Dow Pops After Jobs Data, Big-Cap Oil Earnings

Blue chips Exxon and Chevron are higher after earnings

Blue chips Exxon and Chevron are higher after earnings

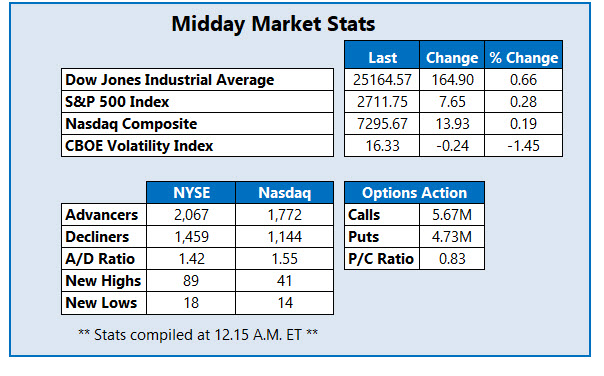

The Dow Jones Industrial Average (DJI) is continuing to ride tailwinds from this morning's bang-up jobs report. Positive earnings reactions for blue-chip energy stocks is fueling upside, too, with the Dow up almost 165 points at midday.

Traders also digested a strong Institute for Supply Management (ISM) manufacturing purchasing managers index (PMI) and construction spending data for January, though consumer sentiment hit its lowest level since the 2016 U.S. presidential election last month. The S&P 500 Index (SPX) and Nasdaq Composite (IXIC) are higher, too, though gains are more modest as Amazon (AMZN) takes a post-earnings slide.

Continue reading for more on today's market, including:

The monster price target Wedbush set for this restaurant stock. The heavily shorted healthcare stock seeing volatile trading today. Plus, the weed stock with heavy call action; a big manufacturing deal; and the new Nuvectra CEO gets a cold reception.

There's notable options activity around weed stock Aphria Inc (NYSE:APHA). About 12,000 calls and 2,600 puts have exchanged hands, roughly four times the average intraday pace. The February 10 calls are the most popular, followed by the February 10 puts., and it's possible new positions are being purchased at each front-month strike. APHA is up 8.8% at $9.51.

Continental Materials Corporation (NYSE:CUO) is one of the top performers on the New York Stock Exchange (NYSE) today after the manufacturing company sold one of its assets, Transit Mix Concrete, to Aggregate Industries. The security is on pace for its sixth straight win -- up 27.8% at $19.06 at last check, earlier matching its April 4 annual high of $19.95.

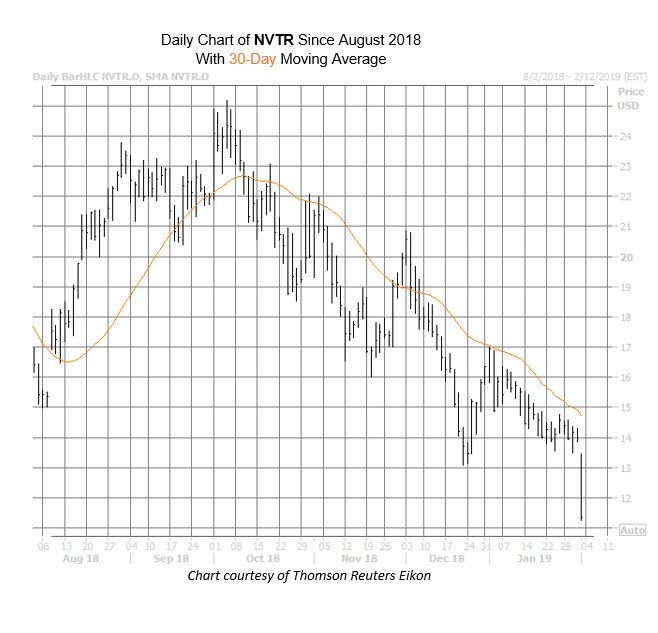

One of the worst stocks on the Nasdaq today is Nuvectra Corp (NASDAQ:NVTR), after the medical device maker appointed Dr. Fred Parks as its new CEO late yesterday. The equity has been pressured lower by its 30-day moving average in recent months, and is now pacing for its worst day since November 2017. At last check, NVTR is down 19% to trade at $11.34.