Dr. Copper hints mining sector officially out of intensive care

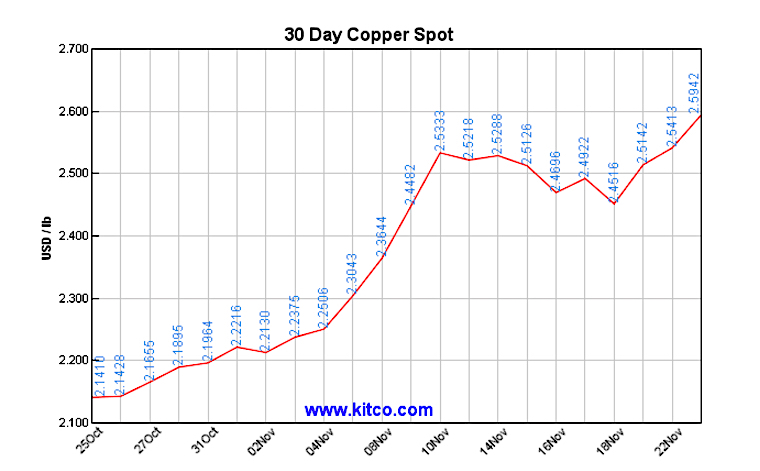

Copper, until recently one of the worst performing commodities in the past two year, is having a great month, with prices up about 20% to more than $5,700 a tonne Thursday.

The rally, which began on the heels of Donald Trump winning in the US presidential election, has been partly based on speculation regarding the impact of the President-elect's $500 billion infrastructure plans on demand for the metal.

It has also been fuelled by a pick-up in Chinese imports, responsible for some 49% of global copper demand, which is seen a good omen for the industry's health.

Increased demand from China, the world's largest copper consumer, has left the market tighter than previously expected -Goldman Sachs.Even Goldman Sachs - usually the most pessimistic when it comes to predicting what's in stake for copper in the short term - has changed its tone to a more positive one, FT.com reports (subs. required).

According to the publication, the investment bank believes the increased demand from China, the world's largest copper consumer, has left the market tighter than previously expected. Now Goldman believes the market will be broadly balanced this year.

BHP Billiton (ASX:BHP), the world's No.1 miner, and Caterpillar (NYSE:CAT), the largest heavy equipment maker, saw the recovery coming from miles away.

BHP, already the world's second-biggest listed copper miner, hiked its annual exploration spending by 29% this year, allocating nearly all its $900 million budget to finding new copper and oil deposits. The firm, who wants copper to be one of the pillars of its future growth, is already looking for more of the red metal in Chile, Peru, the US, Canada and South Australia, as well as eyeing new partnerships to boost its growth pipeline.

In the short term, however, BHP is not that optimistic. "A deficit is expected to emerge as grade declines, a rise in costs and a scarcity of high-quality future development opportunities are likely to constrain the industry's ability to cheaply meet this demand growth," it said in its annual report.

Caterpillar, the world's No.1 heavy machinery maker, recently said it believed iron ore and copper miners would be leading the way in terms of an increase in equipment demand in the next three to five years. Currently CAT makes the most sales to the coal, copper and iron ore sectors, in that order.

Too soon, too fast

Given its widespread use in transport, electricity systems, manufacturing and construction, copper is seen as a barometer of the health of the overall global economy. While other industrial metals and steelmaking raw materials have jumped in value this year, copper is still looking healthier than just a month ago.

"Although fundamentals...for copper have improved, the speed of the recent rally leaves it open to the charge that price action has been too much, too fast," Barclays analysts said in a note to clients earlier this week.

They believe that prices will come under pressure between now and the end of the year as the dollar strengthens ahead of an expected US interest rate increase next month.

They believe that prices will come under pressure between now and the end of the year as the dollar strengthens ahead of an expected US interest rate increase next month.

A recent new survey of 22 investment banks and other commodity research institutions by FocusEconomics analysts and investors confirm Barclays' perceptions, as it also called into question the sustainability of copper's rally.

The consensus forecast for Q4 2017 is only a slight improvement over this year with a rise to $5,070 a tonne ($2.29 a pound).

Meanwhile, Chile's Codelco, the world's No.1 copper producer, reported this week the lowest delivery premiums to the Chinese market on recent record, supporting comments made by local miners that there still a large supply of concentrate, which will continue to exceed demand in 2017.

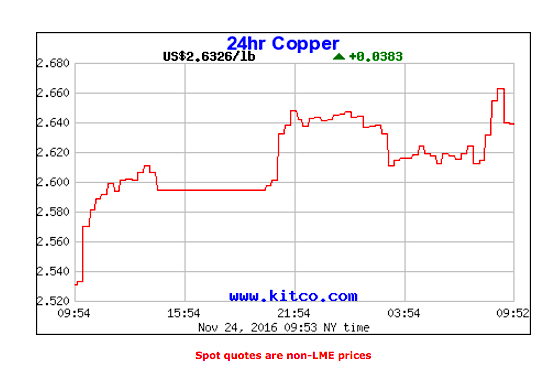

Speculators, however, don't seem to have gotten the memo. Likely backed by algorithm trading and supported by short sellers scrambling to cover positions, the metal continues to build on this month gains. It soared 2.8% to $5,768 a tonne on Thursday, while three-month copper prices jumped 2.3% to $5,903 per tonne.