Bullish Options Traders Sit Out Gold Surge

Gold prices closed higher for an 11th straight session on Friday -- the longest daily win streak on record. And while February gold futures are trading down 0.2% today at $1,319.80 an ounce, they are still holding near September highs. This price action has been mirrored in the SPDR Gold Trust ETF (GLD), though bullish options traders have been relatively absent amid the recent boon.

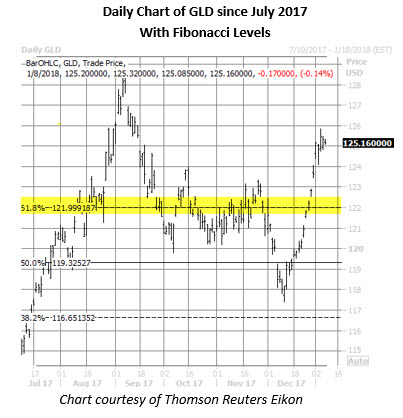

After bottoming at a five-month low of $117.40 on Dec. 12, the day before the Fed issued a rate hike, GLD went on to embark on a string of 11 straight wins over the Dec. 15 through Jan. 2 stretch. All told, the gold exchange-traded fund (ETF) is up 6.7% since this near-term low -- barreling through the key $122 level along the way, a 61.8% Fibonacci retracement of its 2016 high and December low from the same year. And though GLD was last seen down 0.1% at $125.21, January has been the best trading month for the fund since its inception, averaging a 4% gain, according to data from Schaeffer's Quantitative Analyst Chris Prybal.

Nevertheless, call open interest has rarely been lower over the past year, with the 1.92 million contracts currently open ranking in the 4th annual percentile. Plus, the bulk of this activity is centered at the deep out-of-the-money January 2018 190- and 200-strike calls, where 1.18 million and 1.10 million contracts are currently open, respectively.

It's not clear exactly how speculators positioned themselves at these two strikes, but those selling to open the calls set record-high ceilings for the fund. In fact, the highest GLD has ever traded was $185.85 in September 2011. On the flip side, those who bought to open the calls were likely using an options hedging strategy to protect their short gold positions.

Put options, meanwhile, are more popular than usual. GLD put open interest of 1.03 million contracts is ranked in the 79th annual percentile, compared to the 12-month high of 1.32 million puts open on Sept. 15. Peak put open interest of 41,259 contracts is currently found at the June 105 strike. Data can't confirm how these puts were used, but those selling the contracts are eyeing a floor at $105. Those purchasing the puts expect GLD to tumble to two-year lows by June. The ETF hasn't traded below the strike since January 2016.

However speculators are playing the gold ETF, it's a more attractive time to buy premium on short-term options, than sell it. GLD's Schaeffer's Volatility Index (SVI) of 9% ranks in the 13th annual percentile, meaning low volatility expectations are being priced into near-term contracts.