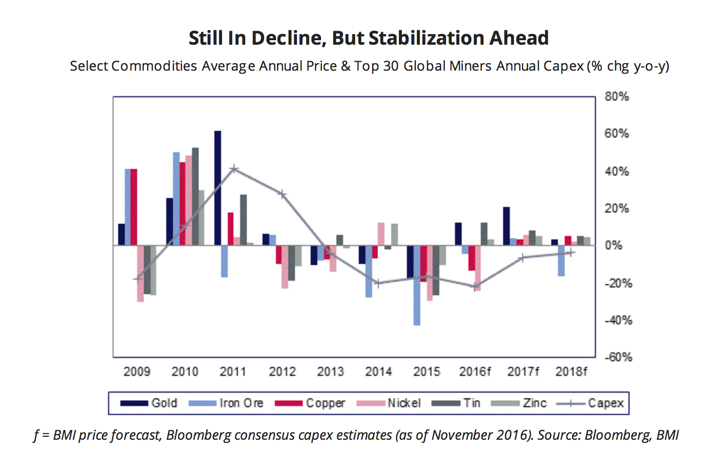

CHART: Mining capex decline set to continue

While precious metals (with the exception of palladium) have suffered a deep sell-off since the surprise outcome of the US presidential elections, the rally in industrial metals seems only to be gaining momentum.

The copper price added 7.7% last week, while nickel rose more than 6% and tin continued its good run. Both zinc and lead enjoyed double digit gains with the former reaching a near nine-year high.

In a new report BMI Research, a unit of Fitch, says the gains in metal prices this year is set to continue in 2017 thanks to infrastructure spending in China and to some extent in the US and the UK, but at a much more modest pace.

The researcher also cautions about the outlook beyond 2017 as the withdrawal of Chinese stimulus could increase the risk of a fallback in some commodities particularly coal and iron ore.

Despite its relatively sanguine view on metals prices BMI expects the decline in capital expenditure in the sector to continue for the next three years as miners seek further cost cuts and improvement of operational margins:

Capex has been declining since 2012, with miners focusing on a strategy of retrenchment, project cancellations and divestment of high cost assets to balance to books and improve margins.

We expect this trend to continue as miners will continue to pursue a strategy of greater capital and supply discipline, which will result in further capex cuts, reigning in global supply.

However, cancellations and retrenchment strategy will offer limited further gains, thus miners will increasingly focus on maximising revenue at existing assets and increasing efficiency overall.

This will be done by focusing on streamlining mine processes (eliminating overlap and a cost-reduction focus) and targeting innovation to improve operational efficiency.