Bad News Is Good News. For Now.

Eric Coffin's new video presentation from the Vancouver Subscriber Investment Summit 2015, Is a Bad Market Good for Gold Stocks?, can be viewed below:

Click here to watch the video now

Click here to watch the video now

Since the last issue the "optimistic scenario" has been the clear winner. Traders continue to expect the Fed to hold off. That has been enough to keep NY trending higher though the trajectory is flattening out. Economic readings haven't improved. It will take plenty of upside surprises through earning season to keep the trend alive.

The trend has been more evident in Europe, Japan and China. All released weak readings and all have traders that expect their respective central bankers to refill the punchbowl. Let's hope they do.

The optimistic scenario has helped gold but not other metals or energy which have all weakened as lower demand going forward is expected. That may happen but we're also starting to see supply response in some base metals at least which should help cushion the fall.

Offshore economic readings have been weak enough that the USD has been able to hold its recent price range. The increase in the gold price is welcome but it looks like stronger offshore readings or more hawkish than expected messaging from the ECB and/or BoJ will be required to generate a break in the Dollar. We want to see gold on the other side of $1200 and the Dollar Index may have to fall below 94 for that to happen. NY markets really falling apart would work too but the process would be a lot messier.

***

The saga continues. Since the last issue the markets have been trading higher and generally following the "optimistic" fork in the road that I laid out in Journal issue 240. That scenario also held for commodities and gold though with less impressive moves than equities. More on that later.

As you'll recall, the "optimistic" scenario is based on the market coming to the conclusion that the Fed will not raise rates for a very long time. Of course, a week can be a very long time on Wall St. For our purposes traders would have to view a 2015 rate increase as off the table and any increase classified as highly unlikely well into 2016.

That is pretty much where we are now. Mainstream financial media is busy explaining how Janet Yellen doesn't want to play the Grinch to Wall St's Whoville come December. (Well, unless it's the ending. Who doesn't love huge bags of gifts and mutts with fake reindeer antlers? That's the straight-to-DVD "QE4" version.) As usual, bond traders are even more cynical, assuming less than 50/50 odds of a rate increase before April 2016. I side with the bond traders but it's important not to forget that the majority of Fed governors want to raise rates. They just don't want a market crash blamed on them.

As you can see from the chart on page 1 the markets like the no Fed hike message. A lot. The S&P has rallied 7-8% in the past two weeks. This didn't come on the back of strengthening economic readings. Most of those have continued to worsen.

Perhaps earnings season is the reason the market is so bubbly? We've only really started reporting Q3. According to Factset.com, 112 large companies have reported and, (surprise!) 83% have beaten estimates. Of course, those estimates were lowered based on recent guidance from the companies so beating them isn't that amazing.

My comment from the last issue about earnings beats headlines leaving me rolling my eyes hasn't changed. The standard MO for large company analysts is to slightly under-promise and have the company slightly over-deliver. Same, same. Nothing to see here, move along.

We won't have meaningful comparables to work with until earning season is done but one potentially significant statistic seems to be forming up. Earnings beats as a percentage of those reported are high at 80% but revenue beats are lower than average at 50%. Both earnings and revenue estimates were ratcheted down dramatically so the beats are no surprise but it's interesting that top line revenues seem to be underperforming earnings so much. More cost cutting?

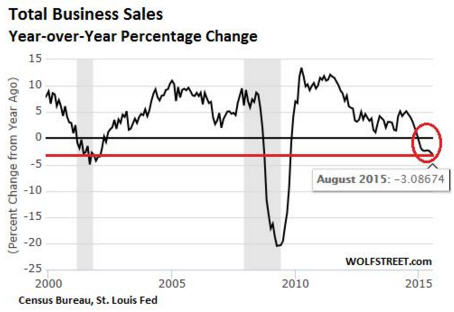

That brings me to the chart below that was derived from US Census Bureau business revenue estimates. It's not a comforting chart, like many others I've displayed in the past few months. Before I go into it I want to reiterate for those who are not long term HRA readers that I'm not some doomer permabear. On the contrary, I get accused of being too bullish more often than not. My concerns about the potential for a severe market correction and possible recession are data, not ideologically, driven.

