Copper Co. Should Be Up Way Higher

Michael Ballanger shares his view on the current state of the market and comments on the price of one of his favorite copper stocks.

Michael Ballanger shares his view on the current state of the market and comments on the price of one of his favorite copper stocks.

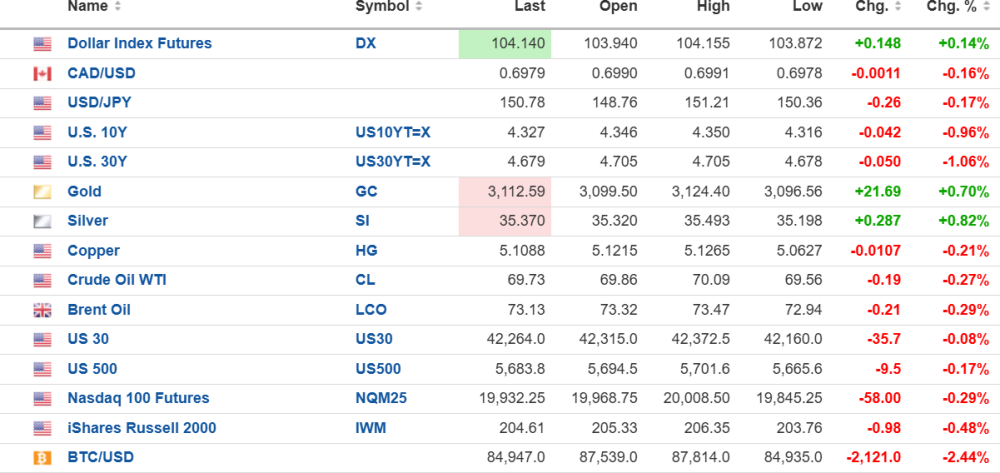

The U.S. dollar index futures (+0.19%) are up to 104.14, with the 10-year yield down 0.96%) to 4.327% and the 30-year yield down 1.06% to 4.679%.

Gold (+0.70%) and silver (-0.82% ) are higher, but copper (-0.21%) and oil (-0.27%) are down.

Risk barometer Bitcoin is down 2.44% to $84,947, returning again to bear market territory, down 22.3% from the top.

Metals

Gold and silver are responding to a big hedge book blow-up by Aussie gold miner Belleview Gold, whose 150k-ounce hedge with Macquarie Bank has forced them to market with an offering priced at an 80% discount to recent market prices. Silver has once again done its best to confuse and confound by vaulting to new highs above that US$35.07/oz breakout level that faked me out a week ago with embarrassing acuity.

If silver holds this level for the weekly close above the BO point, then I will be forced kicking hard and screaming bloody murder to take another run at silver calls. For now, because I am traveling, I will refrain from launching an open position, but subscribers can certainly consider it.

Copper is coming off an overbought condition so as long as it gold $4.95/lb. basis May futures, I will remain bullish. If the monthly close is above $5.00, it is yet another superb technical indication that $6-8 copper is on the immediate horizon.

Stocks

President Trump once again skewered the stock market recovery by imposing 25% tariffs on all foreign auto imports, sending the S&P into another dive yesterday.

These are the kind of absurd gyrations we are forced to accept with this constant barrage of Tweets and Executive Orders that are putting the market in a constant state of uncertainty. Traders are not in the habit of leveraging up in markets like these, so rallies are there "to be sold" with the SPY:US an outright short at the 50-dma around $570.66.

Fitzroy Minerals Inc.

I surfaced from a very long day of travel landing at Heathrow at 8:00 am followed by six hours of missed cutoffs and unbearably narrow "Roman roads" finally arriving in Cornwall about three hours after the markets opened. I was able to follow the trading in Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) after they reported 43m of 2.31% copper with a 1.4m share day but a late-day fade after these moronic traders elected to "sell the news" taking it down from CA$0.39 to CA$0.32 in the last two hours.

I have to shake my head in belief when I told everyone that would listen that those results on their first Caballos drill hole were in every sense of the words "spectacular" and as CEO Merlin Marr-Johnson said "This remarkable intercept from our very first hole at Caballos identifies the potential of a new and significant copper-molybdenum-gold-rhenium system."

I had calls from literally everyone in my book of mining contacts with accolade after accolade as congratulations piled in through email and text messages. In fact, one former corporate client said that the release was one of the best he had ever read for junior and that he was delighted to be able to ADD TO HIS POSITION into the pullback.

What infuriated me was that I had tweeted out the results from Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) from October 2023 where they reported 45m of 1.9% copper, and then watched their stock go from CA$0.15 to CA$1.62 in the next month peaking at a market cap of $416 million.

FTZ/FTZFF reported 42m of 2.31% copper and peaked yesterday at a CA$86m market cap. Even more maddening is that BIG.V is a "one-project wonder" whereas FTZ/FTZFF has three additional projects including Buen Retiro (expected to close next week) giving them three fully-funded projects providing copious news flow for the balance of 2025.

Needless to say, I am a buyer of more stock, and I am looking into any additional weakness. I urge all subscribers to follow me. I will cross my fingers and try to add in the CA$0.28-CA$0.32 range with the undeterrable conviction that FTZ/FTZFF will be gone within twelve months at levels far higher than yesterday's CA$0.39 high.

Add to FTZ/FTZFF. More news is pending next week, with drilling to recommence at Caballos shortly.

| Want to be the first to know about interestingSilver,Critical Metals,Gold andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.