Anglo's top shareholder could reduce it to diamond-only miner

The world's number five diversified mining company, Anglo American announced a "radical portfolio restructuring" at the end of last year. The company with roots going back more than a hundred years to South Africa's gold and diamond fields said it would cut around 85,000 employees, almost two-thirds of its workforce.

London-listed Anglo also said it's reducing the number of mines it operates from 55 to as few as 16 to focus on diamonds, copper and platinum because of better long-term potential. Its nickel, coal and iron ore assets will be put up for sale.

Now it appears Anglo's largest shareholder, South Africa's Public Investment Corporation would prefer an even more drastically downsized company.

PIC, which manages state pension funds of more than $130 billion, has grown its stake in the company to more than 13%, after picking up shares earlier in the year when Anglo was worth less than $5 billion, down from a a peak of $70 billion in 2011.

"If they did this, it would be the end of Anglo"Various media reports say PIC which is overseen by South Africa's minister of finance wants to bundle all of Anglo's assets in the country into a single entity with its platinum mines as the crown jewels. PIC also owns 30% of world number three platinum producer Lonmin.

The African nation's platinum mines, responsible for nearly 70% of global output, employs more than a hundred thousand workers and labour strife, sometimes accompanied by violence, has become a regular feature of the industry.

Bringing the sector, which is seen as a vital strategic asset for the country, under greater state control has been a goal of the ruling ANC party which recently suffered a stinging rebuke from voters in local elections.

Anglo CEO Mark Cutifani is said to have resisted PIC's demands when it comes to jettisoning Amplats, but the slow progress of asset sales to tackle the company's crippling (and junk rated) debt is adding to pressure.

The Australian newspaper (where predictions of Anglo's demise is a popular sport) speculates that "carving out all the South African operations would reduce Anglo "to a middling player focused on just two divisions - its highly coveted copper mines and diamond giant De Beers":

"If they did this, it would be the end of Anglo. There would be a queue of bidders for copper, offering big numbers that they would find it very hard to turn down. That would leave it with De Beers."

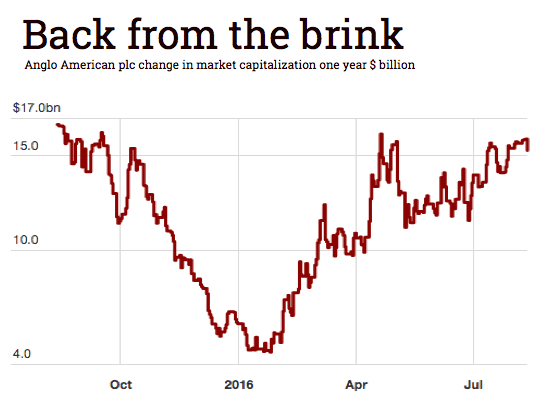

Anglo's market value is up a stunning 186% so far this year for a market capitalization of $16.1 billion on the back of stronger iron ore, coal and platinum prices.The platinum price is performing better than gold in 2016 with a year to date advance of a shade over 33%, while iron ore has surged by more than 40% and met coal is back in triple digits.

Given Anglo's great run since January, the consensus view has become more bearish and further upside for the stock may be limited. Of 24 analysts reporting on the stock 11 expect the company to underperform going forward while five brokerages are urging investors to sell at these levels.