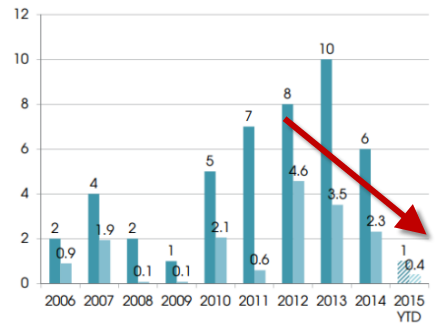

A brutal year for mine financing explained in just one chart

Chart by Preqin.

Year to date the mining sector has raised a miserable $400 million down from a high of $4.6 billion just three year ago, according to data compiled by Preqin released today.

The research firm looked at private equity-style funds targeting assets in energy (including oil and gas); agriculture and farmland; metals and mining; and timberland and water.

The decline in mine financing from just one year ago is huge, an 82% drop compared to the $2.3 billion raised in 2014.

The authors of the study blame the China slowdown and general investor caution. However, conditions may be better in 2016:

There are currently 11 metals & mining funds in market targeting $3.2bn in aggregate capital. Some of these funds may be extending the period before holding a final close with the aim of attracting additional investors. At present, 38% of investors on Natural Resources Online that have indicated their position either have plans for, or are considering, investments in metals & mining over the next 12 months, suggesting that fundraising may prove more positive if market conditions improve in 2016.

Outside of mining, the overall natural resources sector looked bright, which is on course to match the record $61bn raised by the sector in 2013.