Buy These Stocks After the Sell-Off

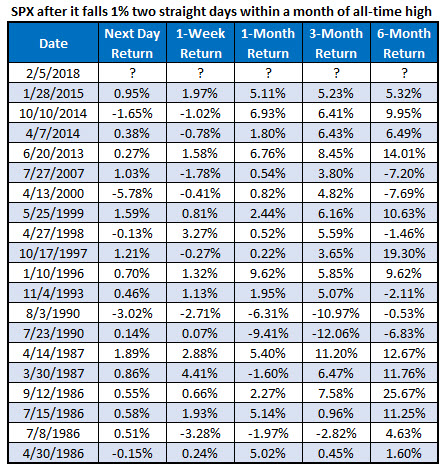

U.S. stocks plummeted again yesterday, with the Dow shattering records with its steepest one-day point loss ever. What's more, the S&P 500 Index (SPX) dropped more than 4%, marking the second back-to-back loss of more than 1%. The last time the index suffered two such losses within a month of touching a record high was January 2015, according to data from Schaeffer's Senior Quantitative Analyst Rocky White. Against this backdrop, we decided to take a look at how the S&P tends to perform after steep stock market pullbacks, and the best stocks to buy after the dip, historically -- including two Dow stocks and two Apple suppliers.

S&P After Sharp Retreats from Record Highs

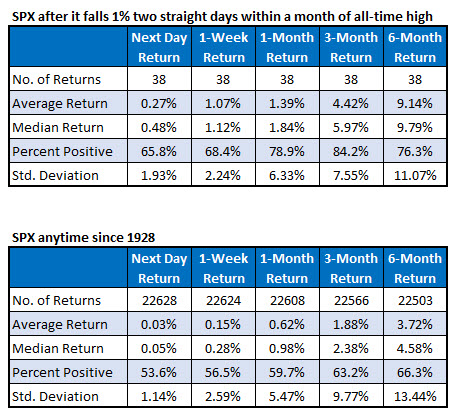

Since 1986, there have been 38 times when the SPX fell at least 1% in two consecutive sessions within a month of an all-time high. However, just five have occurred since the financial crisis, and there were only seven signals since 2000. Roughly 16% of the signals happened just in 1986-87.

The good news is the stock market barometer tends to outperform after these sharp pullbacks. One day later, the SPX was up 0.27%, on average, and higher nearly two-thirds of the time. That's compared to an average anytime gain of 0.03%, with a win rate of 53.6%, looking at data since 1928. Despite futures indicating another steep plunge out of the gate today, the S&P 500 Index was last seen modestly lower in volatile trading.

That outperformance carries over at every checkpoint looking six months out. One month later, for instance, the SPX was up 1.39% -- more than double it's average anytime return. Three months out, the index was up a much better-than-usual 4.42%, on average, with a win rate of 84.2%. It's the same story six months out, with the S&P averaging a gain of 9.14% -- almost three times the norm.

2 Blue Chips to Buy After Pullbacks

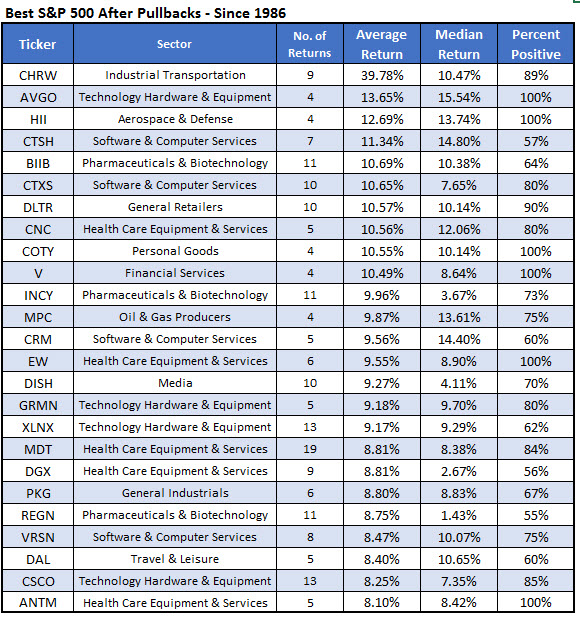

Below are the best stocks to buy after steep S&P pullbacks, historically, looking at data since 1986. Dow stocks Visa Inc (NYSE:V) and Cisco Systems, Inc. (NASDAQ:CSCO) caught our attention. V shares have been higher 100% of the time a month after the last four huge S&P pullbacks, averaging a gain of 10.49%. Around midday, Visa stock was last seen 1.1% higher at $117.55.

CSCO stock has more returns to count -- 13, to be exact -- and was higher a month after 85% of those, with an average gain of 8.25%. At last check, CSCO shares were 1.9% higher to trade at $39.52.

2 Apple Suppliers to Buy After Steep Drops

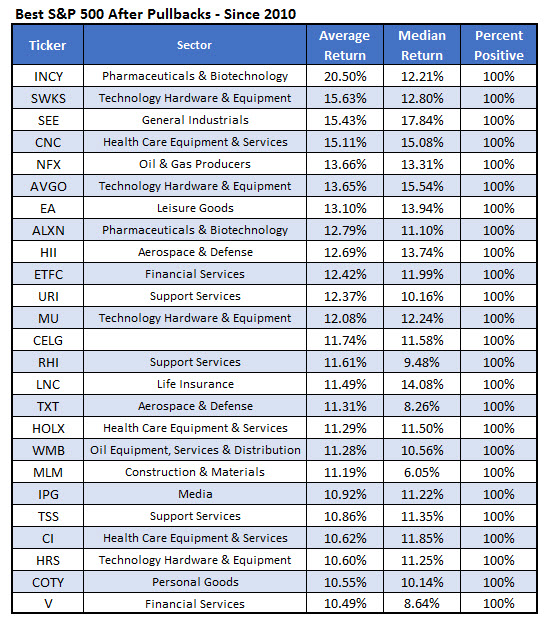

Narrowing that list to include just the sharp pullbacks during the current bull market, a pair ofApple suppliers stands out. First, Skyworks Solutions Inc (NASDAQ:SWKS) is near the top of the list, moving higher a month after the last four sharp S&P pullbacks. SWKS stock averaged a gain of 15.63% after these instances, and today is up 9.6% at $103.73, thanks to a well-received earnings report.

Meanwhile, Broadcom Ltd (NASDAQ:AVGO) shares were also higher after all four pullbacks, averaging a one-month gain of 13.65%. In early afternoon trading, AVGO shares are 2.4% higher at $233.68.