Dollar Slams On The Brakes - Is Gold Next?

U.S. dollar shows signs of bottoming, immediate term.

Be prepared for potential temporary weakness in gold in coming days.

Gold's intermediate-term recovery effort should remain intact.

The price of gold entered the month of January with a head of steam behind it. Gold's history over the last several years told us that a rally early in 2018 was a strong possibility, and the profound weakness in the U.S. dollar all but guaranteed a strong start to the New Year. While gold's the intermediate-term outlook is promising, its immediate-term (1-4 week) trend must now be called into question. Specifically, the falling dollar which galvanized the gold rally since December is showing signs that a temporary dollar bottom may be imminent. In this commentary, we'll take a closer look at the dollar and discuss its immediate implications for gold.

On Thursday, the recent freefall of the U.S. dollar index came to a screeching halt. After a weak opening and a decline to a 3-year low, the dollar saw a strong intraday reversal. At the close on Thursday, the dollar had recovered from its earlier losses to close slightly higher for the day.

The dollar's reversal on Thursday came after remarks by President Trump, who suggested the dollar would strengthen in consequence of the improving U.S. economy. He also stated that Treasury Secretary Steven Mnuchin's dollar-related comments from the previous day were taken out of context. Mnuchin had said on Jan. 23 that a weak dollar is good for U.S. trade.

In a CNBC interview, Trump said that Mnuchin's comments "were taken out of context." He added, "Our country is becoming so economically strong again," adding that "the dollar is going to get stronger and stronger and ultimately I want to see a strong dollar."

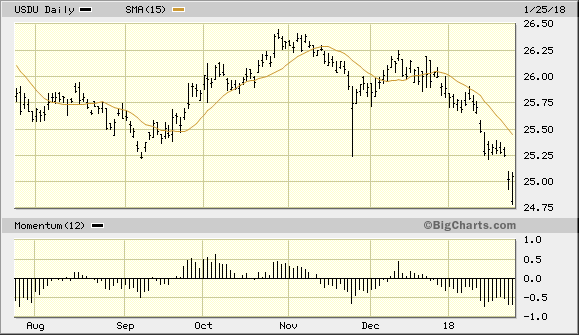

Below is a 1-year graph of the Wisdom Tree Bloomberg U.S. Dollar Bullish Fund (USDU), which is one of my favorite tradable proxies for the dollar index. Here you can see the potential for a "key" reversal in USDU as of the Jan. 25 trading session. In technical parlance, this type of sharp intraday retracement of a big decline is often a prelude to a short-term reversal of the prevailing downward trend.

Source: www.BigCharts.com

Another point worth mentioning is that the dollar has become increasingly maligned in the financial media recently. It's getting close to impossible to read a newspaper or financial magazine without seeing multiple headlines making reference to the weak dollar. This can be considered, from a contrarian's perspective, as a sign that the dollar's decline has been overdone in the immediate term. Thus, a temporary correction (i.e. relief rally) in the U.S. dollar index is possible in the coming days.

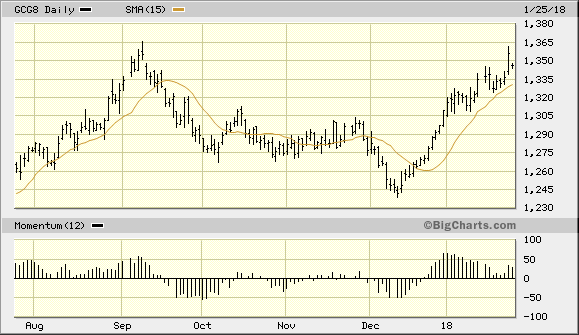

In my previous commentaries, we discussed the likelihood that the gold price would hesitate or consolidate once the previous intermediate-term high was reached. I'm referring of course to the $1,355 level from Sept. 8, a level which was finally broken on the upside on Wednesday, Jan. 24. It's not unusual for smaller traders and investors to bail out of long positions when previous peaks are reached.

The reason for this tendency is that participants who bought gold near the Sept. 8 peak and held on through the ensuing decline into early December were as likely as not to sell out once they arrived at break-even earlier this week. Given how the gold price reacted in the previous trading session, we're likely witnessing that very phenomenon as many traders bail out. See the February gold futures chart below for reference.

Source: www.BigCharts.com

Neither the dollar index nor the dollar ETF (USDU) has confirmed an immediate-term bottom yet. But in light of Thursday's sharp intraday reversal, it's time to be on watch for a temporary reversal of gold's immediate-term trend. If gold reacts to a dollar bottoming effort by pulling back from its recent high, the gold price should remain above the lows from early January during the reaction. This would ensure that its intermediate-term upward trend remains firm.

Meanwhile gold's immediate-term uptrend, as underscored by the rising 15-day moving average in the above chart, still remains intact. If the gold price closes under the $1,330 level, however, the immediate uptrend will have been formally broken. This in turn would serve as a harbinger of temporary weakness in the gold market with a period of consolidation likely to follow. I expect that gold's dominant intermediate-term (3-6 month) recovery will remain intact, however, despite any weakness that may be seen in the immediate term.

For disclosure purposes, I'm currently long the iShares Gold Trust (IAU) and have raised my stop loss to slightly under the $12.75 level on a closing basis. I'm also currently long the VanEck Vectors Gold ETF (GDX), which is my favorite proxy for the actively traded gold mining stocks. I'm using the $23.50 level as the stop-loss for this trading position on a closing basis.

Disclosure: I am/we are long IAU, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.