A Highly Prospective Gold Junior Beginning Major Bull Market

Technical Analyst Clive Maund explains why he thinks Adamera Minerals Corp. (ADZ:TSX.V) is a Strong Buy.

Adamera Minerals Corp. (ADZ:TSX.V) is a junior gold explorer that is attractive to investors here for fundamental and technical reasons.

Fundamentally, it is looking for gold in highly prospective areas near past producers.

Technically, the stock is just starting to advance out of a low base to commence a major bull market.

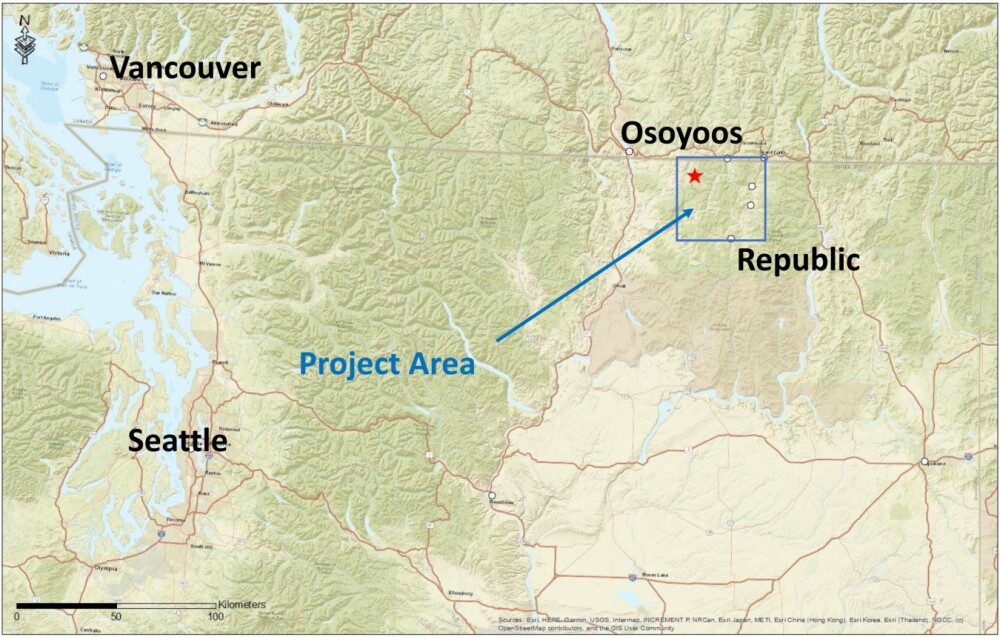

The company's projects are located in the rectangular land area in Washington State just south of the border with British Columbia, to the east of Seattle and Vancouver, as shown on the following map lifted from the company's investor deck.

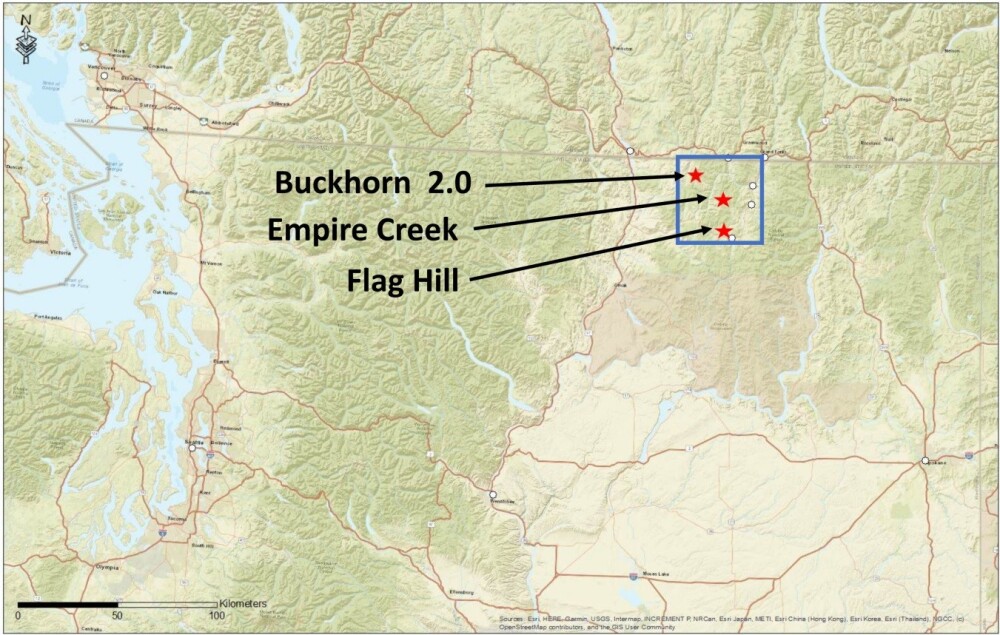

Three of the company's main projects within this area are shown on this map below.