You can see from the Total Business Sales chart that the downtrend is not new. Sales topped out early in this expansion. That itself is unusual. Pullbacks during expansions do occur as the pre-2008 portion of the chart shows but a long decline in revenue growth for the past four years is yet another example of how odd an expansion this is.

Bulls will point out that much of the recent dive can be pinned on low oil prices. That's true, but non-energy revenue growth has dropped too. It's expected to come in at 1.7% for Q3. That sort of number is usually only seen when the economy is heading for recession. It's not a recessionary reading per se and could still turn up but it's close.

The S&P chart looks pretty bullish though it feels like the easy gains might be over. We're not definitively back in a major uptrend but it looks a lot less scary. There will be some strong resistance to overcome just above current levels. I still think we'll need a better than expected earnings season to get full recovery.

I've updated the Value Line Geometric Index chart on this page to show how the broader market is faring. It looks better too but is not out of its downtrend. XVG still hasn't exceeded its "Fed day" high, remains in correction territory and is hitting resistance. The divergence stems from continued weakness in market breadth in the headline indices. They are still being carried by a small number of hot names.

If we don't see further weakening of US economic conditions we may squeak through and have a continuation of the bull market. I don't expect a lot of strength but an uptrend is possible.

Zero interest rates keep traders calm but they aren't news. ZIRP can't carry the market by itself forever. If valuations were low it could maintain the party on its own but overseas shocks this year have traders questioning the Fed's lack of nerve.

For now, traders are just happy the Fed is standing pat. At some point though, they will worry about why unless they see the US economy improving for themselves. It's been an awfully long wait for "liftoff". Whatever its reasons, the Fed has to stand pat for the optimistic scenario to continue playing out. If rates are raised we're back to depending on follow through in earnings and economic strength. I'm not convinced there will be enough of that to levitate the indices in NY.

The Fed must play along for this to work. Even if traders view a rate increase as a vote of confidence initially it will put the bear market scenario back in play unless there is significant improvement in US economic readings first. There is no evidence of that yet.

China "Beats" (!)

The latest "earnings beat" was from a country, not a company, namely China. China reported an initial estimate of Q3 GDP growth of 6.9%. That was higher than the consensus estimate of 6.8%. That's good right? Well, no, apparently. The announcement caused some positive movement on Asian exchanges but by the time NY opened it was being viewed as a negative.

There were two parts to the negatively. The first was China missing the 7% growth target Beijing had set for itself. That couldn't have been much of a surprise. No one has believed that target for months, at least.

Of course there is also continued concern about how accurate the 6.9% number really is. Several private tracking services estimate current growth rates in China are anywhere from 4% to 6.5%. The weaker numbers come from services that weight industrial readings like power consumption and rail traffic heavily. That could be understating things with the economy transitioning to a more serviced based model but, still, few take the 6.9% reading at face value.

I think that coming in right between the consensus estimates and 7% looks awfully convenient too. The true growth rate is probably lower but the more important message is that there is no "hard landing" in sight for China, something many fear.

The second issue was the composition of the growth reported. That was actually good news for China, just not so good for outside markets. Industrial Production and Fixed Asset (read: real estate) investment both came in below consensus but both retail sales and lending came in higher. This is evidence that Beijing is having some success rebalancing the economy. That's not the best news for commodity producers though a good growth rate in China helps, even if it's skewed towards consumers and services.

News of China's weaker growth helped put at least a short term bottom under the US Dollar. As you can see from the chart on this page the 94 level has been strong support for the past year. There are plenty of bulls in the USD market. It's one of the most crowded trades around. If my optimistic scenario is to play out in metals and EM markets we need to see the dollar index fall below that level.

News on the Chinese economy is also directly impacting base metals trading, particularly copper. There are some strange things going on in the copper market. Most traders are quite bearish on base metals due to concerns about China but there is evidence that Chinese traders may be suppressing the copper price.

Metals trading volumes in Shanghai surged after regulators made it nearly impossible to place bearish bets on the Shanghai stock index.

Copper and apparently zinc have been used as proxies to bet on lower growth in China. This makes it much more difficult to read price signals from these exchanges, a situation gold traders are all too familiar with.

