A Quiet Turnaround in a Top Silver District

John Newell of John Newell & Associates explains why he thinks Silver North Resources Ltd. (SNAG:TSX.V; TARSF:OTCQB) is a Speculative Buy.

After quietly building momentum through disciplined exploration and strategic partnerships, Silver North Resources Ltd. (SNAG:TSX.V; TARSF:OTCQB) has broken out technically and fundamentally.

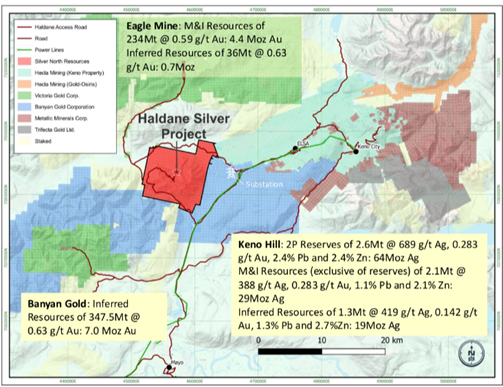

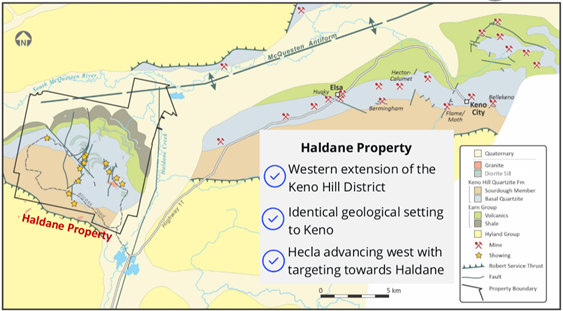

The company has steadily advanced its flagship Haldane Silver Project in the Yukon's Keno Hill District while confirming a CRD system at Tim and uncovering a high-grade lead-silver target at Veronica.

The stock, once forgotten, has now exceeded its first and second chart targets, with a new big picture level coming into focus.

About the Company

Silver North Resources is a Canadian silver-focused explorer with a portfolio of district-scale projects in the Yukon, including the 100%-owned Haldane Silver Project, the Tim Project (under option to Coeur Mining Inc. (CDE:NYSE)), and the Veronica Property, adjacent to Tim. After shifting away from the prospect generator model in 2023, the company now operates as a focused explorer with a clear mission: make high-grade silver discoveries in proven yet underexplored terrain.

Its exploration efforts are centered in the Keno Hill Silver District, one of the world's highest-grade historic silver camps. The company's growing portfolio reflects a blend of near-surface high-grade vein potential (Haldane), confirmed CRD-style systems (Tim), and large-scale geochemical anomalies with recently identified silver-lead showings indicative of a CRD-style system (Veronica).

Management

Silver North Resources is led by a team with deep experience in mineral exploration, project development, and capital markets, including direct success in Yukon and the broader North American Cordillera.

Jason Weber, P.Geo., President & CEO, brings over 25 years of technical and executive experience in exploration. Prior to Silver North, he led both Kiska Metals and Rimfire Minerals, overseeing porphyry and high-grade exploration projects across the Americas. His technical grounding and disciplined corporate strategy have positioned Silver North to maximize value per meter drilled.

Rob Duncan, M.Sc., VP Exploration, has more than 30 years of experience with both majors (Rio Tinto, Inmet) and juniors, including Rimfire and Evrim Resources. His exploration work spans orogenic gold, porphyry copper-gold, and CRD systems, directly relevant to the targets being pursued at Haldane, Tim, and Veronica.

The board includes experienced mine builders and capital markets professionals. Marc Blythe, P.Eng., a third-generation prospector and former VP Mining at Almaden and Placer Dome, brings strong feasibility and underground mining expertise. Craig Lindsay, CFA, was the founder of Otis Gold (acquired by Excellon) and has over two decades of M&A and financing experience in the junior space.

Mark T. Brown, CA-CPA, Executive Chair, has overseen the financial side of the company since 2007 and leads a team at Pacific Opportunity Capital, which supports numerous venture-listed companies. Winnie Wong, CA-CPA, serves as CFO and brings previous experience managing finance and reporting functions for multiple publicly listed miners, including Rare Element Resources.

The board and executive team hold a combined 25% ownership, signaling strong alignment with shareholders.

