As Trump plays with trade fire, brace for a hot summer

Perhaps everything is going to turn out just fine. The American tactic of slapping new tariffs on just about every country in the world of consequence could turn out to be a brilliant negotiating strategy. Tariffs could end up forcing America's friends and foes to come to the table to cut historic deals of substance. Canada, Europe, Japan, and Mexico may all agree to lower trade barriers and tariffs on America's terms while Beijing finds common ground on the issue of technology transfer with Washington. This could all turn out to be one big summer of love, albeit tough love.

Count us as skeptical. Not only are the objectives of the American strategy ambitious (re-write NAFTA, expand its steel and aluminum industries, and end bad China behaviour in the area of intellectual property), but the assumed short timelines for concluding such agreements seem highly optimistic.

By design, the US administration has inflicted direct time costs associated with these negotiations via tariffs which the president hints will come off once deals are cut. What the US administration may not have factored in to their strategy was tit-for-tat retaliation from just about every country, with Japan being the one major exception. As a result, the tariff wars are starting to impact the US economy. While Harley-Davidson (Mixed; HOG) made headlines Monday on a report that it is considering moving some production to Europe to deal with retaliatory tariffs, other potentially far-reaching developments are also taking place. In particular, Fed surveys report that businesses are worried about escalating trade tensions. Such uncertainty could throw cold water on business investment decisions. Less than 6 months ago, investors were euphoric over the positive investment implications associated with Trump tax cuts. Now, those tax-cut tailwinds are encountering strengthening tariff headwinds.

Meanwhile, the Chinese government is clearly letting its currency sink. This will help its domestic industry deal with some of the impact of Trump tariffs. In fact, as pointed out by Justin Low at Forexlive, the Renminbi has already depreciated more than 5% from its highs this year. That move has gone more-or-less unnoticed by investors. In contrast, during the summer of 2015, a sharp 3.85% yuan depreciation precipitated a flash crash in global markets. Right now, the investor consensus appears to be that China will have no choice but to cut a deal and that everything will cool down.

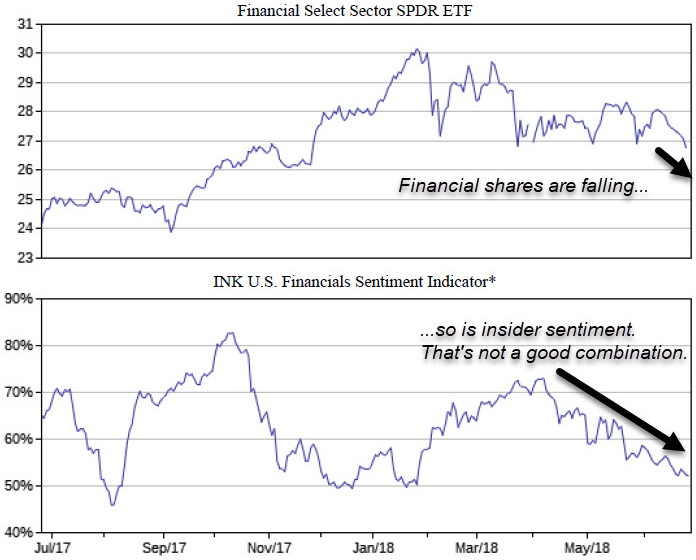

However, insiders are certainly not betting on a China-US trade deal scenario right now. While they are not hitting the panic button, insiders are becoming more concerned. Key insider total dollar selling has been above average over the past week, signalling that market risks are heating up and that stocks are vulnerable to the downside.

The dollar selling has been broad based with Financials and Technology insiders leading the way. As investors have been pouring into technology funds over the past few weeks, insiders have been happy to sell into what Reuters has characterized as record fund inflows. While insiders are often early, retail investors are often late. We will leave it up to our readers to decide who has the timing wrong right now.

This article originally appeared in the US Market INK Report, June 27th, 2018.

*Indicator represent companies with buy only transactions divided by companies with sell only transactions of direct ownership equity securities in the open market by officers and directors filed over the last 60 days.