A Golden Gravy Train

Newsletter writer Stewart Thomson addresses the question of a "Gold Bull Era" and a 40-year inflation and interest rate cycle.

Newsletter writer Stewart Thomson addresses the question of a "Gold Bull Era" and a 40-year inflation and interest rate cycle.

Gold stocks rock!

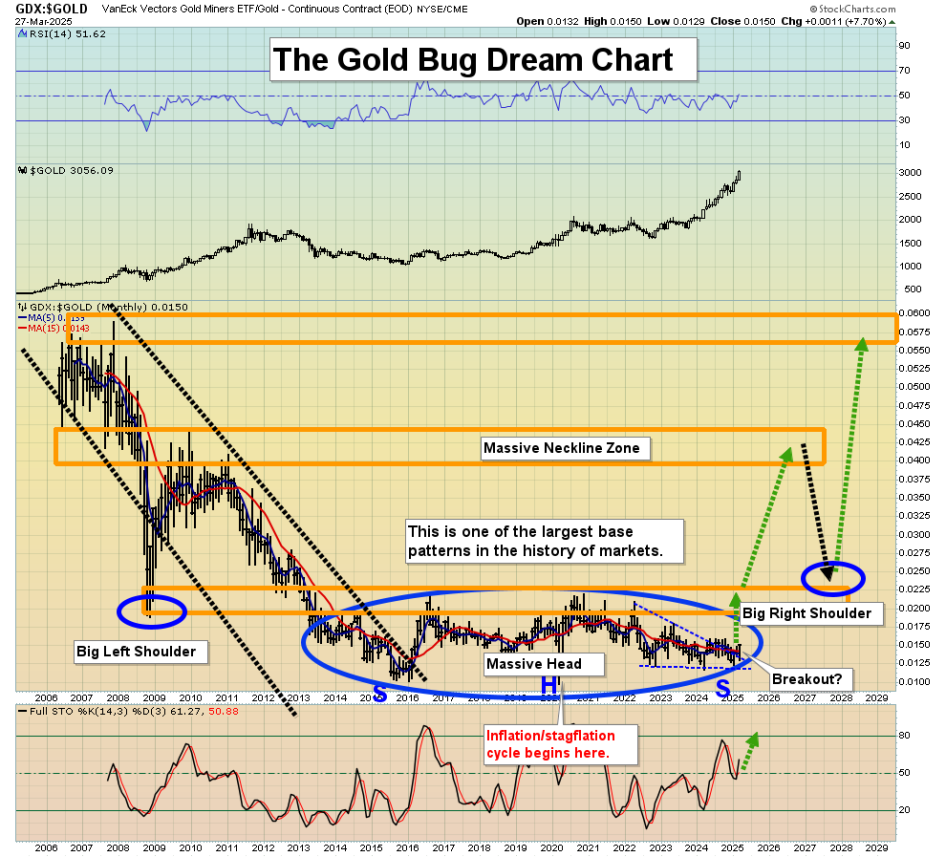

Here's a look at one of the greatest charts in the history of markets, the gold stocks (GDX) versus gold chart. Note when the low occurred (early in the year 2020).

Then have a good look at this chart:

That's the long-term U.S. rates chart . . . with the 40-year inflation/deflation cycle highlighted. The interest rates low occurred at the exact same time as the gold stocks versus gold bullion low occurred.

Here's the bottom line: Gold stocks stage "flash in the pan" rallies during deflation cycles, like the 2009-2011 period, during the deflation cycle of 1980-2020 but. . .

For true big league moves higher, an inflationary cycle is required, and with it comes . . . much higher rates.

Here's another stunning gold stocks chart:

I urged investors to buy senior miners aggressively, basis the rare "inside handle" of this fabulous C&H (cup and handle) pattern.

It's incredibly rare for the handle to be inside the cup . . . and incredibly bullish!

A lot of gold analysts have been caught flat-footed as the gold stocks surge relentlessly . . . and it's happening while the U.S. stock market begins to incinerate in what is likely to become a "hybrid horror" of the 1929 and 1966 meltdown events repeating again.

Most sentiment indexes are technical indexes. They use moving averages, oscillators, etc., to describe sentiment, but they don't always reflect a real investor's mood.

