Copper price is getting crushed

The surge in the copper price to near 18-month highs following Donald Trump's win in the US presidential election came as a surprise to an industry under pressure since 2011 over growing supply.

The bullishness about the impact of Trump's $500 billion infrastructure plans and solid growth in top consumer China on demand for the bellwether metal has cooled down considerably.

2016 was the fifth year in a row that the average copper price declined year on yearAfter a brief surge to within sight of the post November 8 highs last week, bears were firmly back in control on Tuesday .

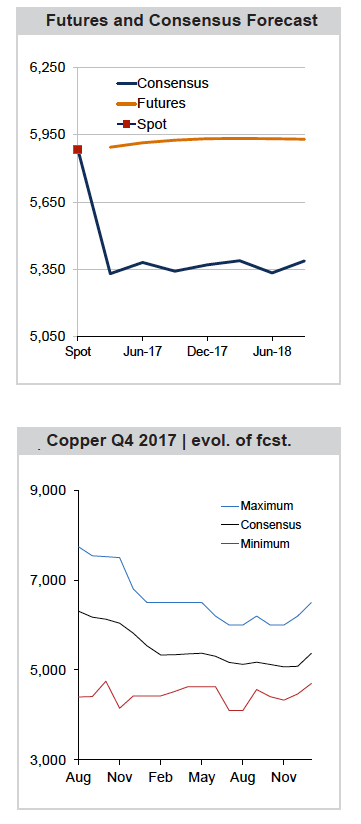

Source: FocusEconomics

In afternoon trade on Tuesday copper for delivery in March traded more than 3% lower at $2.6045 per pound ($5,742 a tonne) in New York.

The decline came despite a plunge in the value of the US dollar which usually moves in the opposite direction of commodity prices following comments by president elect Trump questioning Washington's decades old strong dollar policy.

According to a survey of 22 investment banks and other commodity research institutions released by FocusEconomics on Tuesday analysts and investors are far from sanguine about the prospects for the metal over the rest of the year.

Despite 13 of the analysts polled raising their previous forecasts for the copper price by the end of this year, of those polled only a handful sees copper averaging the final quarter of 2017 above the current spot price. Despite predictions of an improving price environment over the course of 2017, the median estimate for the average price in Q4 2017 is more than 9% below today's ruling price.

The consensus forecast for the average over the whole of 2017 is $2.37 a pound ($5,234 a tonne) rising only marginally in 2018. At $2.21 ($4,871) 2016 was the fifth year in a row that the copper price averaged below the previous year.

The most bullish institution is Unicredit which sees copper averaging 2017 around $2.77 ($6,100) while JP Morgan forecast is decidedly negative - the bank see copper falling to $2.13 ($4,700) by the end of the year with an average below $5,000 in 2017.