Zooming in on this area via the following map, we can see both the location and extent of these three projects. Empire Creek is the rectangular land area just above the center of this map while Flag Hill is the open rectangular land area towards the bottom of it.

A fourth project, Cooke Mountain, not shown on the map above, is shown on this map below.

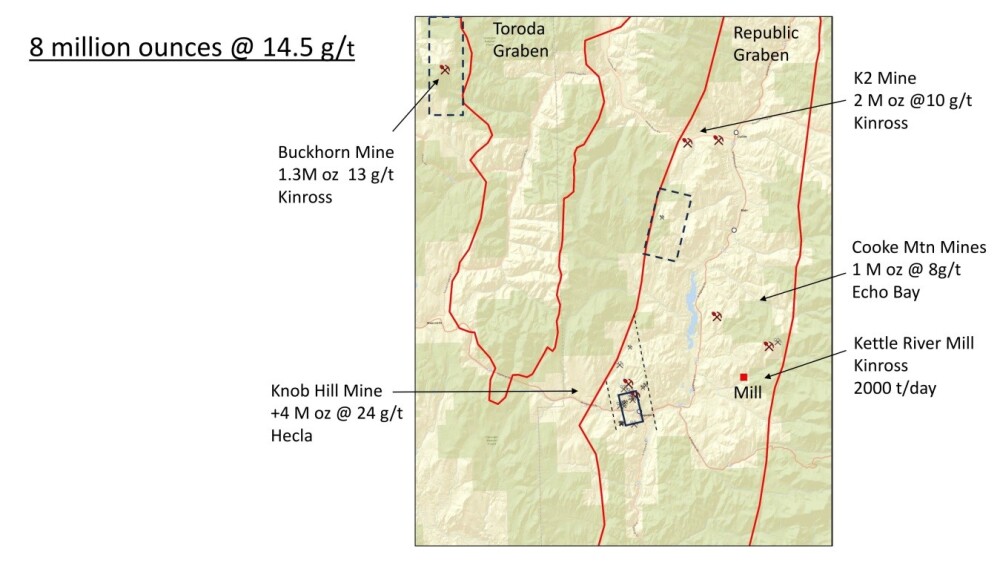

The company's strategy is an effective one based on plain common sense, which is to acquire land around past producing mines, and although this does not, of course, guarantee success, it greatly increases the chances of it except, of course, where there is an abrupt and drastic change of geology within a few kilometers, which is unusual.

