De Beers Issues Synthetics Guidelines

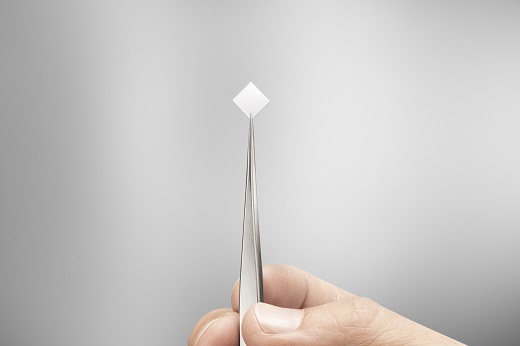

RAPAPORT... De Beers has provided its rough-diamond clients andForevermark partners with guidelines on how to operate in the lab-grown diamondmarket if they wish to continue tapping into its branding.The mining company, which in 2018 forayed intogem-quality synthetics with the launch of its Lightbox brand, is demanding businessesmake full disclosure about their product, segregate synthetics from theirnatural supply, and do not make unproven claims about either category. The"Statement of Principles" outlines the legal structures companies withlab-grown units must have if they wish to use the sightholder logo, as well asthe procedures and training they are required to implement to avoidcontamination or misleading marketing.While De Beers already had rules mandating disclosure and otherbest practices, the new principles "ensure there is no room for doubt" abouthow clients may use the sightholder logo, explained David Johnson, head ofstrategic communications for De Beers."We believe the principleswithin the document set out a responsible approach, and that they are importantfor ensuring people can make clear and informed choices about what they arebuying," he added.The document refers to lab-grown diamonds as "artificial" productsthat "do not have the same inherent, naturally occurring characteristics orenduring value" as natural diamonds. The miner continues to define diamonds asa natural mineral in line with the International Organization forStandardization (ISO).De Beers sent the guidelines to clients earlier this month, as numeroussightholders have launched lab-grownbusinesses under separate entities and trading names.The following is a summary of the guidelines:De Beers customers may only use the sightholder license - including displaying the sightholder logo - for business entities that are exclusively natural-diamond businesses. Entities with both natural and lab-grown activities may not use the logo.The miner recommends setting up distinct and independent businesses for any lab-grown diamond activities, with separate systems, processes and workforces.The rules prohibit "false, misleading or unsubstantiated" claims about the enduring value of lab-grown diamonds, whether directed at other businesses or at consumers. They cannot state or imply that lab-grown diamonds have the "identical inherent value characteristics" as natural diamonds. Similarly, unproven claims about the environmental benefits or ethical advantage of lab-grown diamonds over natural ones are forbidden.Sellers must provide the buyer with full and unambiguous disclosure before the transaction is complete. They're also required to ensure segregation at all stages of the supply process, such as storage, cutting and polishing, packaging, and transportation. Ideally, suppliers should handle natural and lab-grown stones in separate sites.De Beers customers must "take steps" to ensure full disclosure and segregation further along the supply chain, down to the consumer.Clients must have protocols to identify and mitigate contamination risks, and train staff members on the "operational, commercial and reputational impacts" of lab-grown diamonds.Preferably, companies should disclose the countries in which the synthetic diamond was grown, polished and made into jewelry, as well as the identity of the manufacturer. De Beers says businesses should "strive" to declare this, though it's not an absolute requirement.Grading language must contain words that make it clear a stone is lab-grown.Customers must follow relevant laws, regulations and best practices, such as the standards that the US Federal Trade Commission (FTC) and the ISO have published.Image: A diamond platelet at Switzerland-based lab-grown producer LakeDiamond. (LakeDiamond)

RAPAPORT... De Beers has provided its rough-diamond clients andForevermark partners with guidelines on how to operate in the lab-grown diamondmarket if they wish to continue tapping into its branding.The mining company, which in 2018 forayed intogem-quality synthetics with the launch of its Lightbox brand, is demanding businessesmake full disclosure about their product, segregate synthetics from theirnatural supply, and do not make unproven claims about either category. The"Statement of Principles" outlines the legal structures companies withlab-grown units must have if they wish to use the sightholder logo, as well asthe procedures and training they are required to implement to avoidcontamination or misleading marketing.While De Beers already had rules mandating disclosure and otherbest practices, the new principles "ensure there is no room for doubt" abouthow clients may use the sightholder logo, explained David Johnson, head ofstrategic communications for De Beers."We believe the principleswithin the document set out a responsible approach, and that they are importantfor ensuring people can make clear and informed choices about what they arebuying," he added.The document refers to lab-grown diamonds as "artificial" productsthat "do not have the same inherent, naturally occurring characteristics orenduring value" as natural diamonds. The miner continues to define diamonds asa natural mineral in line with the International Organization forStandardization (ISO).De Beers sent the guidelines to clients earlier this month, as numeroussightholders have launched lab-grownbusinesses under separate entities and trading names.The following is a summary of the guidelines:De Beers customers may only use the sightholder license - including displaying the sightholder logo - for business entities that are exclusively natural-diamond businesses. Entities with both natural and lab-grown activities may not use the logo.The miner recommends setting up distinct and independent businesses for any lab-grown diamond activities, with separate systems, processes and workforces.The rules prohibit "false, misleading or unsubstantiated" claims about the enduring value of lab-grown diamonds, whether directed at other businesses or at consumers. They cannot state or imply that lab-grown diamonds have the "identical inherent value characteristics" as natural diamonds. Similarly, unproven claims about the environmental benefits or ethical advantage of lab-grown diamonds over natural ones are forbidden.Sellers must provide the buyer with full and unambiguous disclosure before the transaction is complete. They're also required to ensure segregation at all stages of the supply process, such as storage, cutting and polishing, packaging, and transportation. Ideally, suppliers should handle natural and lab-grown stones in separate sites.De Beers customers must "take steps" to ensure full disclosure and segregation further along the supply chain, down to the consumer.Clients must have protocols to identify and mitigate contamination risks, and train staff members on the "operational, commercial and reputational impacts" of lab-grown diamonds.Preferably, companies should disclose the countries in which the synthetic diamond was grown, polished and made into jewelry, as well as the identity of the manufacturer. De Beers says businesses should "strive" to declare this, though it's not an absolute requirement.Grading language must contain words that make it clear a stone is lab-grown.Customers must follow relevant laws, regulations and best practices, such as the standards that the US Federal Trade Commission (FTC) and the ISO have published.Image: A diamond platelet at Switzerland-based lab-grown producer LakeDiamond. (LakeDiamond)