Day Trading Opportunities In Gold

Gold is close to a break to the upside.

Mining stocks tend to magnify the performance of the yellow metal.

NUGT is a day trading vehicle.

JNUG is another way to approach gold on an intraday basis.

Leveraged instruments are for the short-term.

Gold volatility is picking up. In med-December 2018 the price of April gold futures fell to a low of $1242.70, and by January 25, the yellow metal had risen to a high of $1370.50. As bonds moved lower and stocks corrected at the end of January and into early February, the price of the yellow metal retreated once again, falling to a low of $1309 on February 8. Since then, the April futures moved back to the $1364.40 level and closed last week at around $1350 per ounce.

Daily historical volatility in the gold futures market has been moving higher over recent weeks as daily trading ranges in the yellow metal have increased. With interest rates rising because of inflationary fears, the dollar index at its lowest level since 2014, and two-way volatility returning to the stock market, there is a lot of uncertainty in markets across all asset classes these days. Volatility can be an investor's nightmare, but at the same time, increasing price variance can be a paradise to traders who look to capture the price moves that occur on an intraday basis, or over short periods. With the increase in volatility in the yellow metal and prospects for a continuation of the current trading conditions, trading rather than investing in gold could be the optimal approach to the market. Traders have many tools at their disposal in the gold market these days. Physical bars and coins are the most direct route for investment in the commodity. Futures and options on futures over a leveraged approach for many traders. ETF and ETN products have brought gold investing and trading directly to stock portfolios. These derivative products have done a reasonable job replicating the price action in gold. Unleveraged ETF and ETN products can be appropriate for medium-term positions, but the leveraged products require a much shorter time horizon.

Given the increase in day trading opportunities in the gold market, this could be an excellent time to start trading some of the leveraged products like NUGT and JNUG.

Gold is close to a break to the upside

Gold has been zeroing in on a critical level of technical resistance dating back to June 2016. In the aftermath of the Brexit referendum, the yellow metal traded to a high of $1377.50 per ounce which was the highest price for since 2014.

Source: CQG

As the daily chart highlights, April gold futures got to a high of $1370 on September 8 and then traded all the way down to lows of $1242.70 on December 12. The next rally took the precious metal to a peak of $1370.50, a higher high on January 25. During the period of increased volatility that resulted from the downside corrections in the U.S. bond and stock markets, gold fell to $1309 on February 8 at which point it turned around and climbed back to a high of $1364.40 on February 15. At the end of last week, gold was trading around $1350 per ounce. As the chart shows, open interest has been trading in a pattern of rising and falling with the price of the yellow metal. Open interest is the total number of open long and short positions in the COMEX futures market. When the metric rises with price, it typically validates a bullish price trend. However, when it falls with the price, it tends not to signal an emerging bearish price trend. Therefore, open interest has been consistently supportive of the price of gold over recent months. Gold is close to a level where it will break to the upside which could bring lots of trend following longs and speculative interest to the market potentially fostering higher highs in the weeks and months ahead which could be good news for mining stocks.

Mining stocks tend to magnify the performance of the yellow metal

In the gold market, mining stocks tend to outperform the price of the yellow metal on the upside. Traditionally, investors have flocked to mining shares during bull market periods. As an example, in December 2015 gold traded at a low of $1046.20 per ounce, and it rallied by 31.7% at the highs in June 2016. Over approximately the same period, the GDX ETF of gold mining shares moved from lows of $12.40 to highs of $31.79 per share, an increase of over 156%. The index of the junior gold miners, the GDXJ moved from $16.87 to $52.50, a move to the upside of over 211% over the period. As you can see, the miners outperformed the price of gold during the rally from the late 2015 low to the 2016 and most recent high. On Friday, February 16, the GDX and GDXJ were trading at $22.51 and $32.51 per share respectively. If gold begins to rally and breaks to the upside, and the daily trading ranges continue to widen, there are two-day trading vehicles that could enhance and optimize results for short-term traders looking to take advantage of a bullish run in the gold market.

