Gold: Drivers Change

Gold has stopped to respond to the changes in the U.S. real interest rate.

Dollar and inflation are now gold's main drivers.

Inflation creates a long-term positive background for gold.

Dollar threatens gold with ashort-term correction.

Investment Thesis

The analysis of the gold market prospects amid the actual driver indicates the conservation of a positive, long-term trend and the risk of a short-term correction of the gold prices and, consequently, the SPDR Gold Trust ETF (GLD), which is tied to gold.

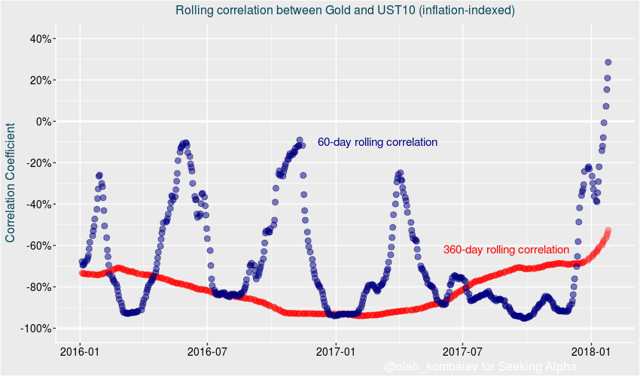

Considering the short-term prospects for gold, it is important to note that its price, for the first time in the last two years, no longer heavily depends on the level of the U.S. real interest rates. So, the current value of the 60-day rolling correlation of the gold price and the real rate significantly differs from the level of the 360-day one.

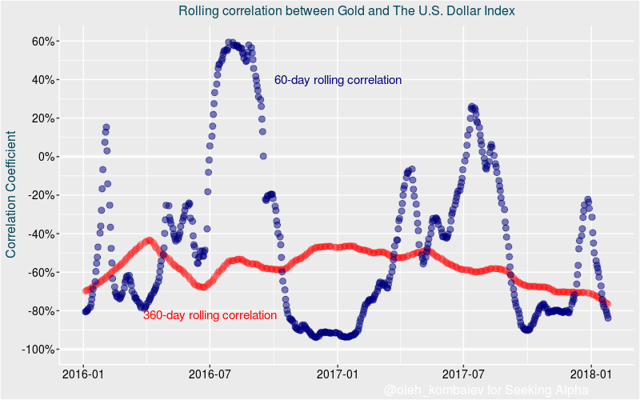

But, instead, gold began to give a stronger response to the dollar dynamics. And in this case, the value of the 60-day rolling correlation exceeds 80%, which is classified as a strong and stable relationship:

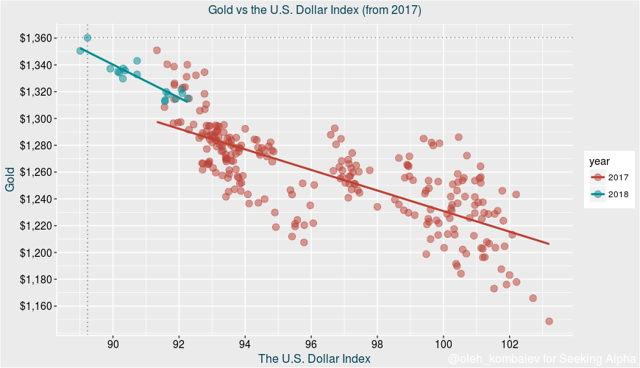

Comparing this relationship to the last year, it is worth noting that the trend line reflecting the interdependence between the price of gold and the dollar index has become steeper now - i.e. gold tends to react to each dollar fluctuation with a sharper movement:

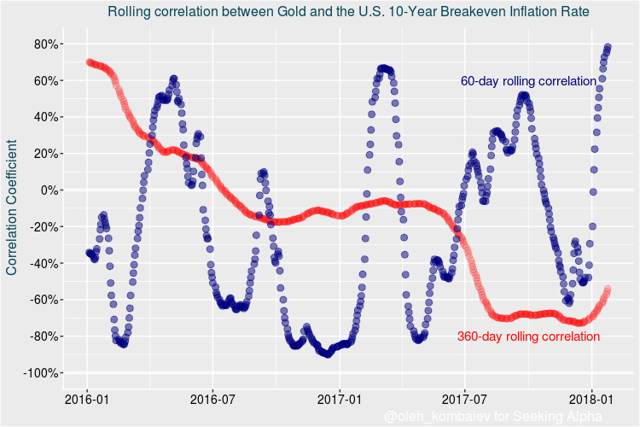

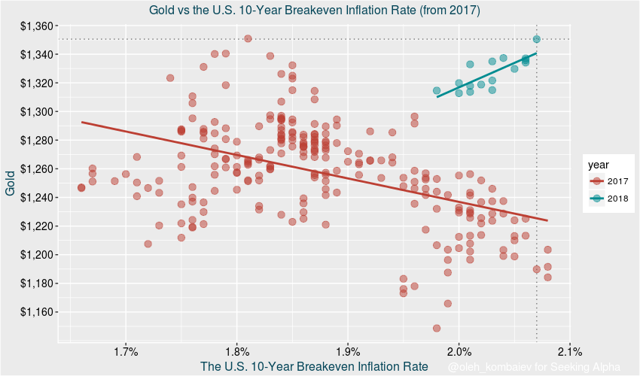

It's also interesting to note that in 2018 gold has returned to the familiar positive dependence on the U.S. level of inflation. The current value of the 60-day rolling correlation between the gold price and the U.S. inflation has reached 80%. On the contrary, an atypical inverse interdependence was observed between the indicators at the end of the last year:

The following chart reflects how the trend of the interdependence between the inflation and the gold price has changed:

So, the dollar and inflation are the two key gold drivers at the moment. If we properly define their dynamics, we'll be able to forecast the direction of gold.

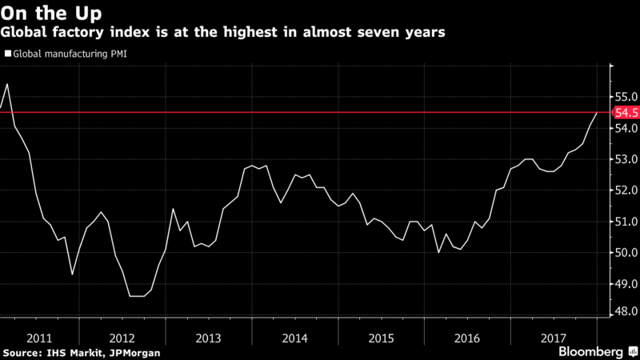

I believe that inflation is one of the long-term gold drivers, and the situation is positive at the moment. It is hard to deny the growth of the world economy. According to the latest data, the business activity is growing in China, Germany, France, Canada and Great Britain. In the meantime, the Global factory PMI has reached its maximum since the year 2011:

Oil, copper, platinum, cotton, even grains were going up in price over the past two months, creating the foundation for raising global prices. Therefore, I believe that gold has a strong positive driver for the whole current year because of the inflation.

On the other hand, the dynamics of the dollar is likely to put pressure on gold in the short term.

Firstly, a quick glance at the dollar index chart (DXY) reveals a high probability of formation of a local bottom: candle on January, 26 with a long base, as well as the reversing MACD and Stochastics indicators, point to a strong support:

Secondly, in January the dollar perhaps has already experienced all the bad things that could happen to it. The U.S. Government shutdown and the U.S. Finance Minister's saying that "a weaker dollar is favorable for trade" are among those things. However, we should not forget that the FED meeting in March is expected to end in increased rate with a probability of more than 70%. The expectation won't be long, and against this backdrop, the dollar is not likely to dive deeper.

Putting It All Together

So, summarizing the above, I believe that given the global inflation dynamics, gold remains in a long run uptrend. From this point of view, in my opinion, the level of $1400+ is quite real for gold in the next six months. But in the short term, I believe, a correction of the gold price is likely to be caused by the rising dollar.

Applying the foregoing to the ETF GLD (a fund that tracks the price of gold), I believe that the price of the fund is in an uptrend with the aim of $131 and the likely short-term correction at the level of $126.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.