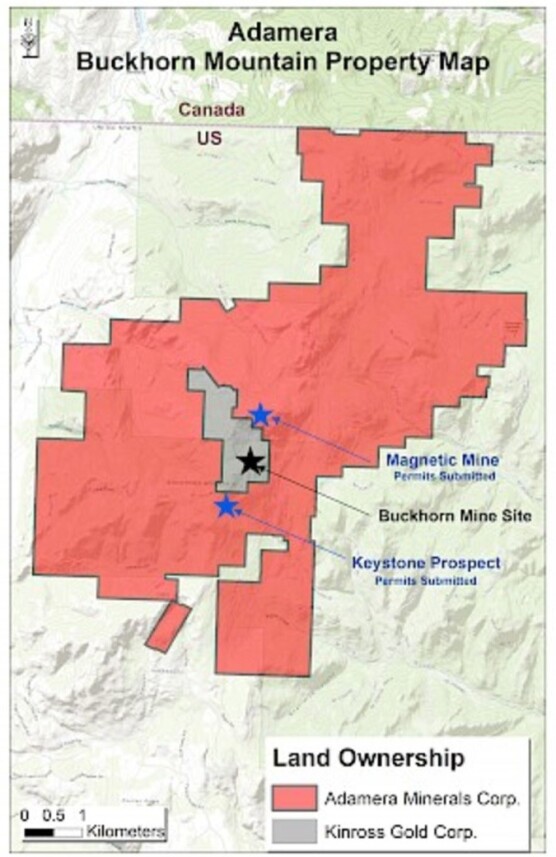

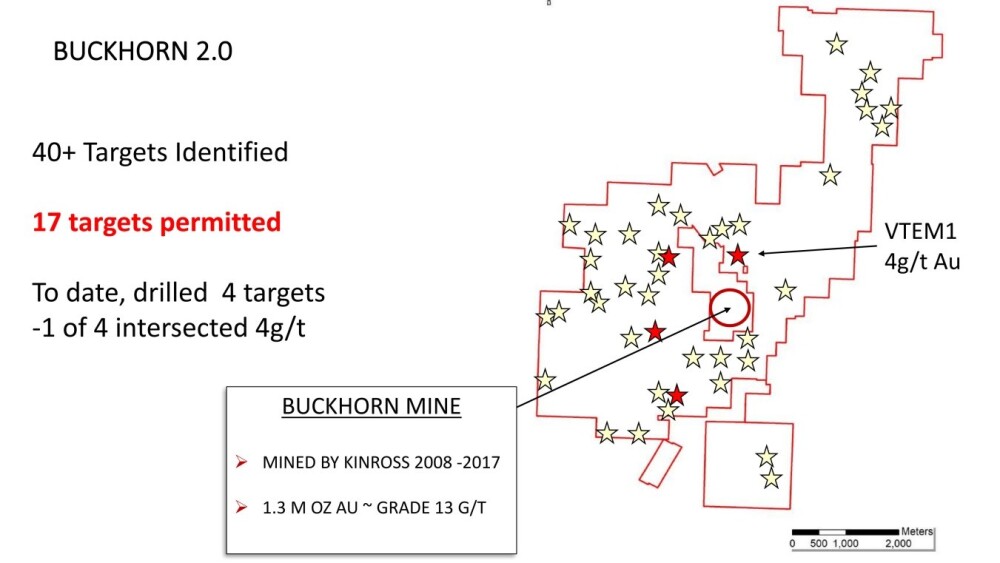

You can see a real-world example of this strategy on the following map, which shows how Adamera has acquired all of the land around Kinross' Buckhorn Mine.

As the Buckhorn Mine produced 1.3 million ounces of gold at a grade of 13 grams per tonne (g/t), the chances of Adamera finding substantial quantities of gold on this land are clearly good. Adamera's 100% owned Buckhorn Project is known as Buckhorn 2.0, which distinguishes it from the Kinross Buckhorn mine that it surrounds.

A point worth making here is that the property is both highly prospective and underexplored, which is due to past companies being heavily focused on production, so there was very little drilling outside of the deposit. Based on historical information, it appears that Kinross had developed more than 100 targets on the claim block that were not drill-tested.

Furthermore, they had applied for permits to drill 950 holes from 675 drill pads and construct 120 km of road to access the drill pads. The size and complexity of the process stalled timely progress, and the company subsequently dropped the bulk of the original land package to focus entirely on the mine site. However, subsequent work by Adamera has identified more than 40 targets, of which 17 are now permitted, as shown on the following map.

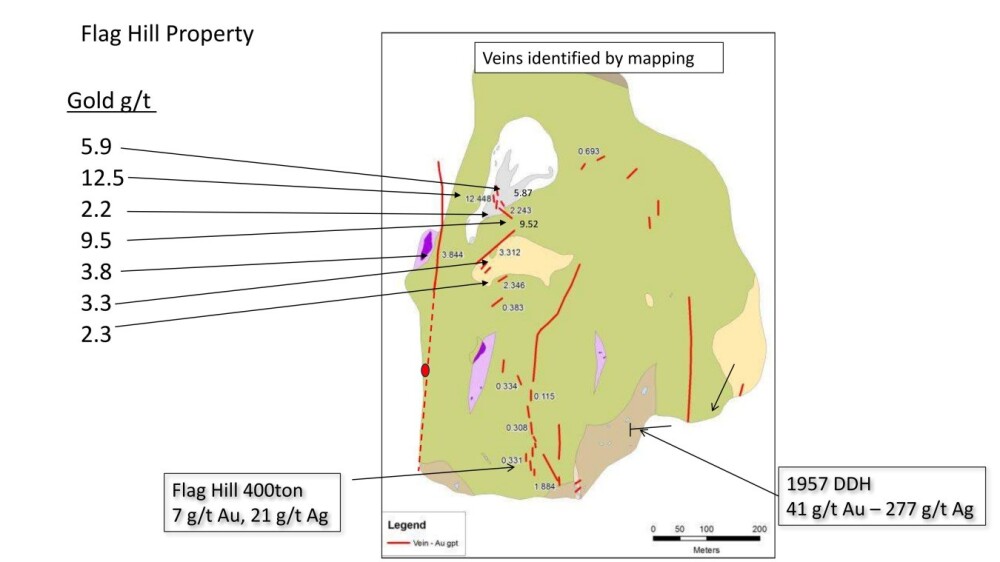

Meanwhile, the other projects within the project area are looking highly prospective, such as Flag Hill and Flag Hill South.

