Barrick Gold: Accumulate On Any Weakness

Barrick reported its fourth quarter and 2017 year results on February 18, 2017. The company delivered earnings that matched expectation.

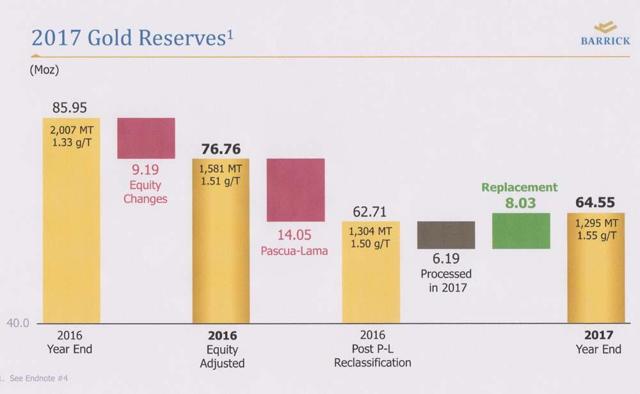

One crucial issue for the company is about the gold reserves which were revised down by 25% last year to 64.55 M Oz.

I am confident that ABX is a good investment and I am prepared to accumulate on any weakness.

Courtesy: Barrick Gold

Investment Thesis

Barrick Gold (ABX) is one of the largest gold producers in the world. The stock price has suffered from a gold price slump and high debt on its balance sheet which reaches over $12.75 billion in 4Q'14, and despite an impressive comeback in 2016, the stock price has been sliding down since then.

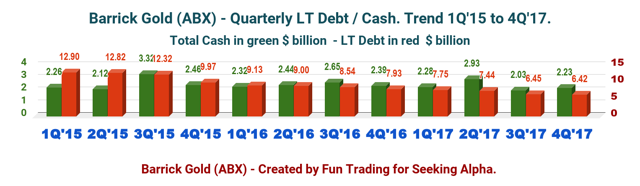

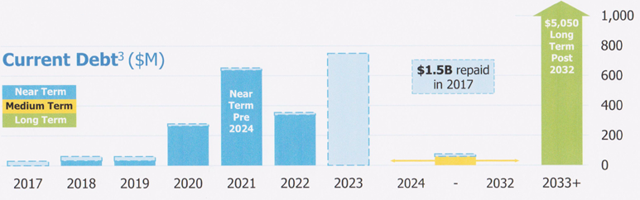

However, while the company holds one of the highest Debt/Equity ratio among its peers, Barrick Gold management is undoubtedly aware of its debt issue. The company has made a significant commitment to cut its long-term debt to $6.42 billion as of December 31, 2017, and expects to reduce it further to $5 billion at the end of this year.

This important goal added to a constant free cash flow pushes me to continue to support ABX as a long-term investor's opportunity and I recommend to accumulate the stock on any weakness, especially at or under $13.

However, to reduce debt to $5 billion this year will be costly and challenging. Catherine P. Raw, CFO, said in the conference call:

We exceeded our 2017 debt repayments target achieving a total debt reduction of $1.51 billion. Our goal remains to reduce out total debt to around $5 billion by the end of this year. However, with our bonds now trading at between 119%, 125% premium to par, we will only take those actions where the risk/reward tradeoff makes sense.

ABX data by YCharts

ABX data by YCharts

Note: The debt reduction has been driven mainly by selling the company's non-core assets to optimize its balance sheet.

Kelvin Dushnisky - Barrick Gold CEO said in the conference call:

Our first priority was to maximize free cash flow. In 2017, our operations generated over $2 billion of operating cash flow and nearly $670 million of free cash flow. This allowed us to increase reinvestment in the future of our business during the year.

