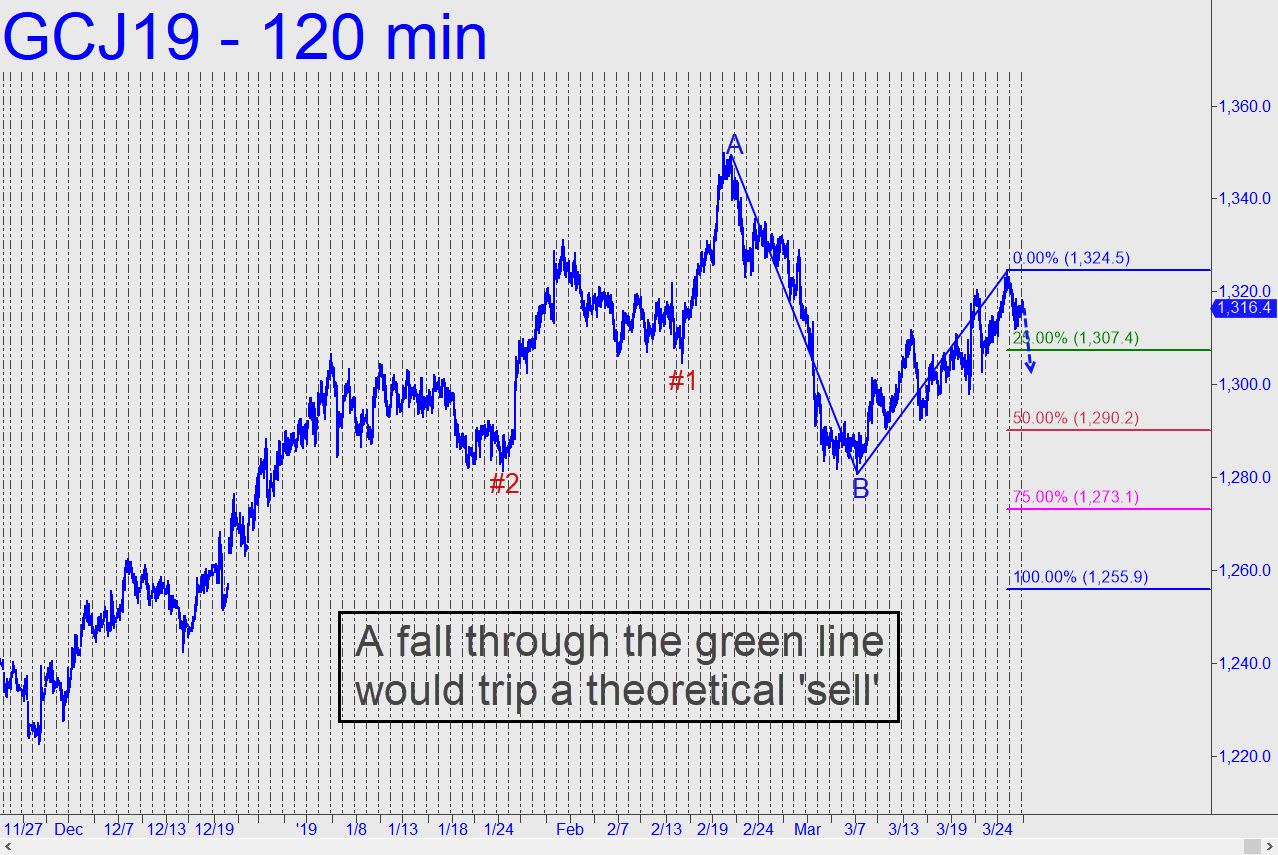

4.5% Fall in Gold Could Be Imminent

April Gold's tortuous slog toward an 'easy' rally target at 1332.00 warrants a closer look at the bearish case. For if the futures were to fall just $9 to the green line shown in the chart (click on inset), that would trip a theoretical sell signal to as low as 1255.90 a 4.5% plunge from current levels. Although the bull trend begun last August from 1182 still dominates the daily chart, the A-B countertrend shown in the chart is sufficiently compelling to imply that a sharp correction may be imminent. The danger would be averted by a rally exceeding 1356. 80, where a small but technically significant peak was notched on the way down from 1400 last spring.

If you don't subscribe, click here for a free two-week trial that will give you access to everything. And please do stop by the Trading Room to say hello.