Don't Miss This Gap Stock Buy Signal

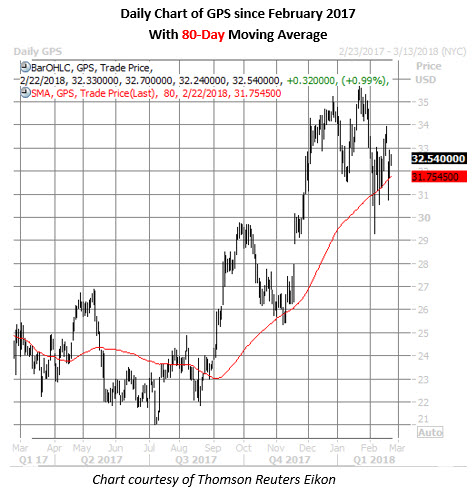

Shares of Gap Inc (NYSE:GPS) pulled back after hitting a two-year high of $35.66 on Jan. 23, but found a floor near $31 -- home to its rising 80-day moving average. If history is any guide, it could be time to join GPS on its next leg higher, as data shows a retreat to this trendline has had bullish implications for the stock.

According to Schaeffer's Senior Quantitative Analyst Rocky White, there have been four other times in the past three years that Gap stock has come within one standard deviation of its 80-day trendline, after spending a significant amount of time north of here. The security went on to average a 21-day gain of 10%, and was higher at the end of that one-month period two-thirds of the time. Based on its current perch, another move of this magnitude would put the shares near $35.70 for the first time since August 2015.

Outside of its recent retreat, likely impacted by broad-market headwinds, the stock is no stranger to positive price action. In fact, GPS is still boasting a 30.6% year-over-year lead, including today's 0.8% gain to trade at $32.49 -- and heading into a historically bullish time for retail stocks.

Short sellers have started throwing in the towel on GPS stock, too, but the shares could benefit from continued covering. While short interest dropped 7.7% in the most recent reporting period to 21.84 million shares, this still accounts for 9.2% of the equity's available float -- or more than six days' worth of pent-up buying demand, at the average pace of trading.

Analysts have been slow to catch up to Gap's longer-term price action, and a round of upgrades and/or price-target hikes could draw more buyers to the stock's table -- especially if the retailer turns in another well-received earnings report after the market closes next Thursday, March 1. While 17 of 19 brokerages maintain a "hold" or "sell" rating on GPS, the average 12-month price target of $31.49 stands at a discount to current trading levels.