A Strategic Bet on World-Class Silver Assets

Expert John Newell details why he thinks Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) might be worth looking into.

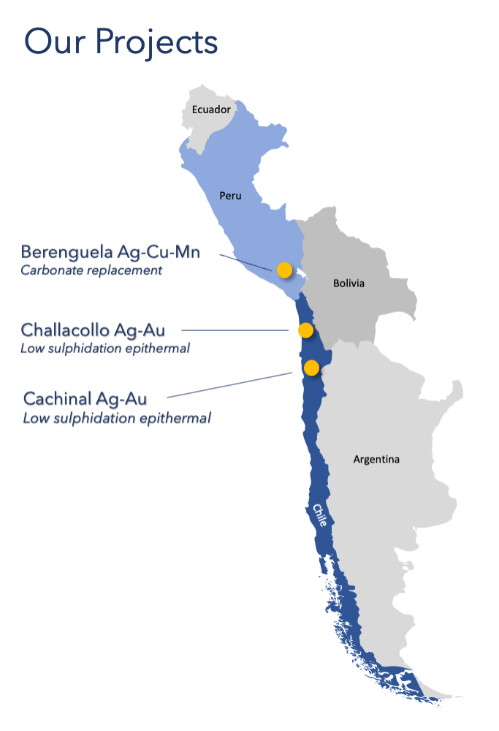

Investors might consider investing in Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) due to its strategic focus on developing world-class silver resources in Chile and Peru, regions known for their rich mineral deposits and favorable mining jurisdictions.

The company has positioned itself in two of the most prolific mining areas globally, offering a compelling mix of opportunity and stability for those looking to invest in precious metals.

You can read more in Aftermath Silver's investor presentation.

Experienced Leadership Ensures Strategic Execution

Aftermath Silver's leadership team brings a wealth of experience in mining exploration, project development, and capital raising. This expertise guarantees a well-funded and efficient approach to advancing its projects. The team's successful track record in the mining industry is a strong indicator that Aftermath Silver is well-positioned to achieve its strategic goals.

High-Quality Project Portfolio with Significant Potential

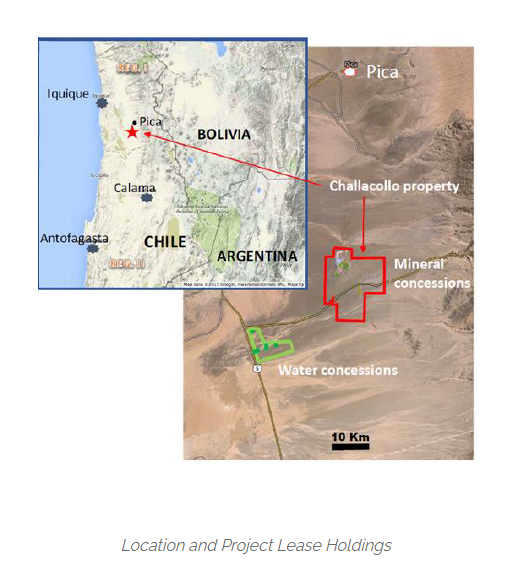

The company's portfolio includes highly prospective properties like the Challocollo and Cachinal in Chile and the transformative Berenguela silver-copper project in Peru. These projects are not only located in mineral-rich regions but also have significant potential to rapidly define resources and deliver strong economic returns. Ongoing metallurgical work continues to support the viability and potential profitability of these assets.

Strong Validation from Renowned Investor Eric Sprott

Eric Sprott, a highly regarded figure in the mining industry, is the largest shareholder of Aftermath Silver. His backing provides strong validation for the company's strategy and enhances its credibility among both institutional and retail investors. Sprott's involvement is a significant endorsement, indicating confidence in the company's ability to deliver value.

Clear Path to Growth with a Focused Strategy

Aftermath Silver has outlined a clear and realistic path to growth, centered on advancing its projects through focused exploration and development. The company's strategy includes moving towards preliminary economic assessments and feasibility studies with the goal of building a significant silver mine. This focused approach provides investors with a clear roadmap to potential returns while mitigating the risks often associated with early-stage mining ventures.

Technically Sound Investment Opportunity

From a technical perspective, Aftermath Silver shares have corrected from their former 2021 highs of $1.95 to a current price of approximately $0.31 forming a solid base over the past two years. This correction and stabilization present a potentially attractive entry point for investors looking to capitalize on the company's future growth and share prices following that growth.

In summary, Aftermath Silver offers a compelling investment opportunity underpinned by its strategic focus on silver-rich regions, high-quality projects, experienced leadership, strong shareholder support, and a clear path to growth. There is a growing global demand for silver. For more information on silver by the foremost institution on the market, see The Silver Institute World-Silver-Survey-2024.pdf.

For investors looking to capitalize on the growing global demand for silver and other critical metals, Aftermath Silver is a company worth precious metal investors serious consideration, and therefore, a Buy.

Aftermath Silver's Website

Aftermath Silver Ltd. (AAG:TSX.V; AAGFF:OTCQX; FLM1:FRA) shares closed for trading at CA$0.31, US$0.23 on September 4, 2024

| Want to be the first to know about interestingSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$1,575.Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.