Discovering Opportunities: A Week in Japan and the Promise of Yamagano

Brian Leni of Junior Stock Review explains why he thinks Irving Resources Inc. (IRV:CSE; IRVRF:OTCQX) is selling for less than its worth, given its upside potential.

Brian Leni of Junior Stock Review explains why he thinks Irving Resources Inc. (IRV:CSE; IRVRF:OTCQX) is selling for less than its worth, given its upside potential.

It's amazing where life can take you. If you asked me 15 years ago, I would have never guessed that I would be traveling the world looking at potential mining investments. Even today, eight years into my full-time investing career, I have to pinch myself is this real?

Successful junior mining investment can truly change your life if you pick the right companies. But, it isn't only picking right, it's as much about controlling emotion and using volatility to your advantage.

Share prices don't go straight up. There are always pullbacks or corrections along the way. If the company's share price falls for no reason other than market volatility, it's a buying opportunity.

Along with market volatility, where a company is in its development cycle plays a huge role in its share price dynamics. For instance, pre-discovery exploration companies see a lot of volatility in their share prices when markets are bad.

In down markets, investors usually weigh the downsides of exploration speculation above the potential that a new discovery could unveil. To me, this spells opportunity if you have the courage to buy when the market is uninterested.

Today, I would like to tell you about Irving Resources Inc. (IRV:CSE; IRVRF:OTCQX), whose projects I recently visited in Japan. In my view, Irving is selling for less than it's worth, considering the potential upside of discovery at its Yamagano project.

Not only that, but this junior company is exploring Yamagano with two of the largest mining companies in the world Newmont Corp. (NEM:NYSE) and Sumitomo.

Let's take a closer look at my time in Japan and why I think Yamagano is primed for discovery.

Yamagano

Yamagano is located on Japan's southern island of Kyushu, which is about a two-hour flight from Tokyo. Although it's October, the south of Japan is hot and humid.

For perspective, the south tip of Kyushu is roughly at the same latitude as the north portion of Mexico. The temperature and humidity, therefore, shouldn't come as a surprise!

Further, the forest that you see in the background of the picture below is more or less all red cedar beautiful.

Red cedar and, unfortunately, heavy sections of bamboo.

It's incredible to see how invasive bamboo can be when left to its own devices.

From the Kagoshima airport, it's about an hour's drive to the project.