Together, the team brings a rare combination of technical depth, operational discipline, and market knowledge, well-suited to advancing Silver North's growing portfolio in one of Canada's top silver districts.

Share Structure

As of December 19, 2025:

Shares Outstanding (Basic): 82MWarrants: 31.4M @ CA$0.15 to CA$ 0.35Options: 4.0M @ CA$0.10 to CA$0.50Market Cap: ~CA$ 34 MCash Position: CA$2.4 MOwnership is divided between Retail (53%), Private Individuals (19%), Management (16%), and Funds (12%). The tight float, insider ownership, and modest valuation give Silver North plenty of torque as discovery news continues to flow.

The Haldane Silver Project

Located just 25 km west of Hecla Mining's Keno Hill operations, Haldane sits within the heart of one of the richest silver districts in the world. Recent results continue to build the case for a high-grade discovery:

13.15 meters averaging 818 g/t silver and 1.39 g/t gold (September 12, 2025)Extension of the Main Fault zone by 50 meters along strike (December 29, 2025)2024 program highlights included:1.83 m @ 1,088 g/t silver3.05 m @ 460 g/t silver5.8 m @ 365 g/t silverDespite historic showings dating back to 1896, the Haldane project remains significantly underexplored, with only 28 holes drilled across 12 km of vein targets. The best grades occur where structures cut Keno Hill quartzite, the same host as the region's major producers. With multiple targets (Main Fault, West Fault, Bighorn, Middlecoff) and consistent high-grade hits, Haldane is shaping into a legitimate high-grade discovery.

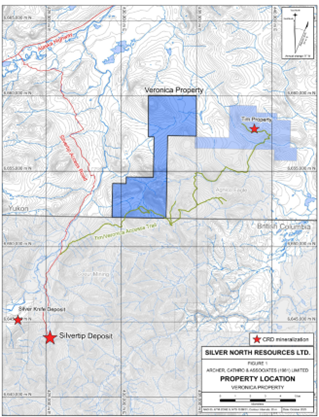

The Veronica & Tim Projects

The Veronica Property: A New High-Grade Signal in the Silvertip CRD District

The Veronica Property, part of Silver North's GDR Project, is located just 11 km northeast of Coeur Mining's Silvertip deposit and immediately adjacent to the Tim Property. Acquired to capitalize on the emergence of the Silvertip area as a new CRD-style silver-lead-zinc district, Veronica hosts a large and expanding soil geochemical anomaly. In 2025, Silver North's field program expanded the Betty Anomaly to more than 1 km by 1 km, open to the east, with strong coincident silver, lead, and zinc values. Importantly, the program delivered the first-ever silver mineralization discovered on the property, including a massive sulphide float sample grading 2,860 g/t silver with elevated lead and gold. Additional mineralized outcrop and fault-hosted galena indicate the presence of a fertile CRD system and elevate Veronica from a conceptual target to a discovery-stage opportunity within this rapidly emerging district.

In October 2025, Silver North confirmed the presence of 76.8% lead and previously reported 2,860 g/t silver at the Veronica Property's Betty Target, a major step forward in validating the project's CRD-style potential. With support from a Yukon government YMEP grant and proximity to Coeur's Silvertip Mine, this project offers a high-impact, low-cost exploration pipeline.

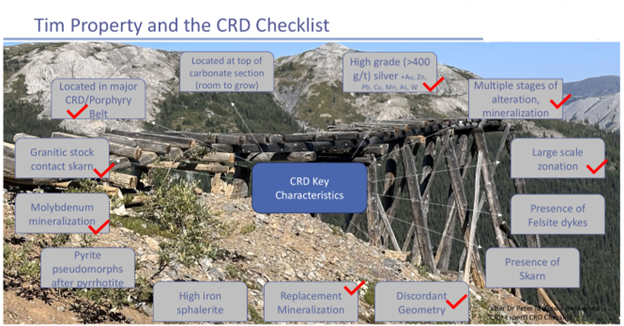

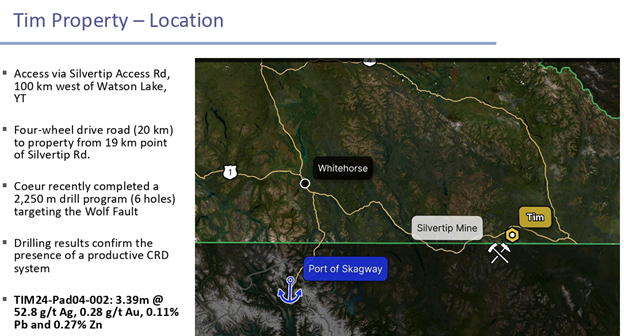

At the Tim Project, under option to Coeur Mining, 2024 drilling confirmed a silver-lead-zinc CRD system. While early grades were modest, geochemical vectors, structural mapping, and pathfinder mineralogy were all textbook. Coeur plans to follow up with deeper drilling in 2025, a potential rerating catalyst for Silver North without needing to spend a dollar.

