From Concept to Confirmation A District-Scale Gold Story Takes Shape

John Newell of John Newell & Associates explains why he thinks Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; X7W:FSE) is a district-scale opportunity.

Occasionally, a junior gold company lines up across multiple critical factors, technical setup, geological potential, and leadership expertise, in a way that grabs your attention. Dryden Gold Corp. (DRY:TSXV; DRYGF:OTCQB; X7W:FSE) may be one of those rare cases.

This is not just another greenstone belt story.

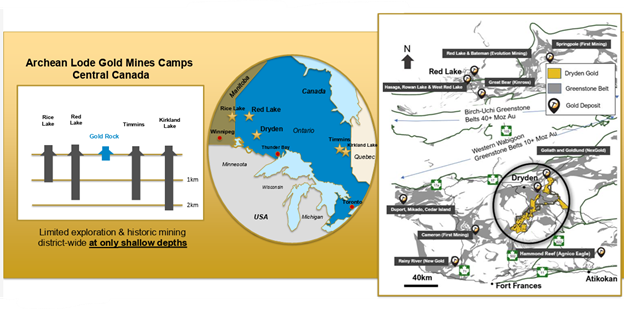

It's a company methodically uncovering stacked high-grade gold zones across a commanding land position in northwestern Ontario, an area that exhibits the structural hallmarks of Red Lake.

With strong backing, a fully funded 2026 exploration program, and a breakout technical pattern in motion, the setup is compelling.

Ontario's Prolific Underexplored Gold District

About the Company

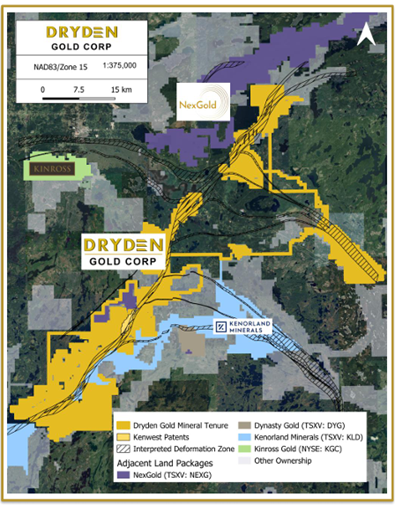

Dryden Gold is a junior exploration company focused on district-scale, high-grade gold targets in northwestern Ontario. The company owns 100% of over 702 square kilometers (70,250 hectares) along the Manitou-Dinorwic deformation zone (MDdz), a 50-kilometer regional structure that has seen limited modern exploration but hosts numerous high-grade occurrences and past-producing mines.

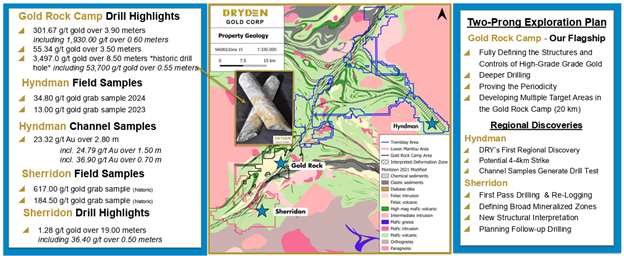

The flagship project, Gold Rock Camp, sits on a structurally complex and mineral-rich corridor, where historic and recent drilling has returned bonanza-grade intercepts. Importantly, Dryden's approach is highly technical, leveraging oriented core and structural modeling to define stacked mineralized systems in multiple host rocks.

The company also holds two fully permitted, high-priority regional targets at Sherridon and Hyndman, where historic grab samples have returned values up to 617 g/t gold, and 2025 drill programs are ready to go.

Strategic Land Position and Neighbors

Dryden's land package is not only large but ideally located. It sits in the heart of one of Canada's most underexplored gold districts and shares its borders with several major and fast-moving exploration players.

Kinross Gold Corp. (K:TSX; KGC:NYSE) holds ground directly to the west, anchoring the area with Tier-1 infrastructure and capital.

Kenorland Minerals Ltd. (KLD:TSX.V; KLDCF:OTCMKTS; 3WQO:FSE) has secured a large adjoining land position and has just released very encouraging soil-till results contiguous to Sherridon. This property is optioned to Centerra Gold Inc. (CG:TSX; CADGF:OTCPK)). Centerra is a strategic equity investor in Dryden and Kenorland.

NexGold Mining Corp. (NEXG:TSX.V; NXGCF:OTCQX; TRC1:FSE) controls ground to the north and released their March 2023 feasibility study for developing the 2.1 million ounce Goliath Gold Complex.

Dynasty Gold Corporation (DYG:TSX.V) and other smaller operators are also active in the region.

This growing cluster of advanced exploration programs and a mine development, highlights the strategic significance of the Dryden Gold District. It's a classic setup big structures, shallow gold, good neighbors, and infrastructure already in place. Roads, power, and labour are all within reach, and Dryden's permits allow year-round drilling at an estimated all-in cost of just $250/m.

