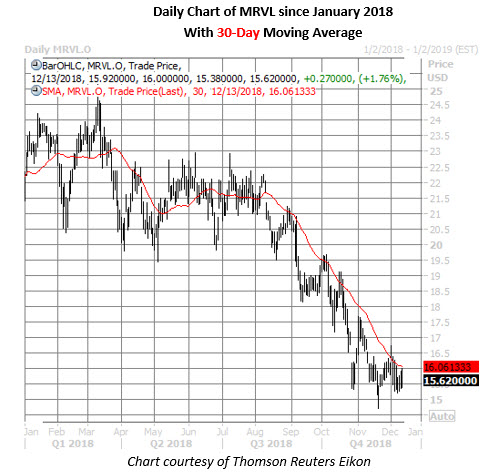

Citi Says Buy Marvell Technology Stock After 2018 Slide

The shares are down 38% from their early March peak

The shares are down 38% from their early March peak

Citigroup upgraded Marvell Technology Group Ltd. (NASDAQ:MRVL) to "buy" from "neutral," and raised its price target to $19 from $17.30 -- a nearly 24% premium to last night's close. The brokerage firm said Wall Street is discounting the chipmaker's impressive networking sales, and the short-term risk-reward profile looks attractive following MRLV's 2018 struggles.

At last check, MRVL stock is up 1.8% at $15.62, paring its monthly deficit to 3.4%. Longer term, the tech shares are down 38% from their early March 11-year peak of $25.18, with their 30-day moving average applying steady pressure since a mid-August bear gap. Additionally, the security tapped a 15-month low of $14.69 on Nov. 20.

Nevertheless, the overwhelming majority of covering analysts maintain a "buy" or better rating on MRVL stock, with not a single "sell" to be found. Plus, the average 12-month price target sits all the way up at $23.72 -- in territory not explored in nine months.

Elsewhere, short sellers have been cashing in on the tech stock's slide, with short interest down 18.6% in the two most recent reporting periods to 22.85 million shares. These bearish bets still represent more than 5% of MRVL stock's available float, or nearly three times the average daily pace of trading.

Options traders, on the other hand, have been positioning for more losses. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MRVL's 10-day put/call volume ratio of 1.01 ranks in the 96th annual percentile, meaning puts have been bought to open over calls at a quicker-than-usual clip.

Today, puts have a slight lead over calls, with 2,354 of the former and 2,148 of the latter on the tape at last check, roughly 1.2 times what's typically seen at this point. The weekly 12/14 15.50-strike puts are most active, though it looks like speculators may be selling to open positions here, setting a floor for Marvell Technology stock through tomorrow's close.