A Near-Term Gold Producer with Exploration Upside and Technical Breakout Potential

John Newell of John Newell & Associates explains why he thinks Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) is a Speculative Buy.

Occasionally, a junior mining company crosses a threshold that resets investor perception moving from hopeful exploration story to tangible, near-term cash flow. That's exactly where this Canadian gold developer finds itself right now.

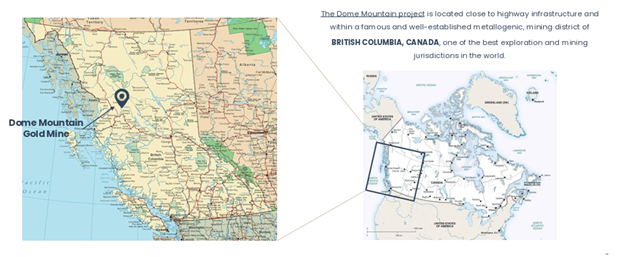

Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) is advancing its fully owned, fully permitted Dome Mountain Gold Project near Smithers, British Columbia.

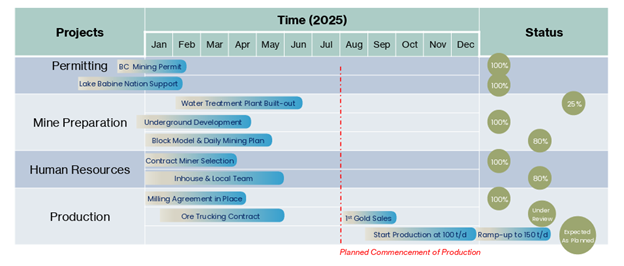

The company is preparing to transition into production in Q3 2025, targeting an initial output of 15,000 ounces of gold annually.

With only nine full mine permits granted in BC over the past decade, Dome Mountain stands out as a rare, fast-tracked development play backed by a seasoned team and strong community and First Nations relationships.

The Dome Mountain site benefits from historic infrastructure, a toll milling agreement with Nicola Mining, and low capex requirements. The mine is connected via all year round accessible roads, and the company has already constructed a water treatment plant with six times the current processing capacity, underscoring its long-term vision and environmental planning.

This is a renovation story of a high-grade past producer, being modernized for the next gold cycle.

Management

CEO Mr. Rana Vig brings over 30 years of entrepreneurial experience, with the last 15 years being with public companies across mining, cannabis, and tech. He's not just leading the company; he, along with his family and the original founders, have contributed over $2 million of their own capital.

Mr. Vig has a track record of building companies from the ground up as well as restructuring them. In 2018, he became the CEO of Lead Ventures and led its restructuring by acquiring Curaleaf Holdings Inc., which raised $520 million, making it the largest Canadian cannabis financing in history.

Shortly after that, he took the helm of Rockbridge Resources, a failed Oil and Gas venture, which he restructured by acquiring Harvest Health & Recreation, which closed a $300 million financing, making it the third largest cannabis financing of 2018. His commitment and visibility, especially with local stakeholders and the Lake Babine First Nation, have been instrumental in fast-tracking Dome Mountain to production.

Chief Geologist Bill Cronk, P.Geo., brings more than 25 years of global experience, including time with Northern Empire, which was acquired by Coeur Mining. He's supported by Norman Brewster, former President of Iberian Minerals, and Gurdeep Bains, a former VP at Canaccord with deep capital markets expertise. Together, they form a well-rounded, well-capitalized team capable of executing a complex buildout.

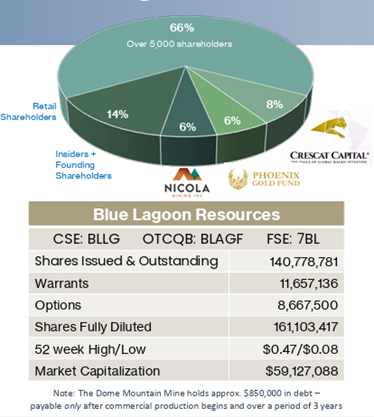

Share Structure

As of July 2025, Blue Lagoon has roughly 140.8 million shares outstanding and 161.1 million fully diluted. The company's market cap sits around CA$94.3 million, with institutional investors, management, founders, and insiders controlling a healthy 34% of the equity.

Retail shareholders hold about 66%. There are just over 5,000 shareholders globally, with strong visibility in Germany, the United States, and now Australia, as the company expands its investor reach.

Technical Chart Overview

From a technical standpoint, Blue Lagoon has completed a long bottoming process.

After finding support near CA$0.22 in 2023, shares broke out above neckline resistance at CA$0.55, a move that confirms a multi-year base and points toward further upside.

Next technical targets:

CA$1.10: prior congestion zone and psychological resistance

CA$1.50: upper resistance from the 2021 rebound

CA$3.10: the big-picture technical target based on the full measured move of the base

Momentum indicators like MACD and RSI are turning up, and volume is expanding. With near-term production as a fundamental tailwind, the technical breakout is now supported by a real business catalyst.

Why Speculators Should Watch Now

Production at the Right TimeGold is trading near record highs, and Dome Mountain is ready to deliver. With permits secured, underground development in progress, and ore shipments scheduled for Q3 2025, this company is about to become a rare small-cap producer in Canada.

2. Fully Permitted in British Columbia

BC is a tough permitting environment, yet Blue Lagoon secured full mining and effluent discharge approvals in February 2025. It's one of only a handful of mines to do so in the last 10 years, giving it a distinct advantage.

3. Low Capex, Fast Ramp-Up

The company's relationship with Nicola Mining (including a toll-milling agreement and equity support) means capital costs are low, and startup timelines are short. Infrastructure is already in place. The water treatment plant is complete. This is a fast-moving story.

4. First Nations Partnership

Blue Lagoon's engagement with the Lake Babine Nation is more than box-ticking, it's a genuine relationship. From ceremonial inclusion to collaborative planning, the company has built a model for respectful resource development. This local buy-in de-risks execution and future expansion.

Source: Lake Babine Nation Instagram and Blue Lagoon's Company Presentation

Source: Lake Babine Nation Instagram and Blue Lagoon's Company Presentation

5. Exploration Upside in a Proven District

The 22,000-hectare land package is only 10% explored. The Boulder Vein is just the beginning. The company has already drilled nearly 50,000 meters and made new discoveries like the Chance and Federal zones. Once cash flow begins, further drilling will be internally funded.

6. Tight Float with Momentum

With a clean share structure, strong insider ownership, and growing institutional awareness, BLLG is seeing increased trading volumes and media coverage. It recently entered the CSE's Top 25 list, not something often seen from a pre-revenue junior.

Final Thoughts

Blue Lagoon Resources is an advanced-stage, near-production gold company with a compelling blend of low-risk development and high-reward exploration. From a chart perspective, it has completed its first breakout move and may now be entering a re-rating phase as production begins.

This company remains a Speculative Buy at the current price of CA$0.65, but a de-risked one relative to most juniors. Fully permitted, tightly held, and technically strong, Blue Lagoon deserves a spot on the radar of gold investors looking for the next wave of producers to emerge in a rising gold price environment.

Readers can learn more at Blue Lagoon's website here.

Blue Lagoon Resources Inc. (BLLG:CSE; BLAGF:OTCQB; 7BL:FSE) closed for trading at CA$0.65, US$0.48815 on July 21, 2025.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Blue Lagoon Resources Inc.Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.