3 Gold Stocks With Above Average Valuation Multiples

Gold stocks having EV/EBITDA equivalent to global peer average of 9.4X or higher.

Gold stocks having stable fundamentals and a strong position despite lower gold prices and forex.

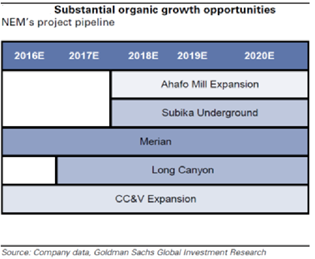

Sound market valuation due to substantial organic growth opportunities in project pipeline.

Source: The Balance

Investment Thesis

Enterprise Value to Earnings before Interest Depreciation and Amortization ((EV/EBITDA)): This valuation is a good measure for capital-intensive industries like gold producing firms. It helps investors compare gold mining companies with various capital structures.

In our gold universe, we were able to filter for gold stocks whose valuation multiples are higher than the global average of 9.4%.

Through the investment research below, we can verify the market speculation that these three companies are indeed above average ((EV/EBITDA)). We will also prove in this equity research that these solid valuations are well anchored on strong fundamentals and organic growth opportunities.

1. Newmont Mining ((NYSE:NEM)):

About three-quarters of NEM's gold deposits are presently located in the US and Australia.

Cost guidance for All-in-Sustaining-Costs (AISC) was lowered by $10 per ounce. Over 50% of NEM's production is pegged at an US dollar denominated cost base. However, the impact of a rebound in the commodity currency space (specifically AUD and CAD) appears to be limited. The present cost cutting strategy of NEM has more room to move.

NEM has one of the strongest balance sheets in the sector with a Net Debt-to-EBITDA of 0.8X, after repaying $1.3 billion in 2016. The company also grew its cash on hand to $2.8 billion. Enterprise Value-to- EBITDA ((EV/EBITDA)) is 14.1X, higher than global peer average of 9.4X.

Source: Guru Focus.

Assuming a $1,212 per ounce average gold price, NEM is well positioned to produce nearly $ 1 billion in free cash flow this year. It has ample financial flexibility to repay its $575 million convertible bond due last July. It was also able to return cash to shareholders through bigger dividends over the next 12 months.

Guidance for capital expenditures rose from $900 million to $1.1 billion due to the expansion projects of Tanami and Northwest Exodus. This is also inclusive of the initial capital funds that will be utilized for Ahafo Mill/Subika Underground expansion.

For 2018, guidance for capital expenditures is expected to record $1 billion, while 2019 guidance is projected from $600 million to $730 million.

Source: Company data, Goldman Sachs Global Investment Research

According to Goldman Sachs, majority of NEM's expected growth over the next 12 months will stem from brownfield expansions of current operations instead of external opportunities. Prevailing gold prices of $1,300 per ounce will allow the company to remain incentivized to focus on brownfield opportunities rather than exploring large scale M&A or committing to significant greenfield projects with big capex bills.

2. Randgold Resources ((NADQ:GOLD)):

GOLD is a gold mining company in Africa. The company is listed in the London Stock Exchange and NASDAQ. To date, major discoveries include the 4.9 million ounce Tongon deposit in C??te d'Ivoire, the 3.3Moz Massawa deposit in eastern Senegal, the 7.5 million ounce Morila deposit in southern Mali, and the 7.2 million ounce Yalea deposit in western Mali.

Earnings of $294.2 million in 2016 generated an increase of 38% y/y. This reflected lower cash costs partially offset by a 16% climb in depreciation and a 126% increase in corporate tax expenses for the year.

Source: Factset Research

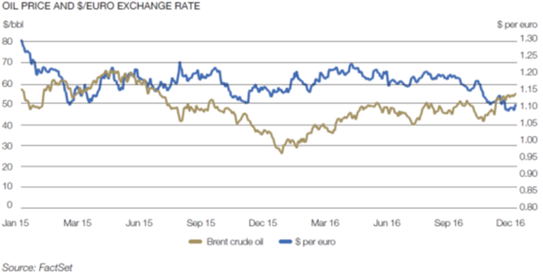

Costs were positively impacted by fuel and oil prices. Cash costs came in at $667 per ounce. Euro and US dollar exchange rate remained consistent throughout the year.

In the first nine months of 2017, GOLD sustained its performance with gold production up 11%. Total cash cost per ounce was lower by 9% while earnings were up by 22%.

Key revenue earner Kibali produced a credible second half performance as it addressed the critical operational issues. These issues include stability of the plant and dealing with multiple ore sources.

More than $2 billion capital outlay was required for the acquisition and development of Kibali. Majority of which had been paid out in the form of taxes, permits, infrastructure and payments to local contractors and suppliers.

Kibali must now be equipped to pay back the loans taken to support its project development. Its ability to do so will be impeded by the increasing amount of debt and capital expenditures, already tapering off.

GOLD is owed $200 million by the government in terms of VAT refunds, excess taxes and royalties.

The company's cash balance rose above $500 million in the third quarter this year. The company can well expect to ramp up dividends. However, their dividend strategy will be done at a slower space as the company opted to build further cash reserves. Kibali underground remains on track and more details on Massawa are expected in 2018 when it goes to the board for approval.

GOLD combines stable fundamentals with robust share market returns. Stock has rallied 11% despite the gold price increasing only by 2%. GOLD is one of the sturdiest names in the gold sector with a market capitalization touching $9 billion. The company sits on an ((EV/EBITDA)) of 11.3X.

3. Royal Gold ((NADQ: RGLD)):

RGLD is into acquisition and management of precious metals royalties.

RGLD entered a new phase of growth during 2017, driven by investments placed at a time near the bottom of the market. The company achieved record revenues, cash flow and earnings during 2017.

RGLD had a total commitment of over $1.4 billion to new investments during 2016 to acquire interests at Prestea, Wassa, Pueblo Viejo and Rainy River.

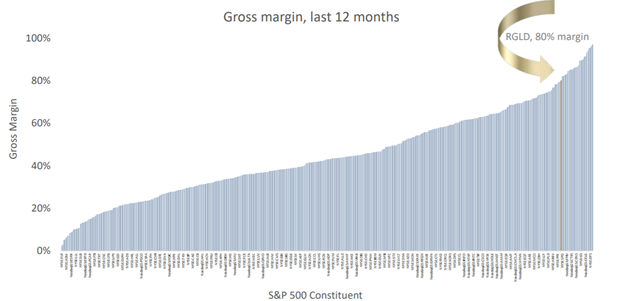

The 80% gross margin recorded this year was more than double of the S&P 500 average. In addition, gross margin was within the top 6% of S&P 500 constituents.

Source: Company data.

They were able to settle down the $95 million in debt and increased credit facility from $650 million to $1 billion. RGLD now has over $800 million of liquidity and a net debt to EBITDA ratio near 1.7X. It is still generating around $50 million per quarter to strengthen further balance sheet.

Growth trajectory of dividend per share reached 19% since 2001. This is equivalent to 1.2% annual dividend yield and an average 22% operating cash flow yield. EV/EBITDA multiple is 18.6X in 2017, more than the global peer average of 9.4X.

Source: Guru Focus

Our Takeaway:

The three gold stocks have sharply risen over the past year, and had more room to run with their above average valuations. Each of these stocks performed exponentially well, attributed to its strategic focus on explorations rather than pursuing acquisitions. Another contributing factor to sound valuation multiples is their ability to keep costs in check.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article was written by Hans Centena, our business journalist. Gold News is not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Investing involves risk, including the loss of principal. Readers are solely responsible for their own investment decisions.