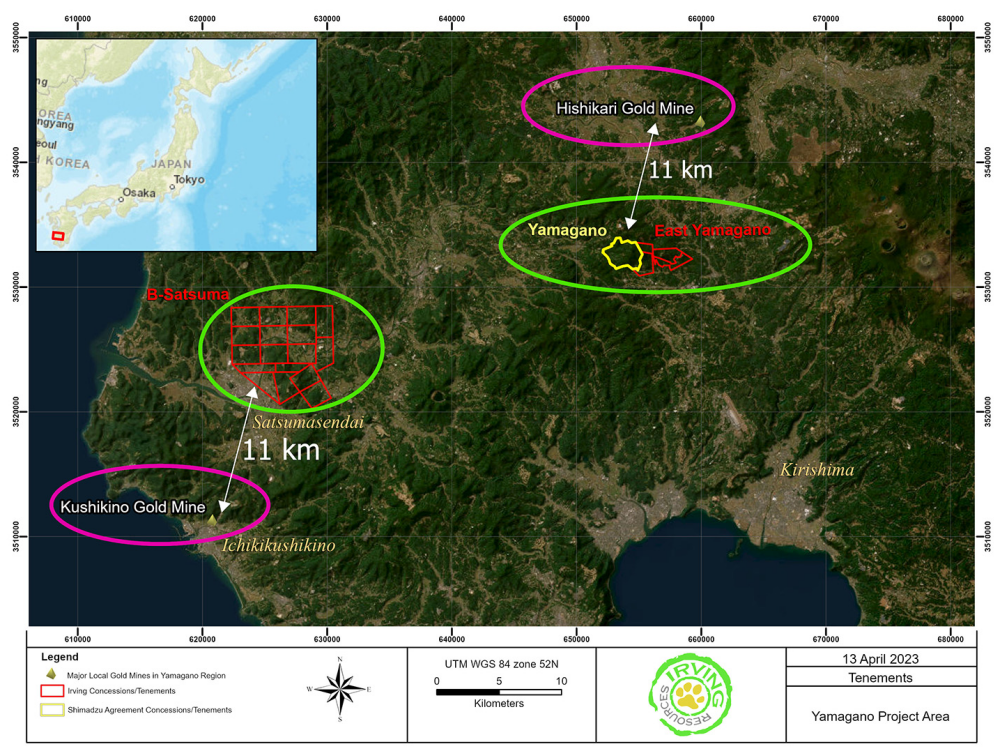

As you can see in the image, Yamagano is located only 11 km south from Sumitomo's Hishikari Gold mine. Hishikari is the world's highest-grade gold mine, with a head grade average around 30 grams per tonne (g/t) gold incredible. Hishikari has been in production for decades now and produced millions of ounces of gold.

Given Yamagano's analogous geology and close proximity, it goes without saying why Newmont, Sumitomo, and Irving are so interested in Yamagano's potential.

The current drill program is focused on East Yamagano, which represents roughly half of the total land package. They're focusing exploration on East Yamagano for two reasons. First, East Yamagano is the portion of the project that has the mineral prospecting license. This versus the western portion of the project, which has the mining license and historical workings. Second is the geological potential of the down dip extension of the historical workings.

Newmont, which owns 60% of the project, is most interested in the large geophysical anomaly that East Yamagano holds. Needless to say, when you're picking up the bill on 60% of the exploration costs, you get to pick where to drill first.

Hole #1, released in May, intercepted 5.0m of 9.62 g/t gold (Au), including 1.0m 45.90 g/t Au. The bulk of the high grade is narrow, but a great hit nonetheless, considering it's Hole #1.

Seeing high-grade mineralization is great, but what we need to see next is the size of the structures. Big structure, plus good grades is what the market is looking for to give Irving more credit for the potential at Yamagano.

Hole #2 was completed in October, and the drill team has now moved on to Hole #3, which is expected to be completed by the end of the year.

Holes #4 and #5 will follow in the new year and, given the rough pace of completion, we should expect them to be completed some time around the end of Q1 2025.

In terms of catalysts for share price appreciation, I would look to the upcoming results from Hole #2 as potentially one of those events.

Hole #2 was 700m and will most likely have its results released in three parts: top of the hole, middle of the hole, and bottom of the hole.

Given we are most interested in the boiling zone of the low sulphidation system, the middle and end of the hole are potentially the most important. My guess is that we should see the first two parts by mid to late December.

In my view, a discovery hole would be an intercept over 100 gram meters.

This is the standard by which discoveries are gauged these days.

The potential is there, I have no doubt.

Concluding Remarks

The importance and value gained by site visits can never be underestimated. It's an invaluable part of being an investor in the junior resource sector. My trip to Japan was eye-opening and has really spurred me to want to learn more about Japan and the rest of Asia.

When it comes to Irving, I have long seen the potential of their project portfolio. Visiting Yamagano and Omu in person and meeting the technical team that is executing the exploration work has only further solidified that potential in my mind.

To me, Yamagano holds the key to garnering frothy market attention once again, and I eagerly await Hole #2 results.

Next to that, and probably the bigger point, is I clearly see that there will be a steady stream of project development across Japan moving out into the future.

In the exploration game, this is vital to success.

Until next time.

If you would like to hear more from Brian Leni, please see Junior Stock Review. You can get 20% off when signing up for the newsletter by using the coupon code: STREETWISE.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Brian Leni: I, or members of my immediate household or family, own securities of: Irving Resources Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Brian Leni Disclosures:

I have no business relationship with any of the companies mentioned. Irving Resources Inc. did pay for a portion of my expenses for the site visit (cost of flight excluded).

I personally own shares of Irving Resources.