The Tim Property Emerging CRD Potential in the Silvertip District

Silver North's Tim Property, located 19 km northeast of Coeur Mining's Silvertip deposit in southern Yukon, is a high-potential CRD (Carbonate Replacement Deposit) silver-lead-zinc target. Optioned to Coeur Explorations, the project lies within an emerging district geologically aligned with Silvertip, with road access and extensive prior geochemical anomalies.

In 2024, Coeur completed a six-hole, 2,250-meter drill program, targeting the Wolf Fault, a structure historically associated with high-grade trench samples up to 1,248 g/t silver and 49.5% lead. Although drilling did not intersect high-grade silver mineralization, Coeur's geological observations identified key CRD indicators such as fugitive calcite veining, argentiferous manganese oxides, and recrystallized limestones all features present at Silvertip.

Coeur can earn up to 80% of the Tim project through staged expenditures and a feasibility study, with CA$1.6M invested to date. The 2025 program is expected to build on new geophysical and geochemical vectors, offering a high-leverage catalyst with no capital risk to Silver North shareholders.

Technical Analysis: Breakout Validated with Higher Targets in Sight

Silver North Resources has confirmed a classic multi-phase breakout after more than two years of base building and resistance compression. The December 2025 chart clearly shows a sustained technical reversal, with the price structure now trending above all key moving averages and prior resistance zones.

The Point of Recognition (POR) around CA$0.18 had proven to be a formidable ceiling throughout 2023 and early 2024, rejecting price on at least three notable occasions. The breakout in mid-2025 finally cleared this multi-attempt resistance with conviction, marked by strong expanding volume and rising momentum.

Since then, the price action has confirmed trend continuation, validating the breakout thesis.

Targets Met and Exceeded

First Target: CA$0.32 Met and exceeded in Q3 2025Second Target: CA$0.43 Surpassed in December 2025Third Target: CA$0.55 In progress, remains a logical interim extensionBig Picture Target: CA$1.05 Now active based on the measured move from the multi-year basing structure and Fibonacci extension levelsSupporting Technicals

Volume has been expanding on rally days, particularly since October 2025, indicating strong institutional and speculative accumulationRSI is elevated but not yet overbought, suggesting continuation is possible before a meaningful consolidationMACD remains in bullish alignment, above zero, with a widening histogramThe chart also shows an ascending triangle breakout, with successively higher lows, confirming strong underlying demandThis is a textbook breakout from a long-term downtrend, supported by strong fundamentals (as covered in the main body of this report) and favorable sector momentum.

Summary

With a breakout above long-term trend resistance now confirmed and targets being met in sequence, the technical roadmap for Silver North Resources (SNAG) remains bullish. Provided the stock can consolidate above the CA$0.38-CA$0.40 zone, the next logical resistance comes into play at CA$0.55, followed by the longer-term target of CA$1.05.

From a technical perspective, this remains a Speculative Buy, with rising momentum, strong accumulation, and new chart territory in sight.

Conclusion: A Speculative Buy with Breakout Potential

Silver North Resources Ltd. (TSXV: SNAG, OTCQB: TARSF) has done what few juniors can in this market: deliver technical progress, exploration success, and capital discipline. With a 100%-owned high-grade silver discovery at Haldane, validation from Coeur at Tim, and an emerging target at Veronica, the company now has multiple potential drivers heading into 2026.

From a chart perspective, the breakout is real. From a project perspective, the grades are there. From a valuation standpoint, the stock remains under CA$30 million in market cap, despite already hitting its first two chart targets. Given that the company appears to be hitting on all cylinders, we continue to view the shares as a Speculative Buy at ~ CA$0.42 for investors who understand the risks involved in mineral exploration.

Investors who would like more information can find it at the company's extensive website here

The original Streetwise article by John Newell can be found here.

| Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$1,500.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.