Alcoa Put Options Pay Off Quickly as Stock Slide Worsens

Subscribers to our Weekly Options Countdown services just doubled their money on weekly 2/2 Alcoa Corp (NYSE:AA) 55.50-strike puts. We recommended these positions just this past Friday, meaning options traders realized a profit of 100% in just a matter of days. Let's look back at what attracted us to AA in the first place, and how the short trade unfolded.

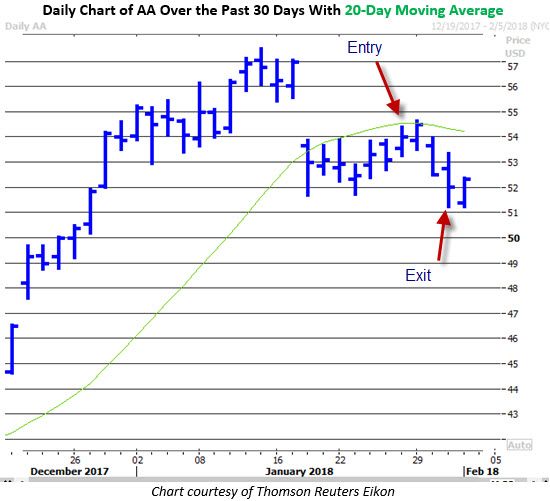

In our recommendation on Friday, we noted that Alcoa stock had recently gapped lower after a disappointing earnings release. In fact, the security was forming a bear flag pattern on the charts, indicating an extended move downward. Adding to the stock's unfavorable technical setup was the 20-day moving average, which had served as resistance since earnings release.

Considering all of this, it seemed unusual that AA didn't have a single "sell" rating from analysts. This suggested optimism from big investors was still too rosy, and further weakness could be in store following the lackluster quarterly update.

This bullishness was seen from options traders, too. Specifically, call buying had doubled put buying across the major exchanges in the 10 days prior to our recommendation. And staying in the options pits, the equity had a Schaeffer's Volatility Index (SVI) of 37%, that ranked in the low 22nd annual percentile. In other words, data indicated it was a good time to buy near-term options

While Alcoa ticked higher in Monday's session, it once again failed to overcome the 20-day moving average. Two days of heavy selling followed, as some of the optimism we cited began to unwind. Wasting little time, we closed out our position on Wednesday, Jan. 31, allowing traders to double their initial cash outlay.