanti has secured nearly 70,000 acresspanning Alberta and Montana in highly prospective helium territory.

And geological interpretationssuggest anywhere from 1.4billion cubic feet of helium to 8.9 billion cubic feet.

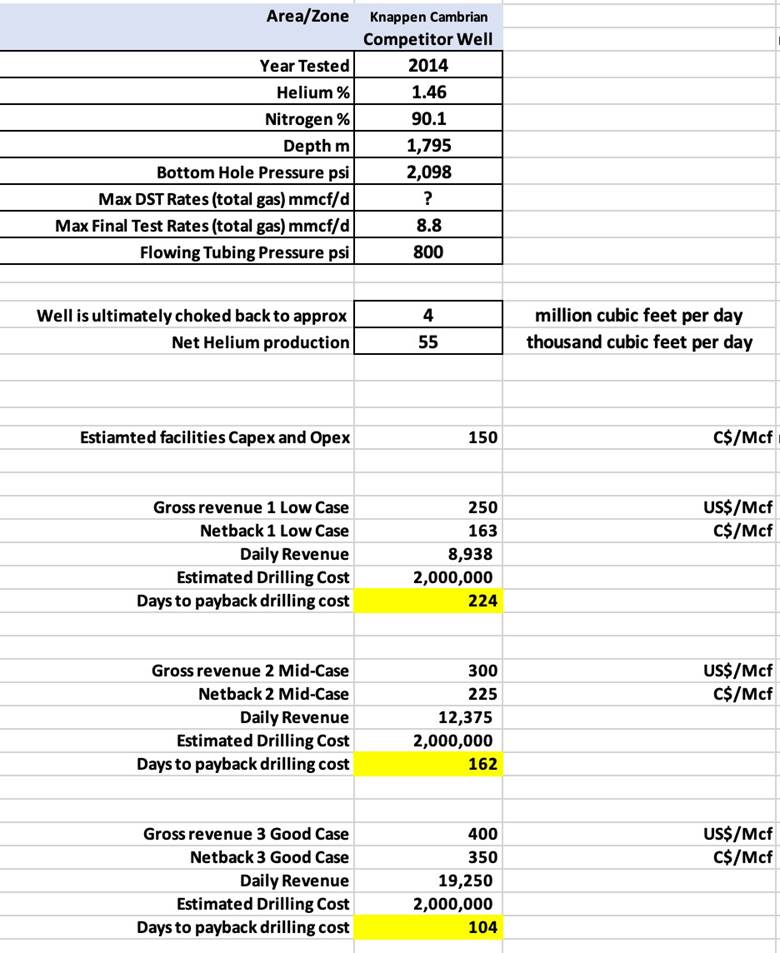

But the biggest thing investors may belatching onto here is the potential payback time …

Avanti estimates that their wells, ifcommercially successful, could yield ~55,000 cubic feet of helium per day, and require just 104 days to fully pay back drilling costs.

Avanti estimates that its wells may yieldat a high level of 55-60 mcf helium a day for the first five years, thengradually decline at ~10% annually thereafter for a total productive life of~20 years. That could mean some two decades of major production and steady cashflow.

We think a setup like this is thesort that set up a tiny company for the major leagues, possibly through aninvestor-rewarding JV deal once you near the development phase.

Avanti has spent the past eightmonths securing this huge land package in ancient shale formations, and nowit’s doing its first drill campaign at the beginning of a helium supply crunchthat has absolutely no way of producing the numbers we need without big newdiscoveries.

With the maiden drill hole completed, this is one to watch for exciting newsflow as more results come in and drilling continues on the project.

By. Tom Kool

**IMPORTANT! BY READING OUR CONTENT YOUEXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-lookinginformation which is subject to a variety of risks and uncertainties and otherfactors that could cause actual events or results to differ from thoseprojected in the forward-looking statements. Forward looking statements in thispublication include that prices for helium will significantly increase due toglobal demand and use in a wide array of industries and that helium will retainits value in future due to the demand increases and overall shortage of supply;that Avanti will able to successfully pursue exploration of its licenses andproperties; that Avanti’s licenses and properties can achieve drilling andmining success for commercial amounts of helium; that indications of potential for economic helium in Avanti’sinitial wells will predict future results; that Avanti will be able fulfill itsobligations under its licenses and in respect of its properties; that Avantiwill be able acquire the rights to the helium on its prospective heliumproperties; that the Avanti team will be able to develop and implement itshelium exploration models, including their own proprietary models, that mayresult in successful exploration and development efforts; that historicalgeological information and estimations will prove to be accurate or at leastvery indicative of helium; that high helium content targets exist on Avanti’sprojects; and that Avanti will be able to carry out its business plans,including timing for drilling and exploration. These forward-looking statementsare subject to a variety of risks and uncertainties and other factors thatcould cause actual events or results to differ materially from those projectedin the forward-looking information. Risks that could change or prevent these statements from coming tofruition include that demand for helium is not as great as expected; thatalternative commodities or compounds are used in applications which currentlyuse helium, thus reducing the need for helium in the future; that the Companymay not fulfill the requirements under its licenses for various reasons orotherwise cannot pursue exploration on the project as planned or at all; thatthe Company may not be able to acquire the helium rights on its properties ascontemplated or at all; that the Avanti team may be unable to develop anyhelium exploration models, including proprietary models, which allow successfulexploration efforts on any of the Company’s current or future projects; thatAvanti may not be able to finance its intended drilling programs to explore forhelium or may otherwise not raise sufficient funds to carry out its businessplans; that geological interpretations and technological results based oncurrent data may change with more detailed information, analysis or testing;and that despite promise, results of the recent drilling and exploration may beinaccurate or otherwise fail to result in locating or developing any commercialhelium reserves on the Avanti properties, and that there may be no commerciallyviable helium or other resources on any of Avanti’s properties. Theforward-looking information contained herein is given as of the date hereof andwe assume no responsibility to update or revise such information to reflect newevents or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. Thiscommunication is a paid advertisement and is not a recommendation to buy orsell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners,managers, employees, and assigns (collectively “Oilprice.com”) has been paid byAvanti fifty thousand US dollars for this article to provide investor awarenessadvertising and marketing for TSXV:AVN. The information in this report and onour website has not been independently verified and is not guaranteed to becorrect. This compensation is a major conflict with our ability to be unbiased.This communication is for entertainment purposes only. Never invest purelybased on our communication.

SHARE OWNERSHIP. The owner of Oilprice.comowns shares of Avanti and therefore has an additional incentive to see thefeatured company’s stock perform well. Oilprice is therefore conflicted and isnot purporting to present an independent report. The owner of Oilprice.com willnot notify the market when it decides to buy more or sell shares of this issuerin the market. The owner of Oilprice.com will be buying and selling shares ofthis issuer for its own profit. This is why we stress that you conductextensive due diligence as well as seek the advice of your financial advisor ora registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com isnot registered or licensed by any governing body in any jurisdiction to giveinvesting advice or provide investment recommendation, nor are any of itswriters or owners.

ALWAYS DO YOUR OWN RESEARCH and consultwith a licensed investment professional before making an investment. Thiscommunication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherentlyrisky. Don't trade with money you can't afford to lose. This is neither asolicitation nor an offer to Buy/Sell securities. No representation is beingmade that any stock acquisition will or is likely to achieve profits.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.