Dow, Nasdaq Notch Third Consecutive Triple-Digit Gains

Oil prices fell to a nearly seven-month low as supply ramped up

Oil prices fell to a nearly seven-month low as supply ramped up

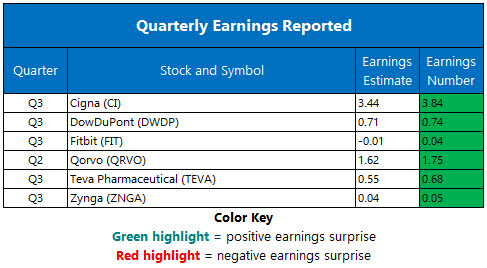

Stocks rallied again today, with the Dow and Nasdaq both notching a third straight triple-digit gain. Upbeat earnings from DowDuPont (DWDP) drove the Dow higher, and traders applauded an encouraging tweet on trade talks with China from President Donald Trump. The S&P also extended its winning streaks to three days, continuing to chip away at October's steep losses. Looking ahead to Friday, Wall Street will react to Apple (AAPL) earnings -- out tonight -- and the highly anticipated October jobs report.

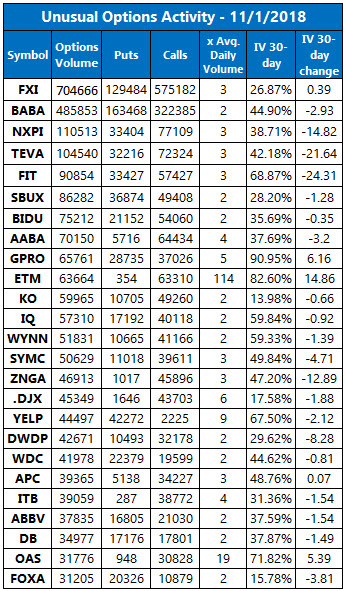

Continue reading for more on today's market, including:

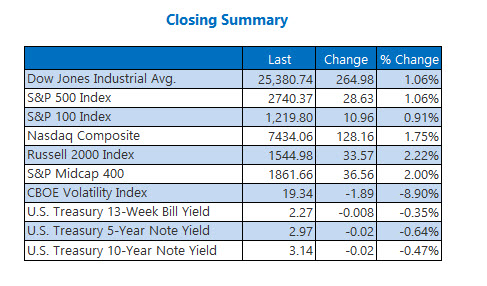

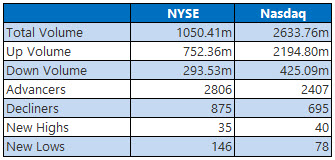

2 healthcare stocks to avoid this month. Options traders targeted this China ETF after the Trump tweet.How Starbucks made noise before earnings.Plus, bullish signals for Square; a big upgrade for one FAANG rival; and the airline stock that could soar in the short term.The Dow Jones Industrial Average (DJI - 25,380.74) closed up nearly 265 points, or 1.1%. It was the Dow's ninth consecutive triple-digit point move, and its first finish above its 200-day trendline since Oct. 23. DWDP led 21 Dow stocks higher with its 8.1% gain, while Verizon (VZ) paced the nine decliners with its 1.8% fall.

The S&P 500 Index (SPX - 2,740.37) added 28.6 points, or 1.1%, while the Nasdaq Composite (IXIC - 7,434.06) tacked on 128.2 points, or 1.8%. It was the Nasdaq's seventh consecutive triple-digit point move.

The Cboe Volatility Index (VIX - 19.34) gave back 1.9 points, or 8.9%, marking its first finish south of 20 since Oct. 22.

5 Items on our Radar Today

Google employees around the globe staged walkouts to protest how Alphabet (GOOGL) handled sexual misconduct. An October New York Times article said Google kept executives accused of misconduct on staff, or in the case of some, offered golden parachutes. (CNBC)Lachlan Murdoch, executive chairman and future CEO of Twenty-First Century Fox (FOXA), said he "will be inquisitive" about possibly buying back the regional sports networks sold to Walt Disney (DIS) earlier this year. (Reuters)Square stock could be sending up buy signals ahead of earnings.The Netflix rival bolstered by an upgrade. Why Alaska Air stock could ascend this month.

Data courtesy of Trade-Alert

Oil Prices Retreat as U.S. Ramps Up Production

Oil prices ended lower today, as major producers ramped up output ahead of U.S. sanctions on Iran, which go into effect next week. In addition, the Energy Information Administration (EIA) said U.S. oil production hit a record high in August. Oil for December delivery shed $1.62, or 2.5%, to end at $63.69 per barrel -- its lowest point in almost seven months.

Gold futures snapped a recent losing streak, as the dollar index fell from annual highs. December-dated gold jumped $23.60, or 1.9%, to end at $1,238.60 an ounce -- the highest settlement in more than three months.