Dynacor Gold: Undervalued Play But A Fragile Business Model Is A Serious Constraint

Dynacor is ramping up production at its new processing plant, Veta Dorada.

After poor 1H 2017 the company seems to be on the right track.

However, Dynacor is facing a few risks discussed in this article.

In my opinion, the biggest constraint is a fragile business model based on the unpredictable artisanal segment of the gold sector in Peru.

Dynacor Gold Mines (OTCPK:DNGDF) is a processing company operating in Peru. In my previous article on this company (and a few other processing companies), I was quite optimistic about it. However, now, I have mixed feelings, and in this article, I am trying to discuss a few pros and cons.

Introduction

Dynacor's strategy is simple. Peru is one of the world's largest producers of gold, but a big part of the production (roughly 20%) is attributable to illegal mining or, using the official terminology, the so-called artisanal and small-scale mining (ASM). ASM, apart from being a main source of income for the miners and their families, is also responsible for environmental pollution. To solve this problem, the Peruvian government tries to "civilize" this business. The proposal is simple: go legal and process your gold at modern facilities built by the professionals. Dynacor is such a professional company.

Veta Dorada Plant

In October 2016, Dynacor poured its first gold at the Veta Dorada processing facility. As a result, its old gold mill, Metalex Huanca, was put on care and maintenance. Here is an excerpt from the CEO's letter addressed to Dynacor shareholders at the end on 2016:

"We will focus on operating the most modern and efficient gold ore processing facility in Peru and I expect that by the end of 2017 we will be operating the plant between 300-360 tpd and will have produced close to 90,000 ounces of gold. This will propel Dynacor to the number one spot in terms of ore processing in Peru and make your Company a leading edge in terms of environmental performance and social responsibility. Further expansion, in 2018 and 2019, of our milling capacity to 450-600 tpd will be implemented in step with market conditions"

Unfortunately, in March and April 2016, the company encountered unfavorable climate conditions (heavy rainfalls), and then (3Q 2017), the southern part of Peru experienced a strong earthquake. As a result, the company's operations have been negatively impacted by these events.

Now, in my opinion, there are a few critical factors that should be monitored by investors interested in gold processing companies: the amount of ore stockpiled, cash cycle, throughput and suppliers' strength. Let me discuss these factors taking Dynacor as an example.

Ore stockpiled

To run smoothly, a processing company should hold a sufficient amount of ore. Let me check whether Dynacor has a sufficient ore inventory.

According to 3Q 2017 report, at the end of September 2017, Dynacor held ore worth $1.3M. Now, during 3Q 2017, the company was paying $958 to purchase one ton of ore from artisanal miners, on average (I have arrived at this figure dividing the cost of ore purchased in 3Q 2017 by the amount of ore processed during that quarter). It means that Dynacor held 1,347 tons of ore at its stockpile. Keeping in mind that the current plant capacity is 300 tons of ore per day, it means that the company held extremely low ore inventory (enough for 4.5 days of production).

Further, although Dynacor has been steadily increasing its ore inventory since 1Q 2017, investors should monitor this measure carefully. Simply put, if the company encounters similar negative events as in 2Q and 3Q 2017, its operations could be in trouble (with suspension of operations in the worst case).

Source: Simple Digressions

What is more, low ore inventories may be an indication of problems with ore purchases. And it could be even a more serious problem - if artisanal miners, due to some reasons, were not that keen to provide Dynacor with gold ore, the company's ambitious expansion plans would have to be adjusted properly (to the downside).

Cash cycle

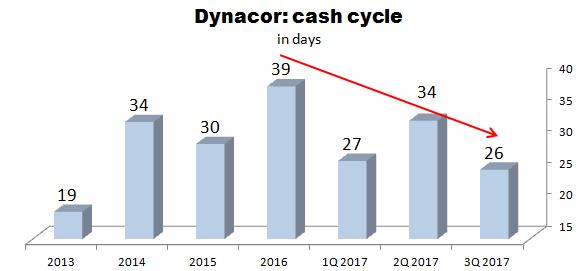

It looks like Dynacor has an excellent chief financial officer. Look at this chart:

Source: Simple Digressions

Generally, the lower working capital and shorter cash cycle, the better. Dynacor keeps its cash cycle at a very low level. As the chart shows, the cash invested in the extraction process returns to the company within one month (26 days during 3Q 2017, on average). In my opinion, it is a good sign because the company has more cash at hand. As a result, Dynacor was able to pay off all its debts, and now, the company is debt free.

Note: investors should remember that a short cash cycle is also a result of low ore inventory (a problem discussed in the section "Ore stockpiled").

Artisanal miners have strength

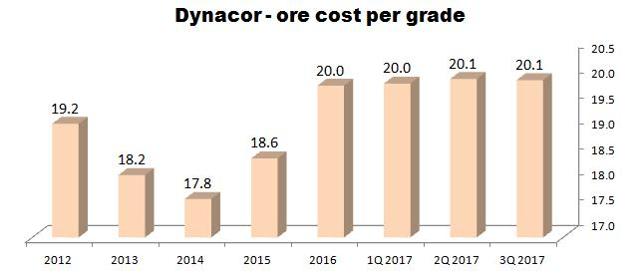

In my previous article on Dynacor, I introduced a unique performance measure (invented on my own) called "Ore cost per grade processed". Today, I would like to modify this concept a little bit. First of all, this metric measures the negotiation power of artisanal miners. In other words, to show sound results, Dynacor has to buy the gold ore at the lowest cost possible. However, it looks like artisanal miners are stronger than before, and it is not that easy to buy super cheap ore. Look at this chart:

Source: Simple Digressions

I have calculated the ore cost per grade in the following way:

Ore cost per grade = cost of ore/(head grade x tons of ore processed)/gold price received

I realize that the formula is a little bit complicated, but my intention was to show the historical cost of one gram of gold purchased by the company using a fixed price of gold (to eliminate a positive impact of rising gold prices).

The final conclusion is as follows:

Dynacor has to pay more to artisanal miners for the ore purchased. The chart shows that after eliminating all distortions (variable head grades or throughput and different gold prices), the opening of a new gold facility resulted in a 10% increase (roughly) of the artisanal miners' negotiation power. In other words, the company has to pay 10% more for the gold purchased from artisanal miners than before (when the old mill was operating).

In my opinion, now, it is a minor issue for the company. During a bull market in gold, this problem is contained by higher gold prices. However, investors should keep in mind that artisanal miners in Peru are tough and strong, and lower gold prices may have a bigger negative impact on Dynacor's results than many people think.

Throughput

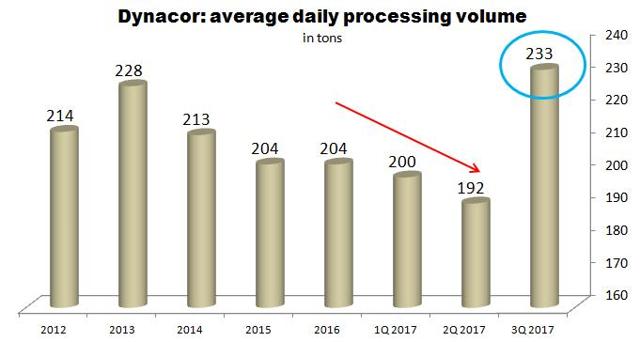

The first half of 2017 was a negative surprise. Due to particularly poor 2Q 2017 (weather conditions), Dynacor was processing less and less ore (the red arrow on the chart below). However, during 3Q 2017, throughput jumped from 192 tons per day in 2Q 2017 to 233 tons per day (the blue circle):

Source: Simple Digressions

Now, according to one of the latest announcements, in October and November, Dynacor produced 15.2 thousand ounces of gold. Assuming the same grades and recoveries as in the previous months, I estimate that the daily throughput in October and November was 242 tons. Definitely, after initial problems, the company is increasing its throughput, which is the good news for Dynacor investors. On the other hand, the company is still far away from the upper limit of the mill (300 tons per day).

Value

Dynacor, apart from running a processing plant, owns a few mineral properties (with Tumipampa in Peru being the most interesting one). In this article, I have focused on the Veta Dorada plant only (let me leave mineral properties for another article), so the value calculated below does not take into account the potential value delivered by Tumipampa (in my opinion, it is an interesting asset).

Now, it is relatively easy to assess value to a processing plant. A mill is a long-term business operating at well-known parameters (throughput, efficiency etc.). So, to find its value, an analyst has to make a few reasonable assumptions and use the following formula:

Value = annual free cash flow/discount rate

Here are my assumptions

Gold price: $1,273 per ounce (as of 3Q 2017) Growth rate: 0% (I assume that Dynacor is to process the ore at the current maximum capacity of 300 tons per day) Cash flow from operations: $131 per ton of ore processed (as of 3Q 2017 and at a price of gold of $1,273 per ounce) Cash spent to keep the mill running: $2.5M a year (annual depreciation charge attributed to the mill and reported by the company in 3Q 2017 report) Discount rate: 7%Applying these assumptions, I have arrived at the following value:

Value of Veta Dorada = ($131 x 365 days x 300 tons per day - $2.5M)/7% = $169.2M

In other words, at current maximum capacity of 300 tons per day, the mill is worth $170M, roughly.

However, apart from processing operations, Dynacor is involved in mineral exploration. According to 3Q 2017 report, since the beginning of 2017, the company has spent $437,000 on mineral exploration up to date. On a per-year basis, it is $0.6M, roughly.

Now, it is possible to calculate Dynacor's value, excluding potential cash flows delivered by the company's mineral properties (in fact, in this simplified model, these properties are liabilities - the net present value of exploration expenditures is negative):

Veta Dorada's value: $169.2M Net present value of exploration expenses: minus $8.6M (annual exploration expenditure of $0.6M divided by a discount rate of 7%) Net debt: minus $5.7M (as of the end of September 2017) Dynacor value = $169.2M less $8.6M plus $5.7M =$166.3M or $4.29 a share (using a share count of 38.8 million).Summary

In my opinion, Dynacor is not a sure thing. Despite putting online one of the best processing plants in Peru, the company faces a set of risks. In this article, I have discussed a few of them: low ore inventory, slowly rising plant throughput and growing strength of artisanal miners. On the other hand, Dynacor is a well-managed gold processor holding a number of mineral properties (with Tumipampa being the most interesting one).

Now, using a discounted cash flow model (and excluding the value of mineral properties, which are free lottery tickets in this model), it looks like the company's shares are strongly undervalued now (the shares, valued at $4.29 a share, now are trading at $1.57 a share), so it seems that investors are very skeptical about Dynacor. If I were to find the reasons standing behind this skepticism, I would point to the company's fragile business model based on the highly unpredictable artisanal segment of the gold market in Peru. In other words, the figures (valuation) support the company, but the business model discloses a few serious constraints.

Did you like this article? If yes, please, visit my Unorthodox Mining Investing section where I manage a portfolio of up-to-ten mining picks, discuss new investment ideas and provide my subscribers with a medium-term outlook on a few financial markets (particularly the base / precious metals market). Most recently I have introduced a new section called "Developers". This service is dedicated to mining companies planning to open new mines within one or two years.

Disclosure: I am/we are long GDX, CEF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.