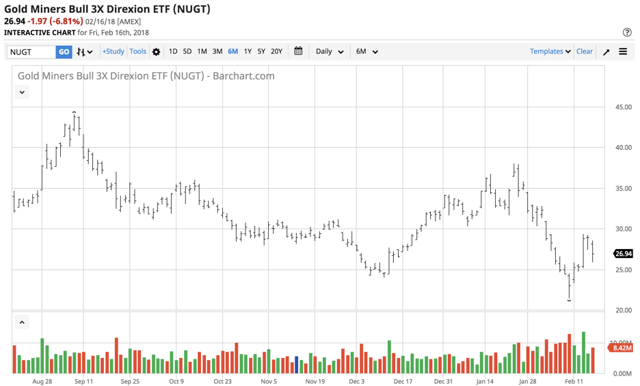

NUGT is a day trading vehicle

NUGT is the triple long leveraged ETN product that seeking to replicate three times the daily performance of the NYSE Arca Gold Miners Index.

Source: Barchart

As the chart over the past six months shows, NUGT has traded in a range from lows of $21.40 to highs of $44.03 and was trading at the $26.94 per share level on Friday, February 16. NUGT is strictly a day trading instrument and should never be held as a long position for periods longer than one week. The ETN is subject to reverse splits as the hedges that create the triple leverage involve the purchase of call options on gold mining stocks. Therefore, time value or theta works against an investor or trader holding NUGT making the instrument valuable for short-term market timers, but a potential disaster for medium to long-term investors.

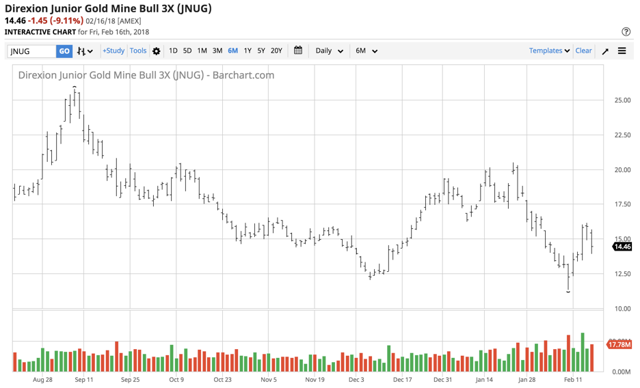

JNUG is another way to approach gold on an intraday basis

JNUG is the triple leveraged EETN instrument that operates in the same fashion as NUGT, except it attempts to replicate the price action of the even more volatile junior gold mining shares.

Source: Barchart

Over the past half-year, JNUG traded in a range from lows of $11.34 to highs of $25.76 per share. While both of these instruments are likely to follow the path of gold, there is another level of risk as they reflect the hold mining shares which typically rally and dip alongside the precious metal. There are no guarantees that if the price of gold breaks above the $1377.50 resistance level and moves to $1400 or higher than NUGT and JNUG will move with the price of the yellow metal. However, in the past, both instruments have typically outperformed the price of the underlying commodity.

Leveraged instruments are for the short-term

Leveraged trading instruments are not for the faint of heart, nor are they for medium or long-term investors regardless of the commodity or asset they represent. These vehicles are for traders who are in and out of markets many times within the trading day and who rarely take positions home overnight or for longer periods.

We could be coming into a period where the price of gold, precious metals, and other commodities see increasing daily trading ranges and overall volatility. The weak dollar and fears over inflationary pressures could present a potent bullish cocktail for the prices of commodities, and gold could become a leader in the sector because of its long history as a barometer for the economic conditions. At the beginning of this week, the yellow metal was trading at around $25 below the post-Brexit high. If the price moved above that level, we are likely to see lots of action in the market and NUGT and JNUG could become explosive and active daily trading vehicles for those in the gold market. NUGT and JNUG trade average daily volumes of 6.4 million, and 11.7 million shares. With respective net assets of $1.21 billion and $792 million, they are both highly liquid short-term vehicles that could enhance your trading results as gold works its way higher.

To profit from commodities, you have to stay ahead of the trade. As a veteran commodities market watcher, I'm uniquely qualified to help you do that. My Marketplace service, the Hecht Commodity Report, offers a comprehensive weekly outlook on over 30 individual commodities markets, including U.S. futures. One of the most detailed commodities reports available, The Hecht Commodity Report provides weekly up, down or neutral calls on each market and highlights technical and fundamental trends. I also make timely recommendations for risk positions in ETF and ETN markets and commodity equities and related options. The Hecht Commodity Report is a must-read if you want to profit in commodities, so subscribe today. And, there is an active chat section in the service where I reply quickly to answer all questions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.