ABX - Balance Sheet And Production In 4Q'2017: The raw numbers.

| Barrick Gold | 1Q'15 | 2Q'15 | 3Q'15 | 4Q'15 | 1Q'16 | 2Q'16 | 3Q'16 | 4Q'16 | 1Q'17 | 2Q'17 | 3Q'17 | 4Q'17 |

| Total Revenues in $ Billion | 2.25 | 2.23 | 2.32 | 2.24 | 1.93 | 2.01 | 2.30 | 2.32 | 1.99 | 2.16 | 1.99 | 2.23 |

| Net Income in $ Billion | 0.057 | -0.009 | -0.264 | -2.622 | -0.083 | 0.138 | 0.175 | 0.425 | 0.679 | 1.084 | -0.011 | -0.314 |

| EBITDA $ Billion | 0.80 | 0.69 | 0.49 | -2.63 | 0.66 | 0.88 | 1.12 | 0.89 | 1.63 | 1.56 | 0.41 | 1.27 |

| Profit margin % (0 if loss) | 2.5% | 0 | 0 | 0 | 0 | 6.9% | 7.6% | 18.3% | 34.1% | 50.2% | 0 | 0 |

| EPS diluted in $/share | 0.05 | -0.01 | -0.23 | -2.25 | -0.07 | 0.12 | 0.15 | 0.36 | 0.58 | 0.93 | -0.01 | -0.27 |

| Cash from operations in $ Million | 316 | 525 | 1255 | 698 | 451 | 527 | 951 | 711 | 495 | 448 | 532 | 590 |

| Capital Expenditure in $ Billion | 514 | 499 | 389 | 311 | 270 | 253 | 277 | 326 | 334 | 405 | 307 | 350 |

| Free Cash Flow in $ Million | -198 | 26 | 866 | 387 | 181 | 274 | 674 | 385 | 161 | 43 | 225 | 240 |

| Cash and short term investments $ Billion | 2.26 | 2.12 | 3.32 | 2.46 | 2.32 | 2.44 | 2.65 | 2.39 | 2.28 | 2.93 | 2.03 | 2.23 |

| Long term Debt in $ Billion | 12.90 | 12.82 | 12.32 | 9.97 | 9.13 | 9.00 | 8.54 | 7.93 | 7.75 | 7.44 | 6.45 | 6.42 |

| Dividend per share in $ | 0.05 | 0.05 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.02 | 0.03 | 0.03 | 0.03 | 0.03 |

| Shares outstanding (diluted) in Billion | 1.165 | 1.165 | 1.165 | 1.165 | 1.165 | 1.165 | 1.165 | 1.165 | 1.166 | 1.166 | 1.166 | 1.167 |

Source: Company filing and Morningstar.

1 - Gold Production Details

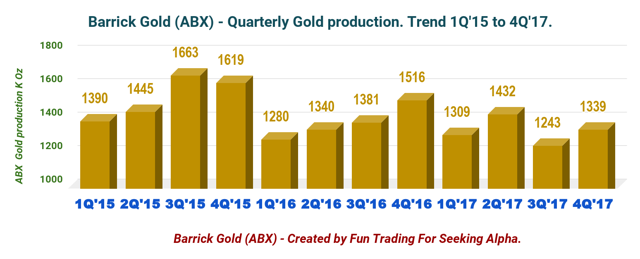

Gold production was 1,339K Oz, up 7.7% sequentially and minus 11.7% from the previous year.

Barrick is one of the industry's lowest cost producers.

All-in sustainable cost AISC (by-product) is one of the lowest in the industry and has been under $800/Oz for over two years. One of the best AISC among its peers. Below is the production per mines.

All-in sustainable cost AISC (by-product) is one of the lowest in the industry and has been under $800/Oz for over two years. One of the best AISC among its peers. Below is the production per mines.

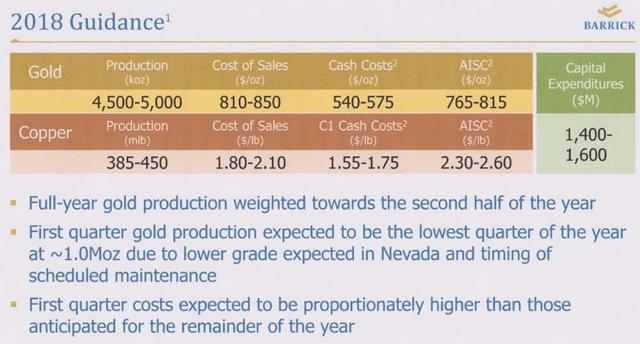

Note: Barrick is also producing Copper. Production for the 4Q'17 was 99 Mlbs from three mines: Zaldiva (50%), Lumwana and Jayid Sayed (50%)

