Are shorts bets set to send Barrick soaring?

We have been digging through the latest IIROC bi-weekly short report looking for nuggets of opportunity. By assessing the combination of short positioning and insider commitment in stocks, we are typically able to spot some bullish or bearish signals.

In the latest IIROC report which covers the period between February 16th to 28th, Barrick Gold (Mostly Sunny; ABX) caught our attention.

In terms of insider signals, Barrick Gold has a couple of things going for it. First, it ranks in the top 30% of all stocks in our insider commitment category which takes into account officer and director beneficial holdings as well as recent buying or selling. A culture of equity ownership has taken hold at the firm and is one of the hallmarks of John Thornton's leadership. To get a better sense of opportunity over the next 6 to 12 months, we look at insider commitment in relation to valuations and price momentum to provide us with an INK Edge outlook. On this front, the stock shines brightly with a mostly sunny outlook.

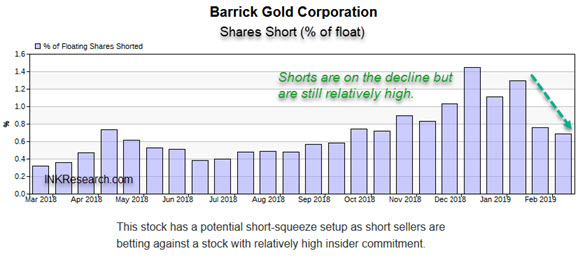

Short sellers seem to have a drearier outlook on the stock than our INK Edge rankings or insiders at the firm. While there can be many reasons to short a large stock like Barrick Gold, including hedging derivatives exposure, the fact remains that short interest at the firm remains relatively high. In fact, there are more shares shorted now than there were a year ago. On balance, we will take that as a negative bet by the shorts against the company.

That said, short positioning has been trending down, which is a bit of a bullish sign. However, due to the large remaining short position, the potential for a short squeeze is what really makes this situation with Barrick stand out. On average, when the short sellers take on the officers and directors of a firm, we would put our money on the insiders. In the Barrick case, we would also note that the latest short report was based on a period that included the news that the firm was pursuing a merger with Newmont Mining (Mixed; NEM). Perhaps that helps explained why some shorts pulled in their horns a bit. We suspect the stubbornness of remaining unhedged shorts could at some point help push the stock to new highs as they waive a flag of surrender to the insiders.

Barrick Gold is a member of the INK Canadian Insider Index used by the Horizons Cdn Insider Index ETF (HII), a 2017 and 2018 Fundata Fundgrade A+ (R) award winner.

INK Edge outlook ranking categories (Sunny, Mostly Sunny, Mixed, Cloudy, Rainy) are designed to identify groups of stocks that have the potential to out- or under-perform the market. However, any individual stock could surprise on the up or downside. As such, outlook categories are not meant to be stock-specific recommendations. For background on our INK Edge outlook, please visit our FAQ #5 at INKResearch.com.

This post first appeared on INKResearch.com.