Copper has seen a number of supply cutbacks and shelving of projects in the supply pipeline. Though I'm not sold on these cuts being large enough yet in the face of lower demand from China it is strange that copper isn't trading better with worldwide warehouse inventories below one week's supply. Generalist traders worry about supply growth. That's valid but remember that copper miners overestimate future production. Not occasionally. Every year. No reason to think that isn't happening again.

The situation is similar in the zinc market. Glencore, the world's biggest metal trader and one of the largest zinc producers is in financial trouble. The company makes a lot of money trading and its operations are something of a black box. That has fed trader skepticism about GLEN but the company has been making some dramatic moves to restore confidence.

One of those moves was an announcement of zinc production cuts totaling 500,000 tonnes through the next year. That is a dramatic reduction that would all but wipe out current LME inventories. Zinc saw a one day 10% move in price on this news but has been fading since. LME zinc inventories grew by 200,000 tonnes from mid-August to the end of September. Was this Shanghai traders taking advantage of arbitrage between Shanghai and London or selling zinc to bet against their country's economy? It's still not clear but the sort of reductions Glencore announced should have a bigger impact if the Chinese economy isn't falling off a cliff. Stay tuned.

Lower raw material input (and pork) prices continues to put downward pressure on China's CPI. In China's case that is good news since it isn't suffering from deflation like so many other countries. This will give the Bank of China more room to cut interest rates and bank reserve ratios. While I agree that it's unlikely Beijing can hit its 7% growth target anytime soon things seem to be stabilizing at least internally. Whatever the source of the growth is stability in China will be a boon to emerging markets in general and help restore some balance.

This brings us back to the gold market. It's been one of the better performers this month. The chart on the next page shows a five year trace for the GDX gold miner's index. Not an inspiring chart though there is some reason to be optimistic for a change. Not a real breakout yet but the heavy up volume is encouraging even if the dollar volume is less impressive. There is a lot of new interest in the space.

Gold itself has managed to climb above both the September and August highs and briefly got above its 200 day moving average for the first time in months. Whether it can hold that remains to be seen. It's over bought short term and may consolidate. The key will be whether it can hold on near current levels or fade like it has done so many times in the past couple of years.

The 200 dma was just the minimum objective gold had to reach. The tougher climb is still ahead, getting through $1200 and ideally through the spring high near $1225.

Will it make it? I take some comfort from generalist technical analysts that I check in with occasionally. Most of them see a triangle pattern from which price broke out to the upside. Several consider that a final bottoming pattern. In other words, they think the bear market is now over. It's hard to buy into that just yet. We've all seen this movie so many times it's impossible not to be skeptical.

I agree we may have just seen "the" bottom though I'm disturbed by the rapid rise in bullishness. Commentary has gotten positive quickly and positioning in the futures market has gotten more bearish with a bigger long position and a rapid drop in short positioning.

That doesn't mean the chart guys are wrong. Most that I check with are not gold bugs and have not particular interest in the bullion market. It's just another chart. That's a positive in my book since they have no reason to cheerlead.

Conversely, gold bugs are gold bugs and bound to jump on any upward price move. They're always bullish so their positive opinion is nothing new. I don't like this new bullishness from other sources as its coming too early. Bull markets climb a wall of worry so I want to see more negative commentary outside the gold bug space. Longer term, many investment banks are firmly bearish, which (ironically) is good. We need skeptics and pullbacks and consolidations along the way to build a lasting rally.

If we stick with my optimistic scenario, the USD will determine whether gold can hold its gains. That in turn will depend on the market's reading of the Fed's intentions. Any sort of strength offshore that takes some of the bid off the USD would help too.

There hasn't been much "safety" trade in gold. If the market does roll over we could see a return of that. Not a safety trade per se but a "they're screwing this up" vote of non-confidence in bankers, central or otherwise. That looks the less likely route now but it's not off the table. A major pullback will remove interest rate increases from the equation. That would help metals too though the path would be a lot bumpier. Either way a true bottom for gold may finally be at hand.

?,,?

Join HRA's Free List Now and Receive the Latest Editorial, Media Interviews and Special Reports from HRA for No Cost! Click here now to sign up.

The HRA-Journal and HRA-Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

(C)2015 Stockwork Consulting Ltd. All Rights Reserved.