Analysts Warm to Harley-Davidson Stock as Technical Picture Brightens

Options volume on Harley-Davidson Inc. (NYSE:HOG) is unusually high today, following a round of bullish analyst notes. Specifically, Wells Fargo upgraded the stock to "outperform" from "market perform" and raised its price target to $59 from $49, while RBC bumped up its price target to $54 from $51. Both brokerage firms cited tax reform as a potential tailwind for HOG shares. Against this backdrop, more than 22,000 puts have traded -- six times the expected pace, and more than five times the average daily volume.

Options Traders Brace For Pullback From HOG Stock

Looking closer, the weekly 2/2 50-strike put is the most popular contract today, but it's not clear how options traders are positioning themselves here. A number of other near-term puts are seeing accelerated volume, too, as HOG options traders continue the recent put-focused trend. For example, the equity has a 10-day put/call volume ratio of 2.45 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).

Harley-Davidson's two top open interest positions are the February 47.50 and 50 puts, where more than a collective 20,000 contracts reside. Data from the major options exchanges points to buy-to-open activity at both puts, so traders have been betting HOG shares will breach $50 by the close on Friday, Feb. 16, when the front-month options expire.

Perspective options traders will now need to deal with elevated volatility expectations, however. For instance, the security's 30-day at-the-money implied volatility was last seen at 40%, putting it in the 99th percentile of its annual range.

Analysts Bearish as Harley Tries to Break Out

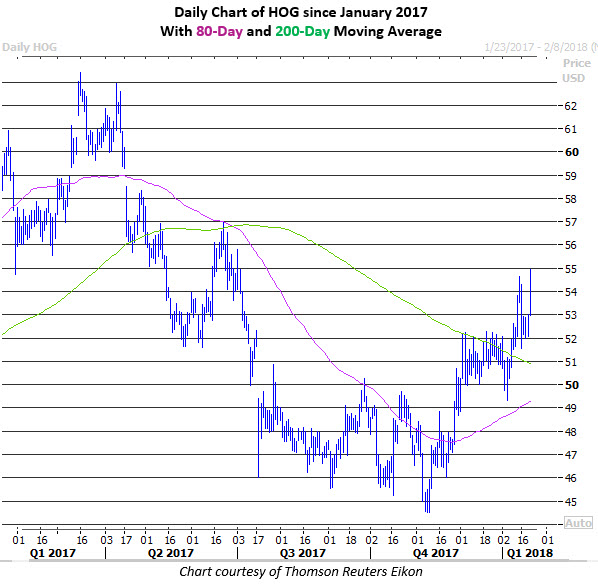

Harley-Davidson stock earlier topped out just below $55, and was last seen trading up 0.9% at $53.49. The shares have rallied almost 20% from their November lows, breaking through their 80- and 200--day moving averages in the process.

Yet as it stands now, just two brokerage firms recommend buying HOG, versus 15 "hold" and "strong sell" ratings. Plus, the equity just surpassed its average 12-month price target of $52.79. So if the shares can extend this technical strength, it could force some analysts to upwardly revise their outlooks.