Amongst the company's other projects in the area, the Cooke Mountain Project has very considerable potential with many targets, and the company also has the potent Talisman Historic Copper Silver Mine, which it may advance in partnership, and the Hedley Project over the border in British Columbia which, although only staked land at this stage, is highly prospective being about 24 kilometers from the Copper Mountain Mine.

The company clearly has an impressive portfolio of highly prospective gold projects at a time when the continuing gold bull market is likely to stir more and more interest in them, especially by larger companies looking to increase their resource base.

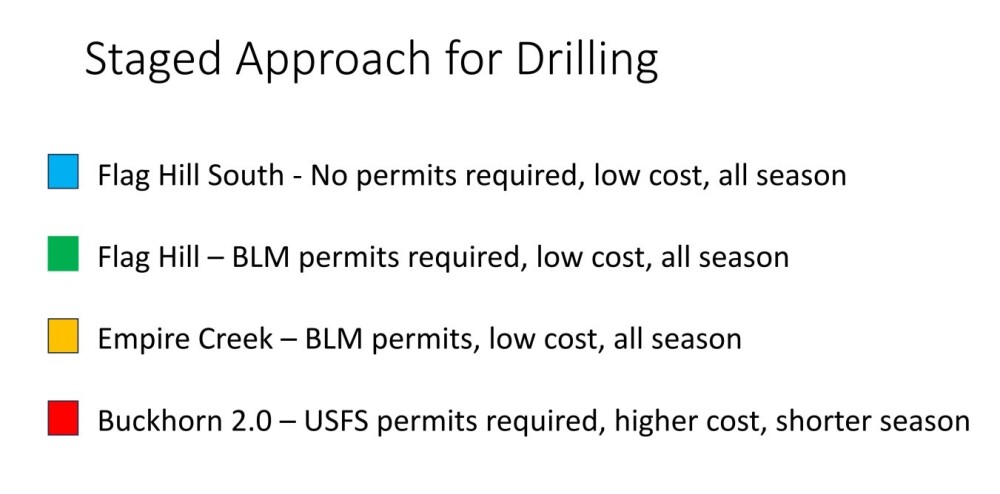

The status of permitting for the various properties is as follows:

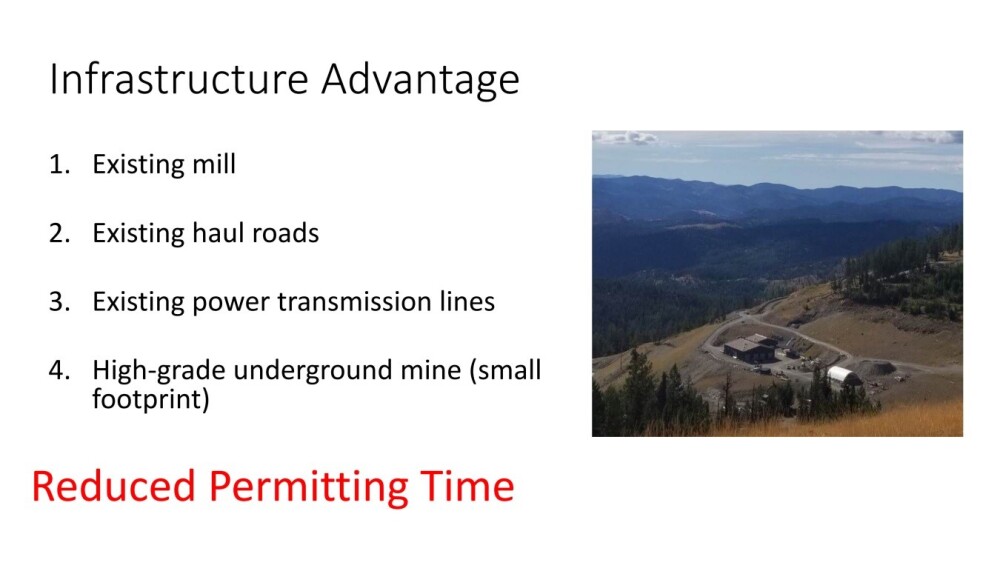

Local infrastructure is good.

