Double trouble for cannabis stocks? Double down on REITs?

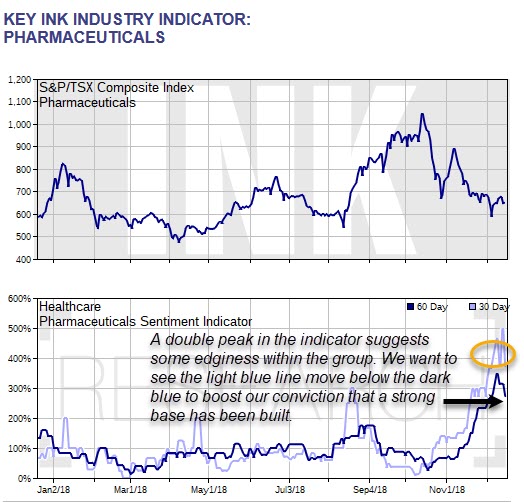

Last Wednesday in an a post, we noted that our 30-day Pharmaceuticals Indicator had peaked on Tuesday. As it turned out, the indicator has since moved back up and peaked again. This adds an extra degree of uncertainty to the prospect that a base for the group may have been established. Once the 30-day indicator moves below the 60-day indicator we will have a bit more confidence that investor anxiety has settled down in the space.

If we are right about the poor outlook for stocks generally going forward, some names in the Pharmaceuticals industry could provide defensive exposure during a bear market. Unfortunately, many stocks in the group are in marijuana-related businesses with excessive valuations limiting their attractiveness as defensive plays. Nevertheless, we have removed the idea of hedging long positions in cannabis stocks with a partial short position in the Horizons Marijuana Life Sciences ETF (HMMJ) from our #3 INK core investment theme of Watching for stock-specific opportunities in Healthcare and Technology.

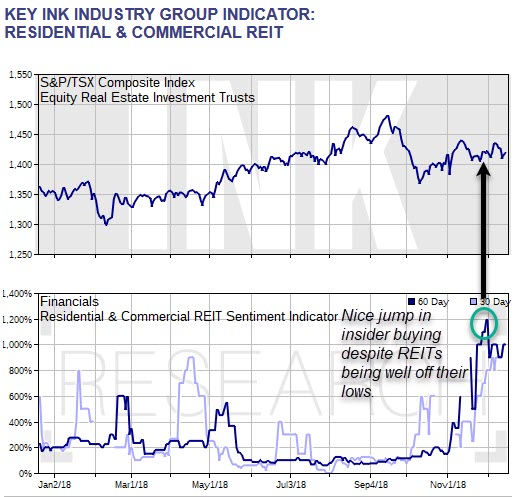

REITs on the other hand, do not generally suffer from high valuations. That may help explain why insider buying in the group has shot up recently even though REITs are generally nowhere near their 52-week lows.

Insiders may also be sensing an end to rate hikes in Canada and the United States which would tend to benefit the group. However, in an economic slowdown some REITs may face financing risk if their mortgages are up for renewal during a contracting credit environment. Consequently, balance sheet quality will be key for individual names should the economy slow as we expect it will.

This is a based on a partial excerpt from today's INK market report made available to Canadian Insider Club members before the market open. Click here for Club membership subscription information.