BlackBerry Stock Could Be a Bargain Right Now

Shares of BlackBerry Ltd (NYSE:BB) are up 3% at $10.55, at last check, but have pulled back since touching a two-year high of $11.78 in mid-October. However, the smartphone maker's recent dip could be a buying opportunity, if recent history repeats. Below, we'll explain why BB stock should be on your bullish radar.

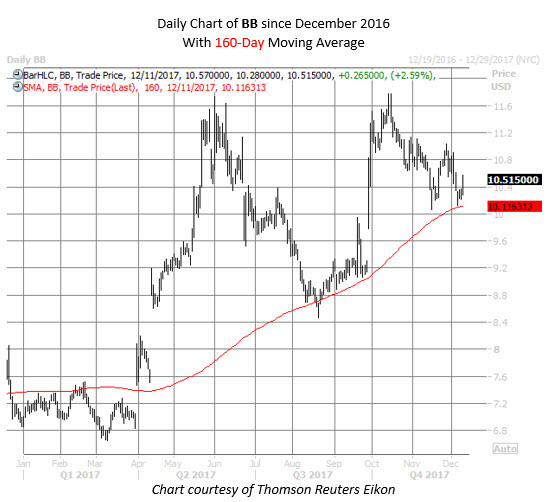

BlackBerry stock recently came within one standard deviation of its 160-day moving average, after a lengthy stint above this trendline. After similar pullbacks to this moving average of late, BB shares were higher 67% of the time one month later, per Schaeffer's Senior Quantitative Analyst Rocky White. What's more, the stock was up an average of 8.68%. From current levels, another 8.68% gain would place BB around $11.46 -- back near recent highs.

Despite the security's long-term rally, analysts remain skeptical, with eight out of 10 following the tech stock carrying tepid "hold" ratings. What's more, the average 12-month price target of $10.32 sits slightly below today'sprice. Upgrades and/or price-target hikes could lift the telecom concern even higher.

Plus, it would take more than three weeks to buy back all the shorted BlackBerry shares, at the equity's average pace of trading. Should BB stock once again bounce from technical support, a short squeeze could add fuel to the fire.