25 Stocks to Short Right Now

Healthcare stocks are in focus today, with the sector sinking on news of a massive Amazon (AMZN) partnership aimed at driving down employee healthcare costs. Even Dow stock Pfizer (PFE) is trading lower this morning, despite an earnings beat. What's more, the next month could be ugly for fellow blue-chip pharma stock Merck & Co., Inc. (NYSE:MRK), if past is prologue. Below, we outline the 25 worst stocks to own in the month of February, historically, and take a look at MRK stock before earnings on Friday.

Below are the 25 worst S&P 500 Index stocks in February, looking back 10 years. To make the list, Schaeffer's Senior Quantitative Analyst Rocky White considered stocks with at least eight years of returns. As you can see, Merck stock has the worst overall win rate, ending the month higher just two of the past 10 years.

On average, MRK shares have dropped 1.58% in the month of February. Plus, Merck is the only Dow component to make the list. (On the flip side, fellow blue chip Visa made the list of Best Stocks to Own in February.)

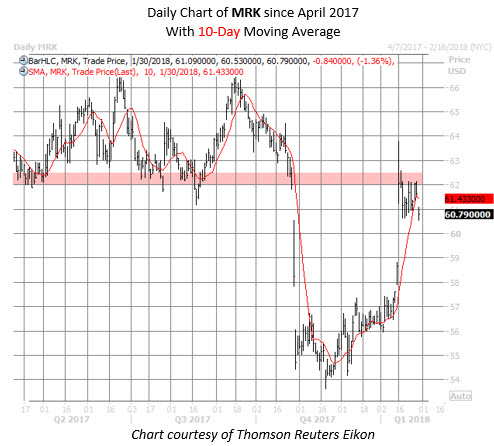

Amid the aforementioned sector headwinds, MRK stock was last seen 1.3% lower at $60.79. The equity is now on pace to end beneath its 10-day moving average for the first time since Jan. 3. Prior to today, the pharma stock enjoyed a Keytruda-related bull gap earlier this month, but has since lost a battle with resistance in the formerly supportive $62-$62.50 area -- where the shares were trading before the first of two October bear gaps.

As alluded to earlier, Merck is set to report earnings before the market opens on Friday, Feb. 2. The stock shed 6% in the session after its October earnings release, and another disappointment later this week could shake the options bulls on Wall Street.

On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), traders have bought to open nearly four MRK calls for every put option in the past two weeks. The 10-day call/put volume ratio of 3.94 is in the 81st percentile of its annual range, pointing to a much healthier-than-usual appetite for bullish bets over bearish. An unwinding of optimism in the options pits could translate into an added headwind for MRK shares, should the company's earnings disappoint.