Lastly, as there are only currently a little over 27 million shares in issue, any influx of demand for the stock should quickly translate into a higher stock price.

Turning now to the stock charts for Adamera and starting with the long-term 12-year chart, we see that the latest major bear market downtrend from the mid-2020 high has brought the price down into a zone of strong support at long-term cyclical lows where an intermediate base pattern has been forming this year. Of considerable importance is the steady uptrend in the Accumulation line over many years, which has even made new highs in the recent past. While this doesn't guarantee anything in terms of price performance, as is clear from past action, it is certainly a positive background factor, especially as the greater the divergence and the longer it goes on, the more likely it is to lead to a major new bull market developing. Thus, the fact that this indicator is already at new highs is thought to bode very well for future price performance. (Note: It is not making new highs on Stockwatch charts, but it is close to doing so.)

Zooming out via the 15-month chart, we see that after a peak late last year at CA$0.80, the price dropped back sharply and has spent all of this year up until October, marking out a low Pan base above a line of support at CA$0.10. However, in mid-October, it suddenly came to life with a gap breakout on good volume that took it up to the top of, but not out of, the base pattern because it did get above the resistance at the June high that marks the upper boundary of the base.

Thus, this move is classed as a "preliminary breakout." However, as it was accompanied by strong upside volume that drove the Accumulation line steeply higher, it is viewed as a very positive development that should lead to a successful breakout clear out of the base pattern in due course and perhaps soon.

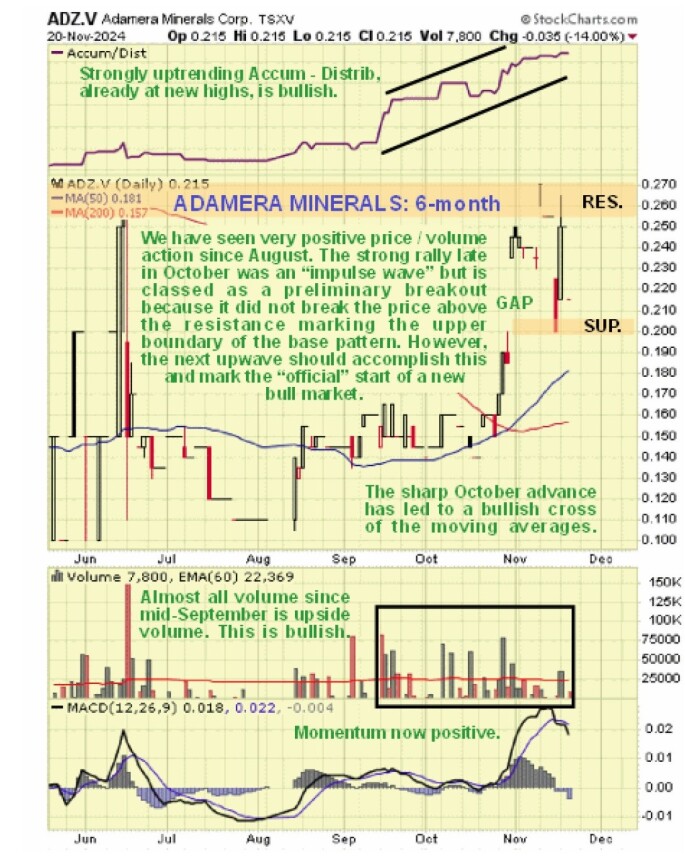

On the 6-month chart, we can see recent action in more detail and how, even before the October preliminary breakout, upside volume had been building for weeks and driving the Accumulation line higher, presaging this move.

The sharp October advance was accompanied by stronger volume and a sizable gap, which both have longer-term bullish implications as does the subsequent cross of the moving averages into positive alignment.

A final point that should be made is that Adamera is moving for its own reasons and is considered unlikely to be affected by the sector correction now in progress that is expected to continue for a while.

In conclusion, with the current consolidation pattern expected to lead to another upleg, Adamera is rated a Strong Buy in this area, especially on any minor dip that may not occur.

Adamera Minerals' website.

Adamera Minerals Corp. (ADZ:TSX.V) closed for trading at CA$0.21 on November 21, 2024.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Adamera Minerals Corp.Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.