Breaking Down Stocks' Best Start to a Year in Decades

U.S. stocks enjoyed their best start to a calendar year in over a decade last week, as traders enjoyed a belated Santa Claus rally. But what could that mean for the rest of the year? Below, we break down the stats for the Dow Jones Industrial Average (DJI), S&P 500 Index (SPX), and Nasdaq Composite (IXIC), and what huge gains in Week 1 have meant historically.

Dow's Best Start to the Year Since 2003

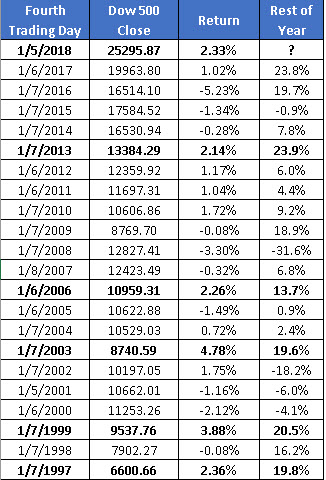

The Dow logged a weekly gain of 2.33% last week, marking its biggest surge in the first four sessions of the year since 2003, when it gained 4.78%. Since 1997, there have been just five other years, in fact, in which the DJI rallied 2% or more in the first four days of the year, per data from Schaeffer's Senior Quantitative Analyst Rocky White.

The last time was in 2013, when the Dow enjoyed a 2.14% gain in the first four sessions. In 2006, the index added 2.26% in the first four days. The other three times were 2003 (4.78%), 1999 (3.88%), and 1997 (2.36%). In all of those years, the DJI went on to enjoy double-digit percentage gains through the rest of the year, logging an average rest-of-year gain of 19.5%.

Strength Begets Strength for the S&P, Nasdaq Too

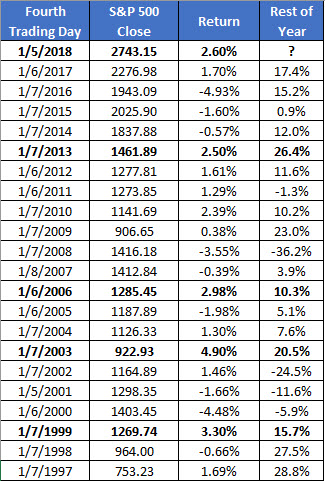

The SPX gained 2.6% last week, marking its best start to the year since 2006. As we established last week, the S&P tends to fare well after gaining 1.5% or more in the first week of the year, averaging a rest-of-year return of 11.76%. That number gets even larger after gains of 2.5% in the first four sessions.

Since 1997, there have been just four other times in which the index rallied 2.5% or more in Week 1, the last being in 2013. The other years were 2006 (2.98%), 2003 (4.90%), and 1999 (3.3.%). The S&P went on to log double-digit percentage gains in all of those years, averaging a healthy gain of 18.2%.

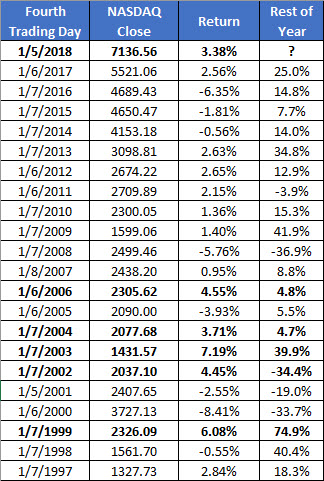

The Nasdaq gained 3.38% to start 2018, marking its best start since 2006, when the tech-rich index advanced 4.55% out of the gate. There have been just five other times since 1997 in which the IXIC gained 3% or more in the first four trading days: 2006, 2004 (3.71%), 2003 (7.19%), 2002 (4.45%), and 1999 (6.08%). Only in 2002 did the Nasdaq finish the year in the red, and even so, it still averaged a rest-of-year gain of 18% after starting with a gain of 3% or more.