Dow Up Triple Digits After Shaky February Start for Stocks

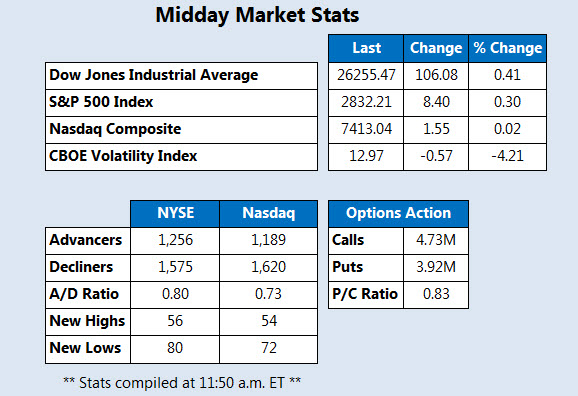

Despite stock futures signaling another big sell-off ahead of the bell, the major equity benchmarks are holding their own at midday. The Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are modestly higher, while the Nasdaq Composite (IXIC) has clawed its way onto positive ground. In the wake of a remarkably strong January performance for stocks, traders today are weighing lackluster productivity data -- down 0.1% in the fourth quarter, versus an expected rise -- against a strong post-earnings rally from Facebook (NASDAQ:FB) ahead of tonight's round of FAANG results.

Continue reading for more on today's market, including:

The drug stock living up to bullish expectations.Goldman loses conviction on a high-flying chip stock. Plus, QRVO's unusual options volume, and the cell phone stock making a comeback.

Among the stocks with unusual options volume today is Apple supplier Qorvo, Inc. (NASDAQ:QRVO), with more than 11,000 calls traded -- 15 times what's typically seen at this point in the day. Traders are reacting to the preannouncement of an iPhone supply deal, which also triggered upgrades from Instinet and BofA -Merrill Lynch. At last check, QRVO stock was up over 15% at $82.99, fresh off a nearly three-year high of $85.24.

Outperforming on the New York Stock Exchangeis mobile network stock Nokia Oyj (NYSE:NOK). NOK shares gapped higher after the company revealed better-than-expected fourth-quarter earnings, and the CEO announced "we are coming back very fast." At last check, Nokia stock was up 13.4% at $5.45.

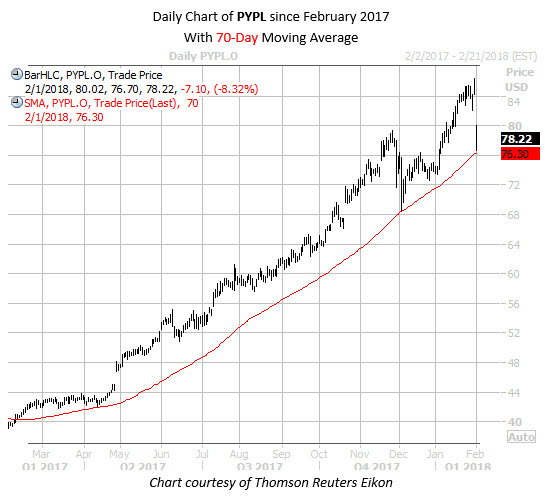

One of the worst performers on the Nasdaq today is electronic payments processor PayPal Holdings, Inc. (NASDAQ:PYPL), after its former parent company eBay (EBAY) announced its migration to a new payment partner. In response, PYPL is down 7% at $79.74. Today's bear gap brings PYPL back in touch with its 70-day moving average, which provided key support for the stock back in late 2017.