BREXIT May Lead to UK Property Crash and Depression

- Brexit no-deal would lead to "worst crash since 1930s"- Gold rose 0.6% in dollars and 1.2% in pounds today- UK economy could contract by 8%, house prices fall 30%, sterling fall 25% warns Bank of England- Sterling collapse would push Irish economy into recession- Carney's doomsday scenario sees the crippling of UK finances, the pound crashing and inflation soaring- BOE accused of "Project Fear" and attempt to scare UK parliament to vote against Brexit deal

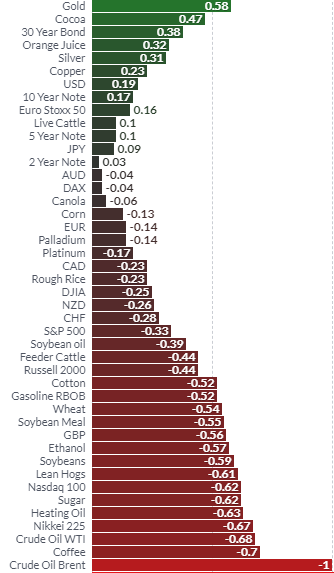

Market Performance - 1 Day (Finviz)

Market Performance - 1 Day (Finviz)

via Times UK:

Britain would be plunged into its deepest recession since the 1930s under a disorderly no-deal Brexit, the Bank of England warned yesterday.

House prices could fall by 30 per cent, interest rates rise to 5.5 per cent and the economy shrink by 8 per cent a greater contraction than after the 2008 financial crisis its worst-case scenario showed.

Ben Broadbent, one of the Bank's deputy governors, said that this would be worse than any crisis since "we went back on gold" and the economy subsequently crashed in 1930. In the 2008 financial crisis the British economy shrank by 6.3 per cent.

The Bank gave its assessment hours after a Whitehall analysis suggested that the economy would shrink under all versions of Brexit.

Editors Note: While the BOE's latest warnings are alarmist, we concur with Mark Carney's advice to "hope for the best but to prepare for the worst" by re-balancing investment and pension portfolios and owning physical gold.

News and Commentary

Gold gains as US dollar weakens after cautious Fed speech (MoneyControl.com)

Gold Rises on Slipping Dollar On Dovish Fed (Investing.com)

Did Fed's Powell 'light the fuse' for a year-end rally? (MarketWatch.com)

Fed's Powell, in apparent dovish shift, says rates near neutral (Reuters.com)

Fed warns 'particularly large' plunge in asset prices is possible if risks materialize (CNBC.com)

Brexit: Dire warnings about the cost of a no-deal are mounting (BloombergQuint.com)

Macro Deceleration Getting Confirmed By How 10-Year T-Yield Behaves (Hedgopia.com)

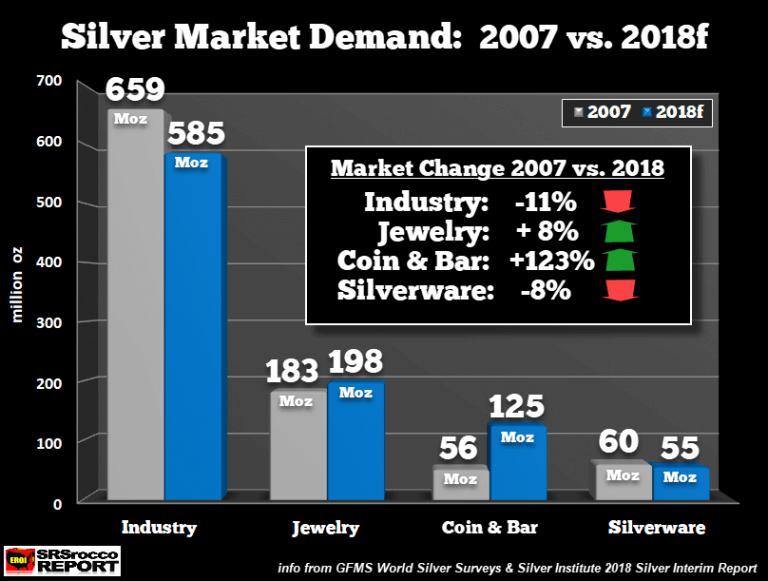

Invest Demand: Still Largest Growth Sector In Silver Market (SRSRoccoReport.com)

Peak Misery: "Everything is Failing" (SevenFigurePublishing.com)

Deutsche Bank Shares Slide As Police Raid Frankfurt Headquarters (ZeroHedge.com)

Gold Prices (LBMA AM)

28 Nov: USD 1,213.20, GBP 949.69 & EUR 1,074.77 per ounce27 Nov: USD 1,225.05, GBP 959.70 & EUR 1,082.21 per ounce26 Nov: USD 1,226.65, GBP 954.58 & EUR 1,079.33 per ounce23 Nov: USD 1,222.15, GBP 951.69 & EUR 1,075.13 per ounce22 Nov: USD 1,228.25, GBP 950.42 & EUR 1,074.72 per ounce21 Nov: USD 1,224.00, GBP 957.29 & EUR 1,075.04 per ounce20 Nov: USD 1,223.10, GBP 951.45 & EUR 1,069.97 per ounce

Silver Prices (LBMA)

28 Nov: USD 14.15, GBP 11.06 & EUR 12.54 per ounce27 Nov: USD 14.28, GBP 11.20 & EUR 12.61 per ounce26 Nov: USD 14.38, GBP 11.18 & EUR 12.65 per ounce23 Nov: USD 14.26, GBP 11.12 & EUR 12.56 per ounce22 Nov: USD 14.52, GBP 11.26 & EUR 12.72 per ounce21 Nov: USD 14.42, GBP 11.26 & EUR 12.65 per ounce20 Nov: USD 14.44, GBP 11.24 & EUR 12.63 per ounce

https://news.goldcore.com/