2016 the year of the stream - gold, silver and copper

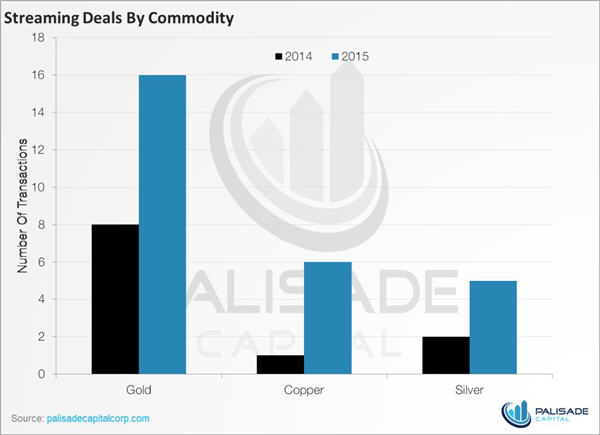

The streaming deal has been a lifeline for many mining companies. In fact, 2015 showcased a record number of streaming deals for gold, silver, and copper. The number of transactions doubled from 11 to 27 year-over-year, with the dollar values associated tripling from $1.1 billion to over $4.0 billion!

What was once considered a new and innovative way of raising money - the streaming deal has taken centre stage as companies are becoming more and more reluctant to issue equity weak market conditions.

Thus, miners are now selling a portion of their future to secure cash infusions now. A streaming deal typically allows the buyer to acquire output at below-market prices in exchange for upfront cash. It's a win-win scenario. The buyer is able to secure steady cash flow. Meanwhile, the miner receives a cash to cushion their balance sheet and appease creditors, while having the necessary capital to develop additional assets.

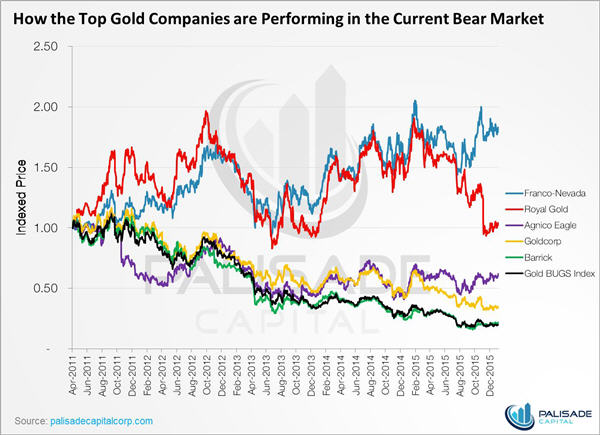

It is no surprise, therefore, that Royalty/streaming companies have outperformed gold mining companies. We wrote an article on this September, 2015, which can be viewed here - http://palisade-research.com/how-do-the-five-largest-gold-companies-stack-up-against-the-hui/. A royalty/streaming company is different from a conventional producer as it does not operate, develop, or conduct any exploration. This minimizes cost exposures and creates a steady cash flow situation.

Not surprisingly, Franco Nevada (FNV) and Royal Gold (RGLD) have both been involved with some of the largest streaming deals of 2015.

Largest Precious Metal Streaming Deals Of 2015

Silver Wheaton (SLW), who pioneered streaming in 2004, ended the year with a $900 million deal with Glencore (GLCNF), a company struggling to service its $30 billion in debt. While the deal is probably Silver Wheaton's last mega deal, there are new players stepping up to replace streaming companies who have maxed out their capacities.

Enter the bottomless private equity groups and pension funds that are also looking to tap into the market. With an estimated $4 billion of viable streams left in the market, mining companies will be able to survive for the time being and actually develop assets for the pending bull run.

Lastly, mining companies are also becoming creative and preserving upside for themselves in these transactions. For example, in Barrick's $610 million deal with Royal Gold, it guarantees higher sale prices in the future. For the first 550,000 ounces of gold and 23.1 million ounces of silver that Barrick delivers to Royal Gold, it receives 30% of the prevailing market prices. For every ounce after that, it receives 60% of the spot prices.

Thus, even in the current challenging markets, miners are still able to finance world class projects and leave the door open for explosive upside. The market understands this, when Teck announced their deal with Franco-Nevada, their share price increased 14% over the next two days of trading.

Only the best companies will survive these bear markets, and the streaming deal will be a tool to keep them afloat. It is these companies, willing to move forward in tough market conditions that will experience rampant growth when precious metals finally rebound.

On another note, if you are a company looking to monetize any sort of royalty or stream, or are looking to acquire a royalty or stream, please contact us. As merchant bankers strongly involved in this sector, we will be able to help you.