Freak copper price jump has analysts scratching their heads

The copper price had its best day in a month, but commodity analysts were at a loss to explain why.

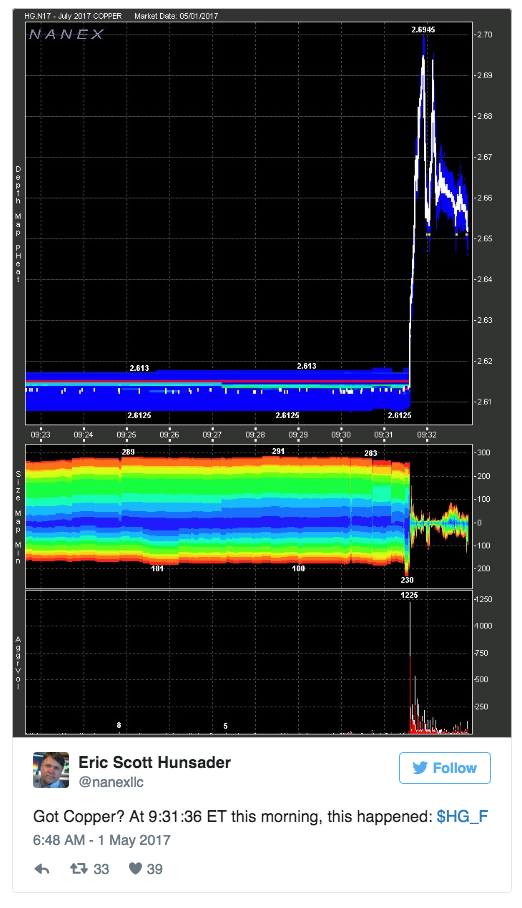

The red metal shot up over 2.5% this morning with July copper futures reaching $2.69 a pound, the highest they've been since April 5.

The jump could be explained by the fact that workers today at Freeport-McMoRan's (NYSE:FCX) Grasberg mine rallied ahead of an expected month-long strike. The miners at the world's second largest copper mine are protesting layoffs. The company has laid off about 10% of its Grasberg workforce due to a contract dispute with the government.

A strike could affect the supply of copper in a year that has already seen several labour-related interruptions.

CNBC pointed out that trading volumes were lower than normal due to key copper trading markets London and Shanghai being closed for a holiday Monday, which could also explain the rapier-like spike.