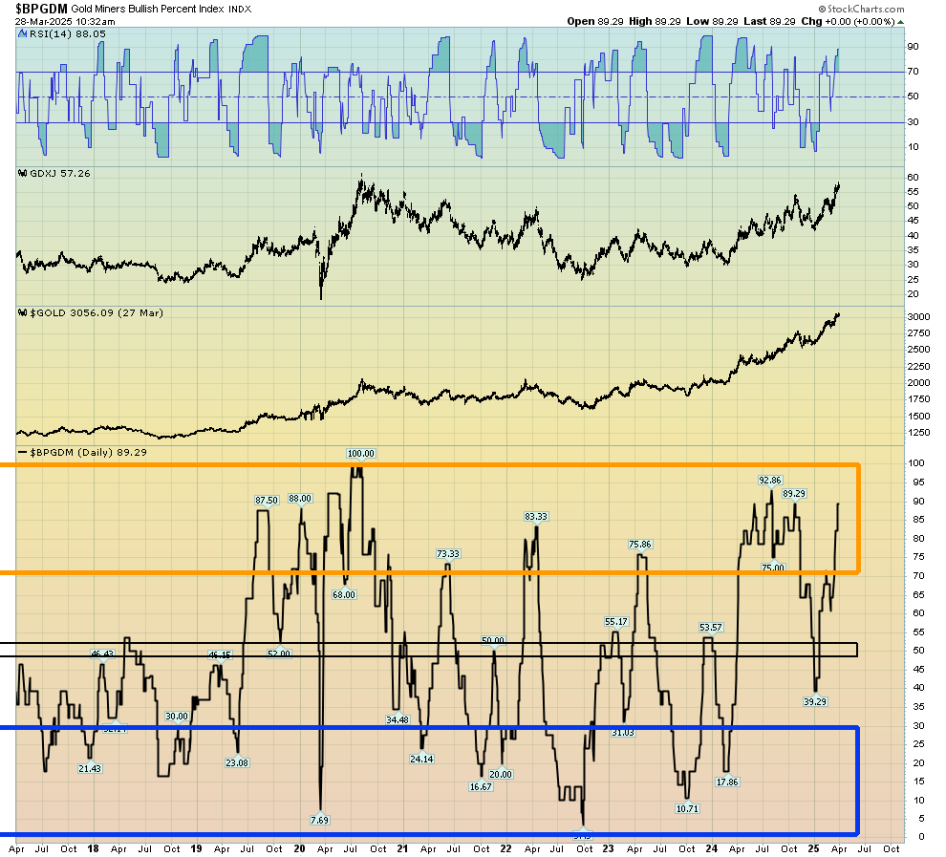

Here's a look at the BPGDM sentiment index for gold stocks:

It has a "nosebleed," but the average gold stock investor is not showing me any greed. In fact, many are as quiet as mice. That tells me that the $60 C&H pattern target for the GDX is likely only a "starter move," and GDX is likely to trade above $100 before there's anything resembling real greed in the market.

What about the juniors? Well, here's a look at the CDNX daily chart:

The chart is showcasing bullish technical action. Also, note that when gold dips, all senior miners dip too, almost without exception.

In contrast, when the CDNX takes a hit, there are many individual miners "marching to their own technical drummer."

Here's a look at one of them now:

Renegade is working in the Red Lake area in Ontario. Note the recent jumps in volume, shown at the bottom of the chart. Gamblers could nibble at this stock with an optional mental stop at 12 cents.

Here's a look at a potentially very big play:

Northern Dynasty Minerals Ltd. (NDM:TSX; NAK:NYSE.MKT) has the world's largest gold and copper resources, and there's a bull pennant on this daily chart. Trump's call to "Drill, baby, drill!" has oil company executives excited. Will "Mine, baby, mine!" be the next call to action from this administration? Maybe. The chart is certainly positive.

There will, of course, be setbacks for both the junior and senior miners in the coming days, weeks, and months . . . but gold bull and bear cycles are very long. This is a particularly interesting bull cycle because it involves empire transition, from a modestly populated and fiat-oriented West . . . to the massively populated gold-obsessed East.

Gold peaked at about $160 around the year 1869 and didn't trade above there for 100 years. The bear cycle from 1980 to 2000 was very short, compared to most cycles for gold. The current cycle isn't really a gold bull market as much as it's a gold bull era . . . one that is likely to last at least 200 years. Gold stock investors, whether they know it or not, are riding what could be the biggest financial gravy train in the history of the world!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I'll send my free "GDXJ, SGDJ, & Key Gold Stocks Play!" report. I highlight technical action in these ETFs, with five of the hottest stocks to buy. Key investor tactics are included in the report.

I write my junior resource stocks newsletter about twice a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank-you.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Northern Dynasty Minerals Ltd.Stewart Thomson: I, or members of my immediate household or family, own securities of: gold and GDX. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?