Note: Barrick is also producing Copper. Production for the 4Q'17 was 99 Mlbs from three mines: Zaldiva (50%), Lumwana and Jayid Sayed (50%)

Two critical issues that faced Barrick Gold in 2017:

In March, a pipe burst at the company Veladero leach pad, resulting in the temporary suspension of mining operations. The mine was back to normal activities in July and Veladero continues to have local community and government support. The company experienced challenges at Acacia mine in Tanzania. The company is hopeful that a proposal, agreeable to all parties, will be reached by mid-2018. On February 16, 2017, we learned that Acacia mining is considering to sell a stake in some or all of its operations in Tanzania.2 - Production Guidance 2018:

Pascua-Lama project on the Chile-Argentina border is mainly to blame after its plans for developing the project have changed from open pit to underground mine.

3 - Barrick Gold - Technical analysis

ABX is forming falling wedge pattern. When this pattern is found in a downward trend, it is considered a reversal pattern, as the contraction of the range indicates the downtrend is losing steam. When the pattern completes, and the price breaks out of the wedge, it is usually in the opposite direction the wedge was pointed, which means ABX may eventually experience a decisive breakout later.

The immediate strategy is to buy close to the line support (in blue) which is around $12.60-$12.25 now (Buy flag) and eventually wait for a re-test of the resistance around $14.50 (Sell/buy or hold flag).

If ABX penetrates the resistance with a substantial volume, then it is essential to add more, and if the resistance is too strong, then it is recommended to sell a large part of your holding and take profit.

4 - Commentary

Barrick reported its fourth quarter and 2017 year results on February 18, 2017. The company delivered earnings that matched expectation. Net earnings for the year were $1.44 billion or $1.23 per share. Adjusted net earnings increased to $876 million or $0.75 per share compared to $0.70 last year.

In the fourth quarter, Barrick Gold recorded adjusted net earnings of $253 million, or 0.22 a share, unchanged from $255 million, or 0.22 a share a year ago.

One crucial financial element that deserves some serious attention is the ability of the company to deliver sufficient free cash flow. On a yearly base, FCF is now $669 million, which is adequate to pay for the $140 million annually and leaves a security margin.

One crucial financial element that deserves some serious attention is the ability of the company to deliver sufficient free cash flow. On a yearly base, FCF is now $669 million, which is adequate to pay for the $140 million annually and leaves a security margin.

Free cash flow is an important clue that should always be carefully evaluated when looking at a long-term investment. ABX passes the test here.

Free cash flow is an important clue that should always be carefully evaluated when looking at a long-term investment. ABX passes the test here.

However, the balance sheet improved in 2017

With and strong near and medium-term liquidity of $6.2 billion including a $4 billion undrawn credit facility. And about 75% of the debt due after 2032 and less than $100 million due before 2024.Source: ABX Presentation

One issue for the company is about the gold reserves which were revised down by 25% last year to 64.55 M Oz., as it sold off some non-core stakes and changed its plan for a South American asset.

Another worry is that production for 2018 is seen as 4.5 to 5 M Oz., which is nearly 11% down from 2017 using the middle-point (Please see guidance 2018 above).

On a final note, about the tax reform. In late 2017, tax reform was enacted in the U.S.A and included a reduction of the corporate income tax rate from 35% to 21%, a repeal of the corporate AMT and mandatory repatriation of earnings and profits from foreign corporations. Barrick Gold estimates that the impact of the reform will result in a net positive adjustment of approximately $200 million.

5 - Conclusion

Barrick Gold presents a rock-solid balance sheet and can be considered as a "cash machine" with free cash flow of $669 million in 2017 or $0.57 per share. However, despite substantial results, the market decided that it was time to sell the stock and it did. Sometimes, we will have to simply admit that the logic of the market is not based on facts, but more on expectation and momentum. We will have to use it and profit.

However, Trading ABX in correlation with the gold price is imperative. The short-term range is $1370 to $1309.

I am confident that ABX is a good investment and I am prepared to accumulate on any weakness.

Important note: Do not forget to follow me on ABX and other gold stocks. Thank you for your support.

Disclosure: I am/we are long ABX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade the stock mainly and own a small long position.