Gold's Most Important Intermediate-Term Test

Gold fast approaching pivotal September 2017 high.

How gold price reacts to this level will determine the interim outlook.

The bulls should eventually prevail, based on momentum factors.

Gold is fast approaching an important benchmark, namely the $1,355 level. This was the closing high from Sept. 8, 2017 as can be seen in the February gold futures chart below. As I'll explain here, gold's reaction to this upcoming test will provide a useful signal on whether the uptrend which began in December has enough strength to continue beyond the immediate term.

One thing that always happens as a previous market high is approached is that traders who bought gold near the previous high and then held on through the subsequent decline will be very tempted to sell out once the previous high is reached. This is due to the indefatigable tendency of investors who experience a scary decline to sell out at roughly break-even rather than holding on to make a profit.

The upcoming test of the $1,355 level is an important test for the strength of this rally. The reason is that when the traders who bought near that high inevitably sell out, there will typically be a reaction of the gold price as the old high is revisited. What happens after this is critical for the survival of the uptrend, for if the remaining bulls aren't fully committed, then rally will stumble and the gold price may have to spend an extended period in a trading range as bulls and bears wrestle for control. If, however, the gold price continues higher beyond the September high at the $1,355 level, the odds will favor the intermediate-term bull market continuing with significantly higher prices to follow. Based on the established internal momentum underlying the precious metals market, the odds favor the test of the September 2017 high being a successful one for the bulls.

Source: www.Barchart.com

Before continuing with our analysis of the near-term outlook, I'd like to address a theme which has been bandied about recently. There has been a suggestion among some high-profile writers that gold should be treated as insurance against a financial market event or social convulsion. The rationale behind the gold-as-insurance philosophy is that gold will often increase, or at least maintain, its value during tumultuous times. While this has sometimes proven to be the case, owning gold is no guarantor of one's personal economic survival in tough times. Gold is not a guaranteed insurance policy; it's a commodity. Investors would do well to remember this before committing their investment funds to it.

Indeed, all too many gold investors are wedded to the idea that gold is "sound money", which is a debatable proposition. The danger in embracing the "gold is good" belief is that it tends to blind the devotee to the inevitable downside potential of the gold price over time. Blindly embracing this belief can therefore lead to substantial losses of one's investment funds.

This should not be construed as an attack on gold ownership. Far from it, for there are times when owning gold from a long-term investment perspective is an excellent idea. What I'm driving at rather is that gold should be treated as any other commodity: own it when the fundamental and technical picture is favorable, but don't be afraid of divesting from it when the outlook is unfavorable. Remember that even gold will sometimes suffer in a financial market panic or economic recession as the proverbial baby is thrown out with the bathwater. And in times of great financial market uncertainty, cash - not gold - is typically king.

A final word of caution about gold investing is in order. Rather than blindly buying and holding gold as a type of financial insurance policy, a better allocation of capital would be to keep investment funds in what one truly believes will appreciate in value in the market's intermediate-to-longer-term timeframe. Whether that is stocks, bonds, commodities (including gold), or real estate is immaterial. But to tie up large sums of money for years in what could be a non-performing asset is not a wise use of one's capital. It's tantamount to burying money in the ground when you could be lending it out at interest. Gold should be purchased only when you see it as having upside potential, whether in the near-term or the longer-term outlook. Bottom line: never assume that to be financially "protected" you "must" own gold, even if it's in a bear market.

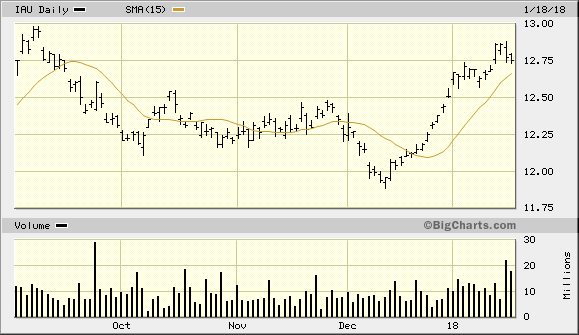

Returning to the short-term outlook, the iShares Gold Trust ETF (IAU), my favorite gold-tracking fund, remains above its rising 15-day moving average. This confirms that its immediate-term (1-4 week) trend is still up with buyers controlling the market for now. After taking some profit earlier this month once the $12.75-$12.80 area was reached, I've since recommended that traders raise stop losses on the remaining part of this trading position. Currently the stop-loss should be raised to slightly under the $12.70 level (closing basis) where the 15-day moving average can be seen in the daily chart. A thrust above the $13.00 level in IAU would tell us that the intermediate-term (i.e. beyond three months) trend for the gold ETF remains favorable.

Source: www.BigCharts.com

Source: www.BigCharts.com

I also recommend raising the stop loss on existing long positions in February gold futures to slightly under the $1,322 level, which is where the 15-day moving average is currently found in gold's daily chart. I also recommend using a level slightly under the $23.50 level as the stop-loss on a closing basis for trading positions in the VanEck Vectors Gold Miners ETF (GDX), which I am also currently long.

Disclosure: I am/we are long IAU, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.