Dollar's Tide Goes Out As Gold's Comes Back In

Dollar continues its losing ways, paving the way for higher gold prices.

Yen rally also continues apace, which bodes well for gold's outlook.

Gold's relative strength needs improvement, however.

The last two weeks were real nail-biters for gold investors as the U.S. dollar threatened to reverse its downward trend while equity markets plunged. In recent days, however, the dollar's relief rally has failed and the greenback has again resumed its downtrend. As we'll see in today's report, the dollar has given gold investors their confidence back as inflation concerns return to the fore. We'll also discuss gold's near-term outlook in view of the resurgent U.S. stock market.

While spot gold edged slightly higher on Thursday, April gold futures closed slightly lower for the day as a little profit-taking was evident after Wednesday's impressive rally. It was evident that the market needed a breather after three consecutive days of higher closes.

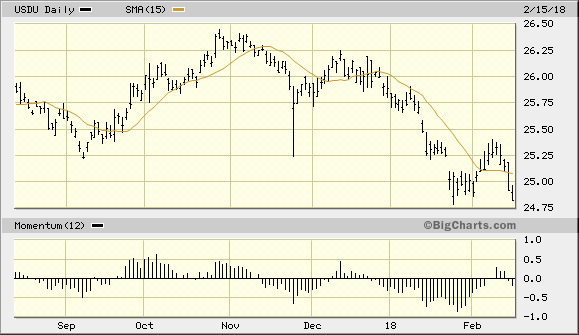

Meanwhile the U.S. dollar index continued to stumble as the greenback hit its lowest level in two weeks on U.S. sovereign debt concerns. The WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) closed 0.40% lower and hit a new 52-week low on Thursday. As I've emphasized in recent commentaries, a close under the $24.90 level established on Feb. 1 (the nearest pivotal low), would formally reverse the immediate-term bottom signal which USDU confirmed last week when it closed two days above its 15-day moving average. By closing decisively under this level on Thursday, the dollar ETF has given gold investors another reason to remain optimistic.

Source: www.BigCharts.com

Indeed, the dollar has been impacted by numerous factors so far this year, including growing concerns that Washington might pursue a weak dollar strategy. Another concern which has undermined the greenback's strength has been the potential loss of its yield advantage as other countries end their monetary stimulus programs. Adding to these fears have been concerns about the increasing U.S. fiscal deficit. All of these factors have helped to keep gold's two-year recovery moving forward even despite fierce competition from equities in recent months.

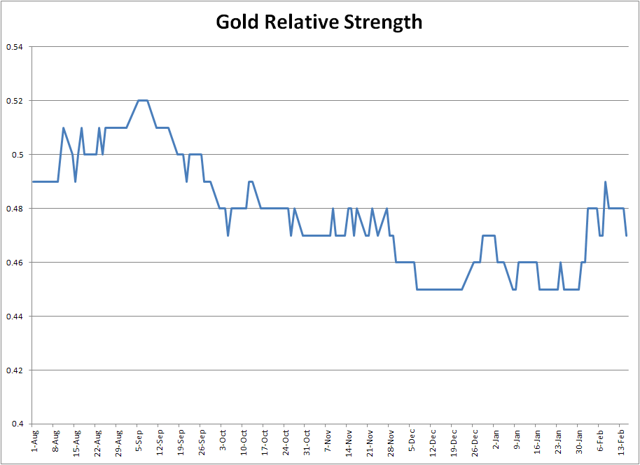

The weakening dollar is the single most important factor for the intermediate-term gold outlook as it provides assurance of gold's buoyancy in the weeks ahead. Gold's most recent gains, though, are equally a reflection of safety-related buying as much as the anticipation of future inflation. The equity market sell-off which started two weeks ago was another reason for gold's impressive relative strength of late. Now that the S&P 500 Index (SPX) has surged over 5% in recent days, gold's relative strength (RS) rating versus the equity market has lost a bit of its shine. The following graph underscores the pullback in gold's RS line in the last two days.

Chart created by Clif Droke

As I've written in recent commentaries, gold's RS line should ideally remain above the 0.48 level in order to ensure a strong relative strength rating versus equities. The higher above this level the indicator gets the more incentive fund managers will have to load up on the metal due to its outperformance compared to stocks. However, even with a subdued relative strength rating the gold price still has the important advantage of a weakening currency component which can still serve to increase its attractiveness to the bigger market players. If nothing else, a weakening dollar serves the function of stimulating gold demand as an inflation hedge.

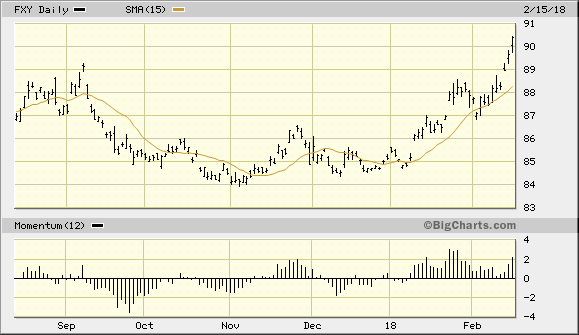

Another important factor which bodes well for the near-term gold outlook is the continued rally in the yen. The rise in the value of the CurrencyShares Japanese Yen Trust (FXY) has been utterly relentless all month (below) and has served as a barometer of the inflation-related and other concerns of global investors. A sustained yen rally has historically paved the way for a bullish gold outlook, so as long as the yen ETF is rising investors should expect that gold will eventually follow suit.

Source: www.BigCharts.com

On a strategic note, I've initiated a new long position in the iShares Gold Trust (IAU) as of Feb. 14. I recommend using the $12.62 level (the Feb. 7 closing low) as the initial stop loss for this position on an intraday basis. Longer-term investment positions in gold can also be retained as the fundamentals underscoring gold's 2-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.