Barrick Gold Corp.: A Million Dollar Options Play?

The dream of making a million on an options trade has been one of my dreams for some years, so today, I'll outline one such possibility.

It is interesting to note at this point that the producers haven't really joined in the fun and are not reflective of the progress made by gold.

Therein lies our opportunity.

This sort of trade is a very big ask.

Preamble

Every now and again it is nice to sit back and dream of just what the possibilities could be. If we don't have dreams they can't come true. The dream of making a million on an options trade has been one of my dreams for some years, so today I'll outline one such possibility.

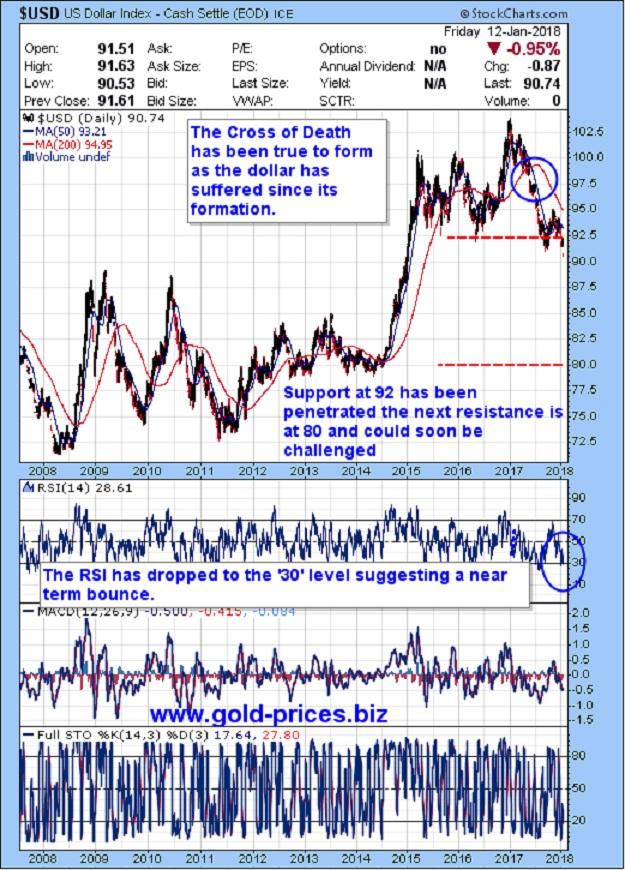

The US Dollar

The following chart depicts the US dollar as it struggles to maintain its purchasing power. A rapid fall now would ignite the precious metals sector.

Gold

The precious metals mining sector is in a healthy position because over the last few years it has been unmercifully battered. It remains unloved in many quarters as the big tech stocks and the cryptocurrencies hold centre stage. The Sword of Damocles has cast its dark shadow over the precious metals sector in the form the Federal Reserve implementing rate hikes. Conventional wisdom suggests that these hikes will add strength to the USD and therefore make gold and silver cheaper in dollar terms. The rate hikes have been implemented but the dollar hasn't responded, rather it has lost value instead. In the face of the above gold has done well and in an improved environment, a market correction, a downturn in the cryptos, delayed rate hikes or not, I think gold will continue to improve this year.

As we are all aware gold made an all-time in high in 2011 and since then it has endured a mauling until it bottomed in 2015. The base building has been an arduous one with a correction taking it back to $1125/Oz. in December 2016. Last year we witnessed gold staging a reasonable recovery putting on approximately $200/Oz. taking it to today's price of around $1330/Oz. To the year ahead I am expecting the excitement to build along with some rotation out of the main market and the cryptos and into gold to the tune of at least $300/Oz. or so. It is interesting to note at this point that the producers haven't really joined in the fun and are not reflective of the progress made by gold. Therein lies our opportunity.

Gold and Silver Mining Stocks

The producers as measured by the Gold Bugs Index, the HUI, remains some 67.93% off its high (630-202) made in 2011. Is it time that they played catch-up? We believe it is because they have put in some hard yards to get their costs down, ditch poorly performing assets, pay off some of their debts and generally improve their operational and their financial situation. They are now making money and any increase in the price of gold and silver should be a direct benefit to them. One negative would be the price of oil, which is also rising, and they need oil to generate the energy required for mining operations. However, with oil at $68/barrel it is a long way short of the $120/barrel that they had to endure a few years ago. We will never have a perfect trading situation, but we are now of the opinion that the mining sector is positioned to increase in value at a ratio of around 3:1 to the performance of gold and silver. There are also many candidates in the frame to act as a vehicle for this trade and we will be utilizing those companies that make-up our short list of suitable applicants to get some diversification embedded into this strategy.

Our chosen vehicle for today's exercise has been hiding in plain sight and it is Barrick Gold Corp. (ABX)

Barrick Gold Corp.

One of the reasons for selecting ABX is that it has been battered more than most and looks a tad oversold. The current stock price is approximately $15.00, it has an EPS of $1.86 giving it a P/E ratio of around 8 which is one of the lowest in this sector. The AISC used to be in the region of $1100/Oz. and with gold selling at a similar price it's no wonder that Barrick Gold Corp. wasn't attractive to investors. Today the cost of producing an ounce of gold is around the $750/Oz. level. Looking ahead the 2018 production guidance is for 5 million ounces with a similar figure for 2019.

Given our premise of a $300/Oz. minimum improvement in the price of gold this would add $1.5 billion ($300/Oz. x 5 million ounces) to their coffers.

A 23% rise in gold prices at a ratio of 3:1 would equate to an increase 69% in the price of this stock. Using a rounded figure of $15.00 + 69% gives us a new price of $25.35.

In Barrick's case debt reduction is something I'm wrestling with; considering that at year end 2014, the debt stood at over $13B, it has done well to more than half this debt, so yes it will put investors off but it's not a show stopper.

And then there's that old intangible aptly named "gut feel" without putting too fine a point on it I am expecting ABX to double or more in the next 6 months.

Barrick Gold Corporation will release its Fourth Quarter 2017 Results on February 14, 2018; we could wait until then, however, we can never have all the data or perfect data at any one time, decisions must be made on what we have which carries risk as we well know.

A Possible Options Trade

An example as follows:

ABX current stock price at $15.00

There are 100 shares per contract.

Predicting a stock price of $30.00 by June

The chosen options series is Barrick Gold Corp. Call Options, Expiration 15 June 2018, strike price $22.00 @ say $0.10 per contract. (Bid $0.08 Ask $0.13)

Should ABX achieve our target of $30.00 by June 2018 these Call Options would be worth $8.00 at expiry;

$8.00 x 100 shares = $800.00 x 1250 Contracts = $1000.000.00

The cost would be 1250 contracts x $0.10 x 100 = $12,500.00

If successful it would be an 80:1 winner, which is a very tall order indeed.

Conclusion

The downside includes but is not limited to;

1. Gold goes sideways or down.

2. Gold doesn't improve fast enough

3. The miners don't follow gold

4. The miners do follow gold, but Barrick remains sluggish

5. Etc.

This sort of trade is a very big ask but the upside potential could be very profitable, however, never risk more than you can afford to lose, there will be other opportunities.

If nothing else, then you can sit back and have a chuckle while we sweat it out.

For disclosure purpose our subscribers and me are long Barrick Gold Corp. options.

Your comments as always would be appreciated.

Go gently.

Disclaimer: www.gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Disclosure: I am/we are long ABX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.