Exploration Highlights

Dryden's methodical, phased approach is designed to maximize discovery potential. Recent drilling at the Gold Rock target area has yielded standout intercepts, including:

301.67 g/t gold over 3.90 meters, including 1,930 g/t over 0.60 meters (KW-25-003)30.72 g/t gold over 5.70 meters15.40 g/t gold over 6.10 metersA historic intercept of 3,497 g/t over 8.5 meters, including 53,700 g/t over 0.55 metersThe Gold Rock Camp is exhibiting "periodicity", a repeating pattern of mineralized zones every few kilometers, a feature associated with world-class gold camps like Red Lake. The company has tested this pattern 2 kilometers north of Mud Lake. First pass drilling and ground sampling have produced very encouraging results. In 2026, Dryden plans additional permitting and drilling at Mud Lake and will also be permitting another area 2-kilometers south of Gold Rock..

Management

CEO Trey Wasser is best known for building Ely Gold Royalties, which was sold to Gold Royalty Corp in 2021 for $300MM. He has assembled a technically elite team.

President Maura Kolb, formerly Exploration Manager at Goldcorp's Red Lake Mine, brings direct experience managing a $50M budget and a 90-person team in this exact geological setting.

She is supported by VP Exploration Anna Hicken, her long-time second-in-command at Red Lake.

This team understands how majors explore and how they think. Their approach blends deep domain expertise with the systematic thinking of a mid-tier producer, applied to one of the most prospective belts in the country.

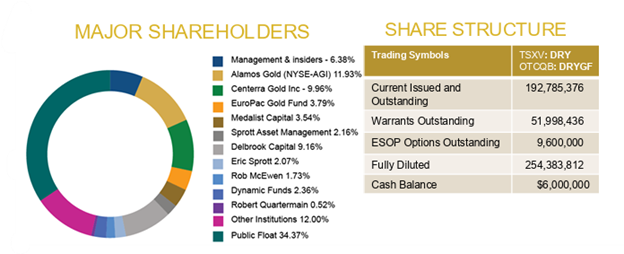

Share Structure and Major Shareholders

Dryden Gold Corp. has a clean capital structure with strong institutional alignment and no near-term financing pressure.

As of November 25, 2025:

Strategic shareholders include Alamos Gold (14.34%), Centerra Gold (9.99%), and high-profile investors such as Eric Sprott, Rob McEwen, Robert Quartermain, Delbrook Capital Advisors, EuroPac Gold Fund, and Medalist Capital.

This is a very experienced shareholder base that knows how to identify successful junior mining companies.

Technical Setup

The technical setup for Dryden Gold continues to unfold with bullish structure and improving momentum. Since triggering a breakout in May 2025, the stock has already met and exceeded its initial technical targets of CA$0.32 and CA$0.40. The current pattern is a textbook symmetrical triangle, formed after a strong impulse wave. Volume has trended lower into the apex, suggesting a potential continuation move could be close at hand. The recent high-volume consolidation has been fueled by the overhang of 38.5MM warrants at CA$0.30. These warrants will expire on December 28, 2025.

Momentum indicators support this interpretation. The MACD is curling higher, showing early positive divergence, while the RSI has remained above 50, typical of stocks in sustained uptrends. Price action is holding above both the 50-day and 200-day moving averages, which are rising in tandem, reinforcing bullish bias.

A decisive move above CA$0.40-CA$0.42 on volume would confirm the next leg higher, targeting:

Third Target: CA$0.46Big Picture Target: CA$0.58 +This setup offers strong risk-reward potential for technical traders and longer-term investors alike, particularly as the stock remains in a tight consolidation phase ahead of a fully funded 2025 exploration program.

2026 Outlook and Catalysts

As Dryden wraps up an already successful year, investors can expect:

Assays in January from the start of the 2026 exploration program this fall, testing high-grade at Gold RockAssays in January/February from drilling this fall at Sheridan and HyndmanA detailed 2026 drill plan emphasizing Gold Rock, including expanded targets at Mud LakeAdditional institutional interest, as the geological model continues to gain traction, with Dryden's aggressive 2026 marketing plansConclusion

Dryden Gold Corp. is shaping up to be one of the more complete junior gold stories in the Canadian market, technically strong, geologically robust, and institutionally supported. Therefore, backed by the near-term fundamentals of the company and the current technicals of Dryden Gold, we believe the company is a Speculative Buy at the current price of CA$0.34.

With a team that's already built value in Red Lake, a land position that's attracting majors, and a fully funded exploration program across multiple high-grade corridors, the company is positioned to generate sustained discovery news into 2026.

For speculative investors looking for leverage to a high-grade Canadian discovery, Dryden Gold checks all the boxes in this rising precious metal market.

Investors can learn more at the company's website here: www.drydengold.com

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Dryden Gold Corp. and NexGold Mining Corp. are billboard sponsors of Streetwise Reports and pay SWR a monthly sponsorship fee between US$4,000 and US$5,000. For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,000.As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dryden Gold Corp. and NexGold Mining Corp.Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.