Boeing Stock Options Bulls Quadruple Their Money

Subscribers to Schaeffer's PowerTrend service more than quadrupled their money on our Boeing Co (NYSE:BA) January 19, 2018 235-strike call recommendation. Here's a quick breakdown of what put BA stock on our bullish radar, and how the winning options trade unfolded.

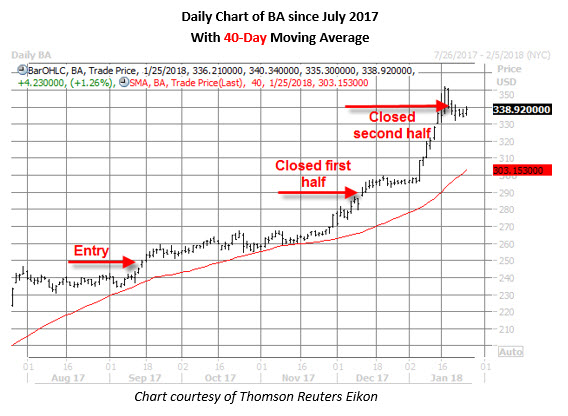

When we recommended the call option back on Sept. 14, the Dow stock was in the middle of a long-term uptrend, boasting a 55% year-to-date gain. What's more, the shares had recently broken out to the upside after spending two months consolidating just below $240, and with BA's 40-day moving average catching up to the stock -- a trendline that has had bullish implications in the past -- it seemed like the equity was ready to embark its next leg higher.

Underscoring this encouraging technical setup was Boeing's moving average convergence divergence (MACD) histogram, which had turned higher, and was positive at the time of our call recommendation. This trend-following momentum signal can often flash buy signals.

Plus, there was plenty of room for analysts to upgrade the outperforming stock, with seven of 16 still maintaining tepid "hold" recommendations. The equity's top-heavy Schaeffer's put/call open interest ratio (SOIR) of 1.15 pointed to a put-heavy backdrop among short-term options traders, too, which could create tailwinds for BA on an unwind.

What's more, BA had consistently rewarded premium buyers over the past year, per the security's Schaeffer's Volatility Scorecard (SVS) of 95. In simple terms, the shares had tended to make bigger moves in the previous 12 months, relative to what the options market had priced in.

BA pushed higher in the final months of 2017 -- boosted by reports of several high-profile orders, including a $7 billion deal with Saudi Arabia, as well as upwardly revised analyst ratings. This allowed us to close half our position on Dec. 12, when BA was trading at $290.17, for a profit in excess of 200%.

Boeing closed out the year as the best Dow stock of 2017, and kicked off the new year with even more bullish brokerage notes. The other half of our bullish position was closed ahead of expiration last Friday, Jan. 19, when BA was trading at $336.83, bringing the total profit on the trade to 345%.