A Potential Powder Keg For The Gold Price

Gold's currency component finally shows some improvement.

A timely short interest increase is also a potential rally catalyst.

The bulls must take advantage now to end gold's trading range.

One of the biggest supports for gold in recent months is the tendency for bearish bets to pile up at the slightest sign of weakness in the metal. The pattern since August has been for short interest to significantly spike whenever the gold price drops, then diminish after gold rallies. This repetitive rhythm has contributed to gold's lateral trading range in the last 3 1/2 months, preventing significant headway. Yet it has also kept the price above its August low and has even allowed gold to establish a series of higher peaks and bottoms. In today's report we'll examine the latest factors which can benefit gold's intermediate-term prospects. I'll argue here that rising short interest, coupled with additional dollar weakness, will help keep gold above its August lows and could even serve as a powder keg for a short-covering rally in the coming weeks.

One of the factors that has helped support the gold price, along with rising short interest, is the lately intensified fear over Britain's exit from the European Union. An attempt at unseating UK Prime Minister Theresa May have thrown doubt on her proposed "Brexit" plans and has caused investors to fear a chaotic EU departure for Britain.

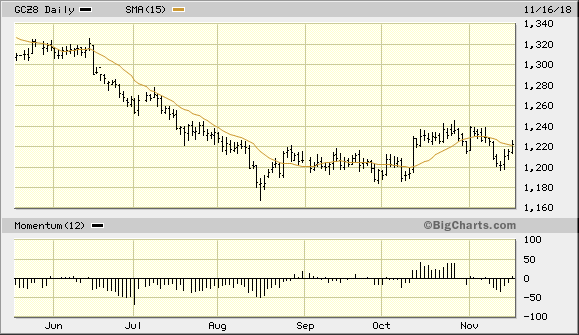

Partly in response to the UK's political turmoil, the gold price rose last Friday to its highest level in a week. December gold closed the latest week at $1,222 after successfully testing the psychologically significant and widely-watched $1,200 level. Last week's rally on global concerns not only erased the setback gold suffered the previous week, but it helped establish a series of higher low in the gold price since the August bottom. The following graph of the December gold futures price illustrates this stair-stepping pattern, which could pave the way for a breakout above the $1,240 trading range ceiling.

Source: BigCharts

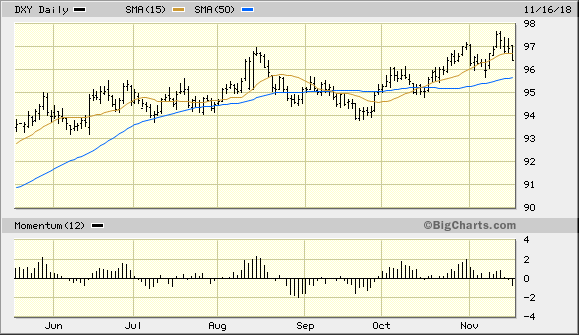

Even more importantly than safe-haven demand was the latest pullback in the U.S. dollar index (DXY). Last week's dollar weakness was the main catalyst behind gold's recovery. DXY closed decisively below its 15-day moving average on Friday, as can be seen below. This was the first time in over a month that the dollar finished below this important immediate-term trend line on a weekly closing basis. I've argued in recent reports that a weekly close under the 15-day MA is a necessary prerequisite for a gold rally. Now that it has finally happened, the gold bulls have their first decisive advantage in several weeks. An upside follow-through in the gold price in the next couple of days would tell us that the bulls plan to take run with their advantage. As I'll explain below, the bulls can also take advantage of another recent development which could help them push the gold price higher.

Source: BigCharts

The latest dollar weakness isn't the only thing that gold has in its favor. The sentiment of large speculators toward gold has fallen again to bearish net position. Non-commercial gold futures contracts totaled -9,247 contracts in the data reported through Nov. 13, a weekly decline of -28,273 net contracts from the previous week's 19,026 net contracts. The data was revealed in the latest Commitment of Traders (NYSE:COT) report released Nov. 16 by the CFTC. The data also revealed that the total bullish gold position fell by -725 contracts to a weekly total of 168,416 contracts. Meanwhile, the total bearish position rose 27,548 contracts to 177,663, a steep increase over the previous week.

The takeaway from the latest COT report is that large speculators have returned to a bearish outlook on the yellow metal after being bullish in the last four weeks. While this tells us that participants remain pessimistic on gold's price outlook, there is potentially enough short interest buildup to allow the metal to rally on short covering in the immediate term. Remember that the last time gold witnessed a steep increase in short interest, the news-related short covering which followed in its wake was enough to push the gold price higher in October. The latest increase in bearish gold positions could be just what gold needs to break it out of its lateral holding pattern of the last three-and-a-half months.

What could serve as the catalyst behind a short-covering gold rally? The most obvious factor would be additional strengthening of gold's currency component. Specifically, if the dollar index manages to close under its widely followed 50-day moving average, the buildup of short interest in the market would serve as a virtual powder keg for a gold rally. I've made the currency component argument in recent reports and it's worth repeating here. The 50-day trend line in the DXY chart shown above can be seen at the 95.50 level. If DXY closes under this level it would signal a serious weakening of the dollar's short-term trend and would almost certainly cause the gold bears to question their pessimistic outlook for the metal. Major short covering would then be expected to follow, giving the gold price another boost.

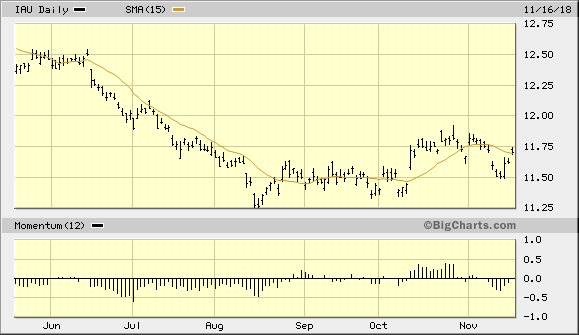

On the ETF front, after technically confirming an immediate-term speculative buy signal, the iShares Gold Trust (IAU) retained its bullish signal last week. IAU recovered late last week after briefly slipping back under its 15-day moving average in the previous week. To reiterate, an intraday violation of the $11.37 level (the Aug. 23 closing low) in IAU would trigger my stop-loss for this trading position. However, the gold ETF is clearly trying to establish a stair-stepping pattern of higher lows, which suggests that IAU remains in strong hands.

Source: BigCharts

In the last report I wrote that if IAU manages to finish this week back above the 15-day MA, we'll have a strong indication that the bulls have regained control of the immediate trend. This happened, as you can see in the above chart, which is encouraging. If the bulls can establish a higher high soon by pushing IAU above its previous high from late October, a renewed rising trend will have been firmly established.

Despite last week's positive performance, gold's troubles aren't over yet and its bear market hasn't been reversed yet. The biggest problem plaguing the gold market in recent months aside from a strong dollar has been the consistent failure of the gold bulls to take full advantage whenever they regain control of the immediate-term trend. They'll once again have a chance to control that trend this week, but they must show the bears they mean business and follow through with last weeks gains. As previously discussed, a weak close in the U.S. dollar index below the 50-day trend line would go a long way toward pushing the bears back and would help gold regain its interim footing.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts