Elliott Wave Analysis: Gold Can do a Double Correction

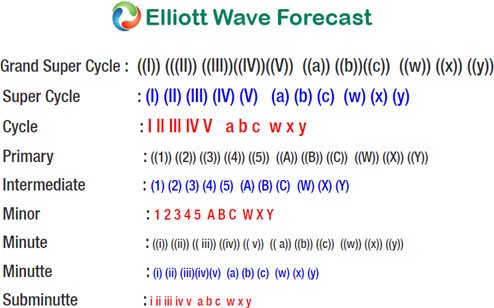

Gold Short Term Elliott Wave view suggests that the yellow metal is still correcting cycle from 12.13.2017 low ($1236.30) as a double three Elliott Wave structure. Down from 1.25.2018 high ($1366.06), the decline is unfolding as a double three where Minor wave W ended at $1306.96 and Minor wave X bounce ended at $1361.81.

Minor wave Y is in progress and the subdivision is also unfolding as a double there where Minute wave ((w)) ended at $1324.75 and Minute wave ((x)) ended at $1336.21. Near term, while bounces stay below $1336.21, but more importantly below $1361.81, the yellow metal has scope to extend lower towards $1288.27 – $1302.28 to end Minor wave Y. Afterwards, expect Gold to resume the rally higher or at least bounce in larger 3 waves to correct cycle from 1.25.2018 high. We don’t like selling the proposed pullback

For this view to be gain more validity, Gold needs to break below Minor wave W at $1306.96. Until then, there is no guarantee Gold will extend lower and the right side remains higher as the yellow metal still has 5 swing bullish sequence from 12.15.2016 low. We do not like selling the proposed pullback and expect buyers to appear at $1228.27 – $1302.28 (if reached) for a 3 waves bounce at least.

Gold 1 Hour Elliott Wave Chart

Become a Successful Trader and Master Elliott Wave like a Pro. Start your Free 14 Day Trial at - Elliott Wave Forecast.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITYAND LIABILITYTrading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk.However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level ofxperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal,analysis, or content.Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted onthe website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s).In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else.Please understand and accept the risk involved when making any trading and/or investment decision.UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization.UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one yearsubscription to our Premium Plus Plan at $1,799.88 for EACH person or firmwho received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.